- China

- /

- Electrical

- /

- SZSE:002896

Ningbo ZhongDa Leader Intelligent Transmission Co., Ltd. (SZSE:002896) Looks Just Right With A 33% Price Jump

Despite an already strong run, Ningbo ZhongDa Leader Intelligent Transmission Co., Ltd. (SZSE:002896) shares have been powering on, with a gain of 33% in the last thirty days. The last 30 days bring the annual gain to a very sharp 84%.

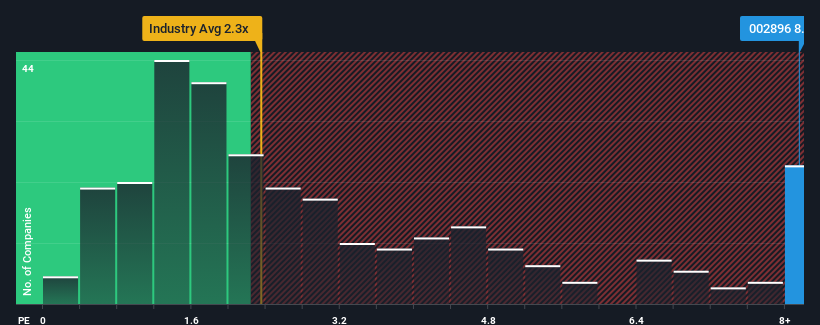

Following the firm bounce in price, given around half the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Ningbo ZhongDa Leader Intelligent Transmission as a stock to avoid entirely with its 8.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Ningbo ZhongDa Leader Intelligent Transmission

How Has Ningbo ZhongDa Leader Intelligent Transmission Performed Recently?

Ningbo ZhongDa Leader Intelligent Transmission hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ningbo ZhongDa Leader Intelligent Transmission will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ningbo ZhongDa Leader Intelligent Transmission?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ningbo ZhongDa Leader Intelligent Transmission's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.3%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 47% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 24%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Ningbo ZhongDa Leader Intelligent Transmission's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Ningbo ZhongDa Leader Intelligent Transmission have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Ningbo ZhongDa Leader Intelligent Transmission's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 2 warning signs for Ningbo ZhongDa Leader Intelligent Transmission that you should be aware of.

If these risks are making you reconsider your opinion on Ningbo ZhongDa Leader Intelligent Transmission, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo ZhongDa Leader Intelligent Transmission might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002896

Ningbo ZhongDa Leader Intelligent Transmission

Ningbo ZhongDa Leader Intelligent Transmission Co., Ltd.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives