- China

- /

- Electrical

- /

- SZSE:002922

The Price Is Right For Eaglerise Electric & Electronic (China) Co., Ltd (SZSE:002922) Even After Diving 27%

The Eaglerise Electric & Electronic (China) Co., Ltd (SZSE:002922) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 21%.

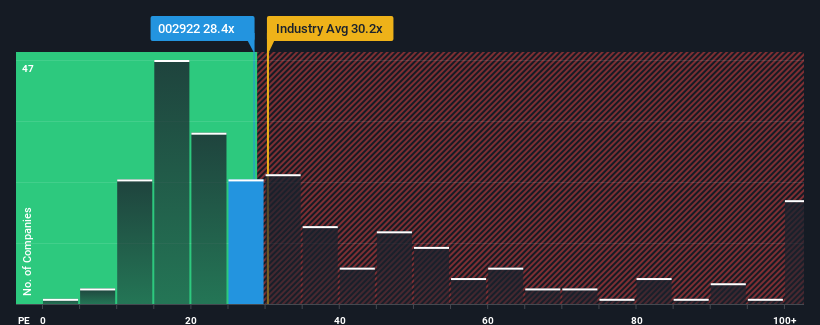

Even after such a large drop in price, there still wouldn't be many who think Eaglerise Electric & Electronic (China)'s price-to-earnings (or "P/E") ratio of 28.4x is worth a mention when the median P/E in China is similar at about 29x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Eaglerise Electric & Electronic (China) certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Eaglerise Electric & Electronic (China)

Does Growth Match The P/E?

In order to justify its P/E ratio, Eaglerise Electric & Electronic (China) would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 24%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 27% each year as estimated by the four analysts watching the company. With the market predicted to deliver 24% growth per year, the company is positioned for a comparable earnings result.

With this information, we can see why Eaglerise Electric & Electronic (China) is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Following Eaglerise Electric & Electronic (China)'s share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Eaglerise Electric & Electronic (China)'s analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for Eaglerise Electric & Electronic (China) you should be aware of, and 1 of them doesn't sit too well with us.

If these risks are making you reconsider your opinion on Eaglerise Electric & Electronic (China), explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Eaglerise Electric & Electronic (China), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eaglerise Electric & Electronic (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002922

Eaglerise Electric & Electronic (China)

Eaglerise Electric & Electronic (China) Co., Ltd.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives