As global markets navigate a landscape of easing U.S. inflation and robust bank earnings, major indices like the S&P 500 and Dow Jones have shown notable gains, reflecting investor optimism. In this environment, identifying stocks with strong fundamentals becomes crucial for investors seeking potential opportunities amidst shifting economic indicators and market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

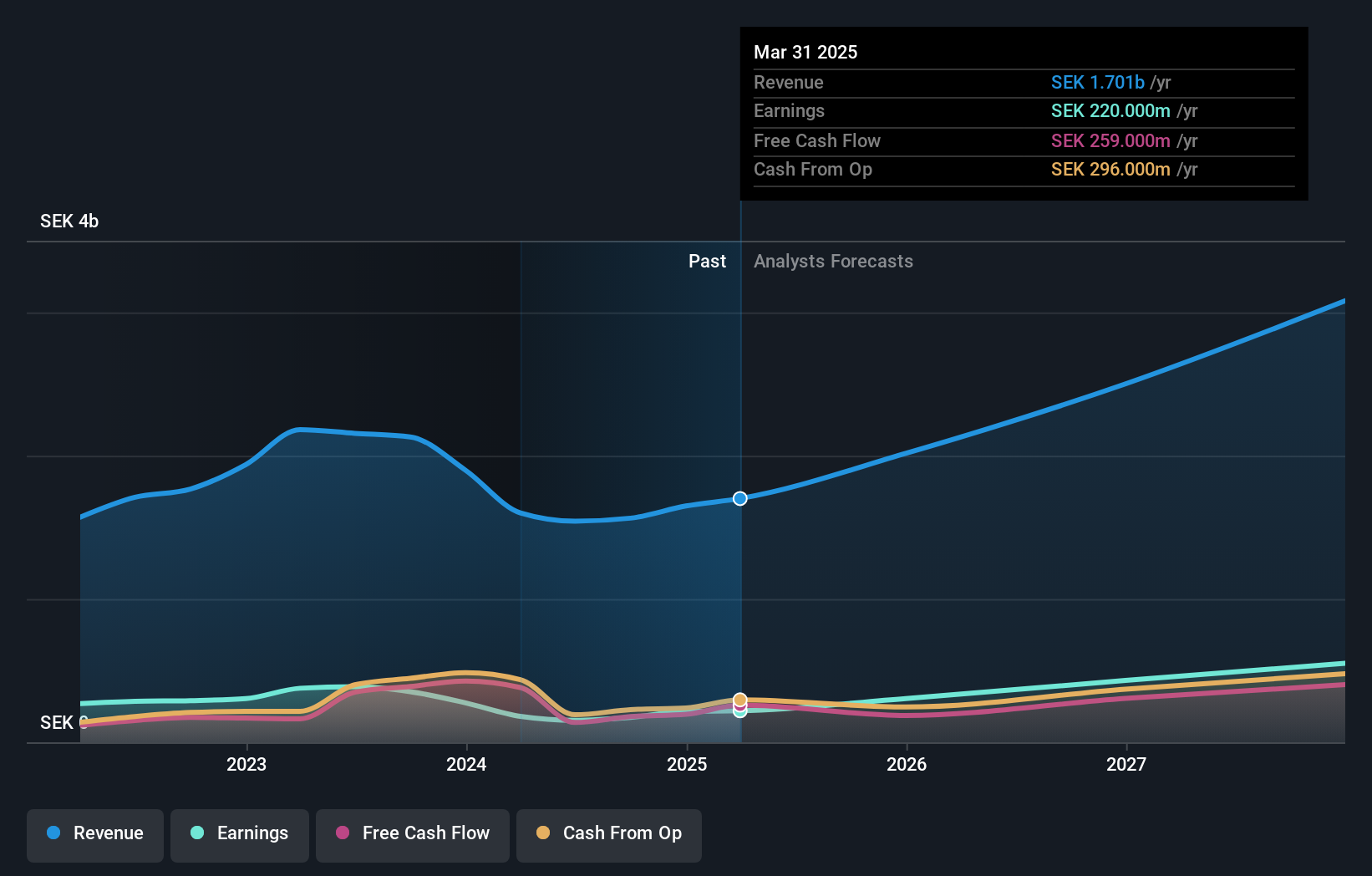

Overview: Engcon AB (publ) designs, produces, and sells excavator tools across various international markets including Europe, the Americas, Asia-Pacific regions like Japan and Australia, with a market cap of SEK14.54 billion.

Operations: Engcon AB generates revenue primarily from its Construction Machinery & Equipment segment, amounting to SEK1.56 billion. The company's financial performance is influenced by its ability to manage production and operational costs effectively, impacting the overall profitability.

engcon, a nimble player in the machinery sector, has been making waves with strategic expansions like its new sales company in Japan to tap into the burgeoning Asian market. Despite a challenging year with earnings growth at -51%, its financial health remains robust as it holds more cash than total debt and covers interest payments 13 times over with EBIT. The recent quarter saw net income rise to SEK 60 million from SEK 40 million last year, though profit margins slipped to 11.1% from 16.6%. With earnings forecasted to grow annually by over 42%, engcon seems poised for recovery and potential growth.

