- China

- /

- Aerospace & Defense

- /

- SZSE:002977

Chengdu Tianjian Technology Co., Ltd.'s (SZSE:002977) Shares Climb 29% But Its Business Is Yet to Catch Up

Those holding Chengdu Tianjian Technology Co., Ltd. (SZSE:002977) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

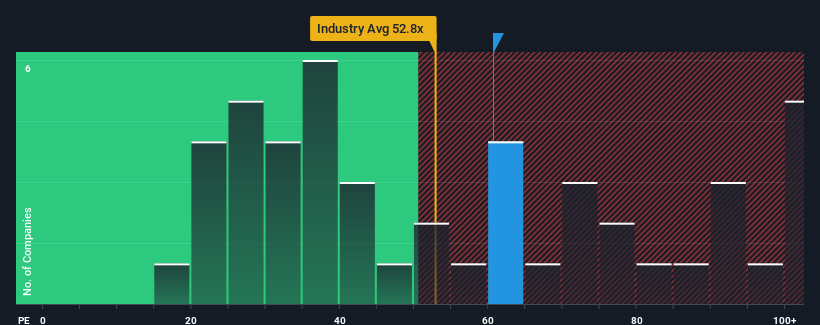

After such a large jump in price, Chengdu Tianjian Technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 60.7x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Chengdu Tianjian Technology's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Chengdu Tianjian Technology

Is There Enough Growth For Chengdu Tianjian Technology?

The only time you'd be truly comfortable seeing a P/E as steep as Chengdu Tianjian Technology's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. This means it has also seen a slide in earnings over the longer-term as EPS is down 50% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's an unpleasant look.

With this information, we find it concerning that Chengdu Tianjian Technology is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Chengdu Tianjian Technology's P/E?

The strong share price surge has got Chengdu Tianjian Technology's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Chengdu Tianjian Technology revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Chengdu Tianjian Technology (1 is significant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Chengdu Tianjian Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002977

Chengdu Tianjian Technology

Engages in the research and development, production, and sales of solid-state microwave front end products in China.

Flawless balance sheet slight.