- Get an in-depth perspective on engcon's performance by reading our health report here.

Understand engcon's track record by examining our Past report.

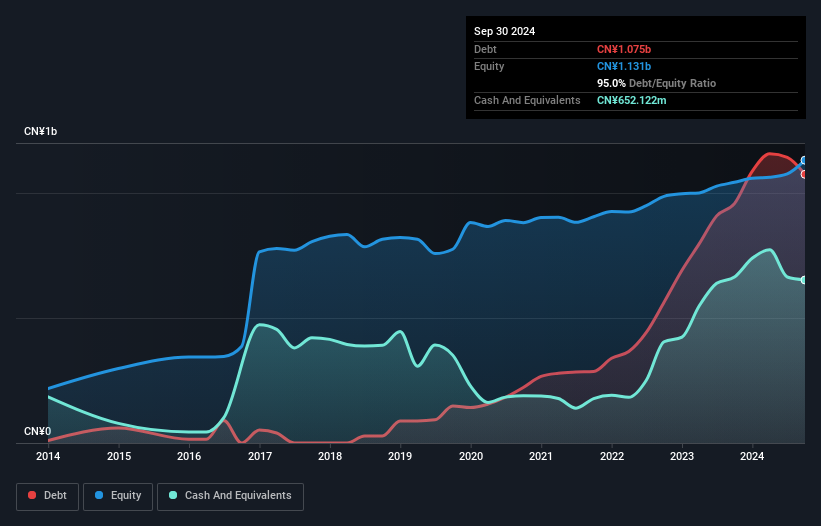

Tibet GaoZheng Explosive (SZSE:002827)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tibet GaoZheng Explosive Co., Ltd. is engaged in the production and sale of civil explosives in China, with a market capitalization of CN¥6.84 billion.

Operations: The company generates revenue primarily from the production and sale of civil explosives in China. Its financial performance includes a market capitalization of CN¥6.84 billion, reflecting its valuation in the market.

Tibet GaoZheng Explosive, a smaller player in the chemicals industry, has shown notable earnings growth of 30% over the past year, outpacing the sector's -5%. With net income at CNY 110.87 million for nine months ending September 2024 and earnings per share rising from CNY 0.3 to CNY 0.4, it seems to be on an upward trajectory. Despite a net debt to equity ratio climbing from 19% to 95% over five years, its interest payments are well covered by EBIT at nearly ten times coverage. The company also announced a cash dividend of CNY 0.7 per ten shares recently.

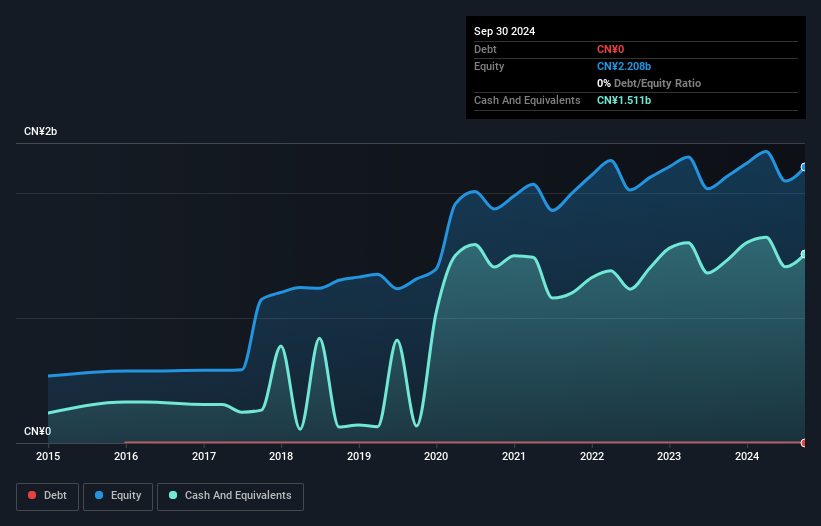

Guangdong Lingxiao Pump IndustryLtd (SZSE:002884)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Lingxiao Pump Industry Co., Ltd. operates in the manufacturing sector, focusing on the production and distribution of various types of pumps, with a market cap of CN¥6.72 billion.

Operations: Lingxiao Pump generates revenue primarily from the sale of pumps, with key financial performance indicators showing a focus on cost management and profitability. The company's net profit margin is an important metric to consider as it reflects its ability to convert sales into actual profit.

Guangdong Lingxiao Pump Industry, a player in the machinery sector, has shown impressive growth with earnings up 18% over the past year, outpacing its industry. The company boasts a strong balance sheet with no debt for five years and trades at a favorable price-to-earnings ratio of 15.5x compared to the broader CN market's 34.3x. Recent figures highlight sales reaching CNY 1.17 billion over nine months in 2024, up from CNY 944 million previously; net income also rose to CNY 330 million from CNY 280 million last year, demonstrating solid profitability and potential for continued expansion.

Make It Happen

- Embark on your investment journey to our 4642 Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Guangdong Lingxiao Pump IndustryLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002884

Guangdong Lingxiao Pump IndustryLtd

Guangdong Lingxiao Pump Industry Co.,Ltd.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives