- Taiwan

- /

- Tech Hardware

- /

- TWSE:2377

3 Stocks That May Be Trading At A Discount Of Up To 49%

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets saw mixed performances with major indices finishing mostly lower. Despite the volatility and cautious sentiment, opportunities may arise for investors seeking stocks that might be trading at a discount. Identifying undervalued stocks involves looking for companies with solid fundamentals that are temporarily out of favor in the market, potentially offering value amid broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.24 | 49.9% |

| Elica (BIT:ELC) | €1.73 | €3.44 | 49.7% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.45 | CN¥22.89 | 50% |

| Ingenia Communities Group (ASX:INA) | A$4.70 | A$9.43 | 50.2% |

| Cosmax (KOSE:A192820) | ₩157800.00 | ₩315109.78 | 49.9% |

| KeePer Technical Laboratory (TSE:6036) | ¥3950.00 | ¥7853.37 | 49.7% |

| EVERTEC (NYSE:EVTC) | US$33.02 | US$65.79 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.90 | €5.77 | 49.7% |

| Open Lending (NasdaqGM:LPRO) | US$6.14 | US$12.21 | 49.7% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

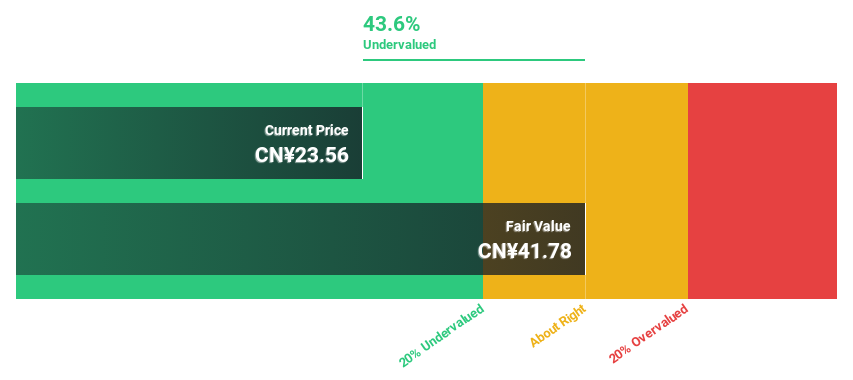

Shenzhen Megmeet Electrical (SZSE:002851)

Overview: Shenzhen Megmeet Electrical Co., LTD focuses on the research, development, production, sales, and services of hardware, software, and system solutions for electrical automation in China with a market cap of CN¥22.80 billion.

Operations: Revenue Segments (in millions of CN¥): Industrial Automation - 1,200; Smart Home Appliances - 950; New Energy Vehicles - 1,050; Medical Equipment - 800.

Estimated Discount To Fair Value: 19%

Shenzhen Megmeet Electrical is trading at CN¥46.25, 19% below its estimated fair value of CN¥57.08, indicating potential undervaluation based on discounted cash flows. Despite a forecast for significant earnings growth of over 30% annually, recent results show net income decline to CN¥411.15 million from CN¥482.66 million year-over-year. The company has engaged in a share buyback program worth up to CN¥40 million, potentially enhancing shareholder value amidst revenue growth expectations exceeding the market average.

- Our comprehensive growth report raises the possibility that Shenzhen Megmeet Electrical is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Shenzhen Megmeet Electrical stock in this financial health report.

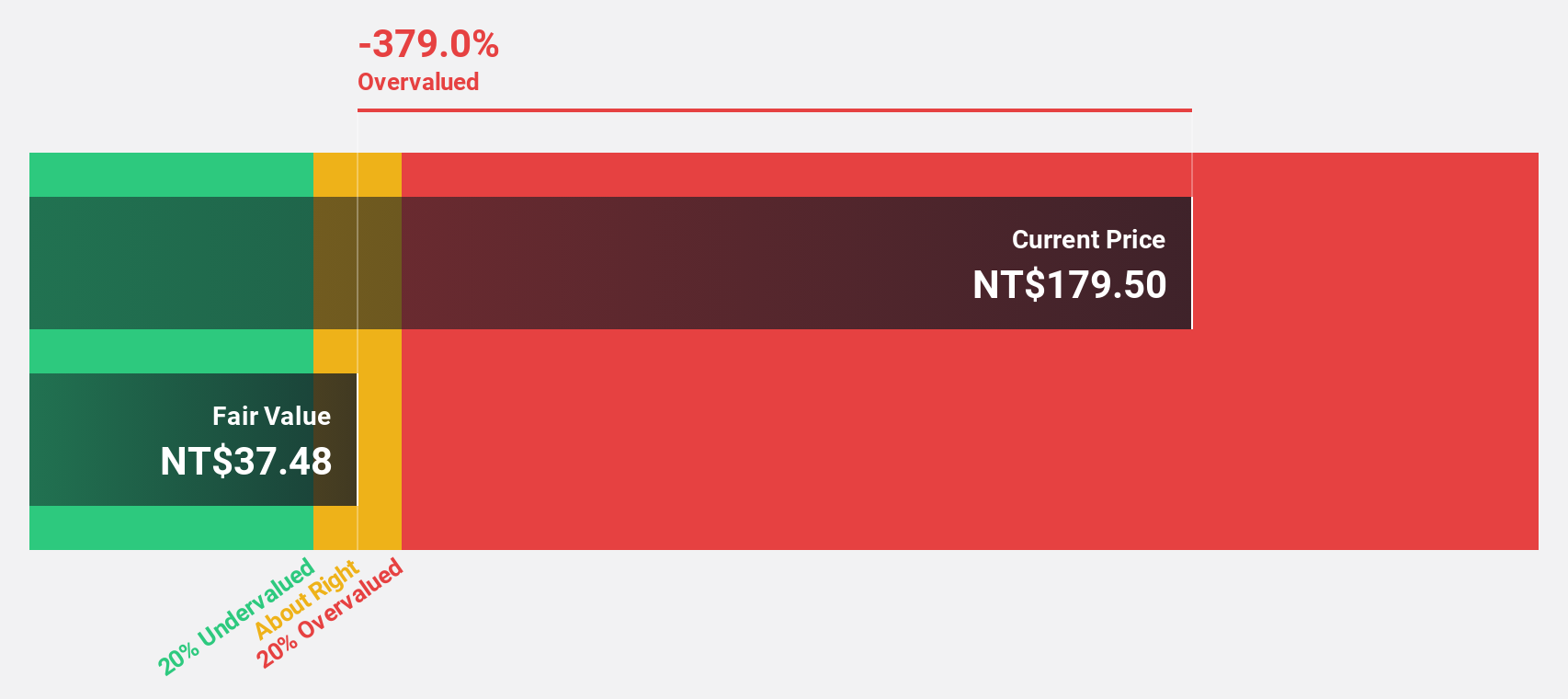

Shihlin Electric & Engineering (TWSE:1503)

Overview: Shihlin Electric & Engineering Corp. is involved in the manufacturing and sale of heavy electrical equipment, electrical machinery, and automotive electrical equipment across Taiwan, Mainland China, Vietnam, and international markets with a market cap of NT$107.58 billion.

Operations: The company's revenue is primarily derived from Power Distribution at NT$22.69 billion, followed by Vehicle Parts at NT$5.96 billion, and Automation Equipment and Spare Parts Department at NT$3.52 billion.

Estimated Discount To Fair Value: 15.8%

Shihlin Electric & Engineering, trading at NT$211, is below its estimated fair value of NT$250.7, suggesting potential undervaluation. Recent earnings reports show net income growth to TWD 706.97 million from TWD 595.29 million year-over-year, with revenue rising to TWD 8.17 billion from TWD 7.68 billion. Despite recent executive changes and index inclusion, the company's projected earnings and revenue growth exceed market averages, though return on equity remains relatively modest at a forecasted 16.2%.

- In light of our recent growth report, it seems possible that Shihlin Electric & Engineering's financial performance will exceed current levels.

- Dive into the specifics of Shihlin Electric & Engineering here with our thorough financial health report.

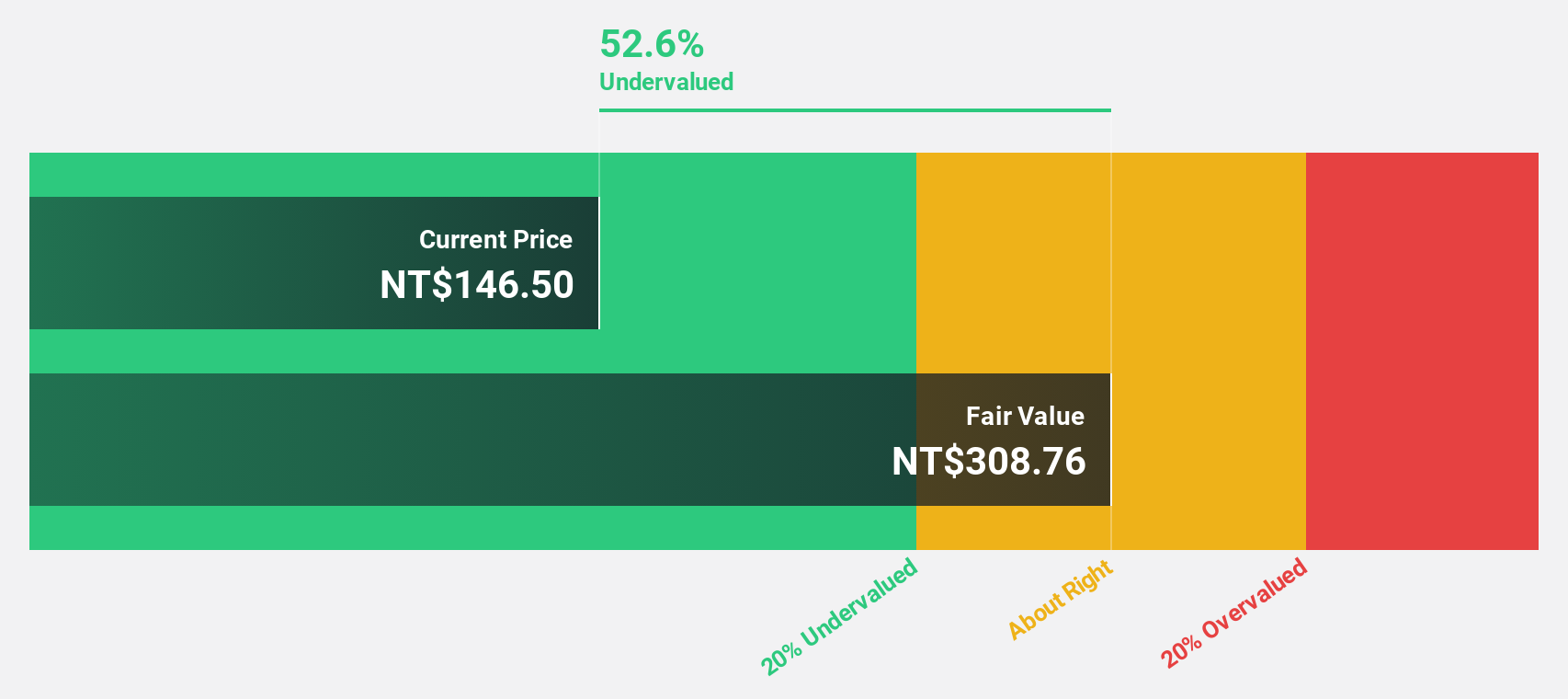

Micro-Star International (TWSE:2377)

Overview: Micro-Star International Co., Ltd. is a company that manufactures and sells motherboards, interface cards, notebook computers, and other electronic products globally, with a market cap of NT$154.19 billion.

Operations: The company's revenue is primarily derived from its computer information business, amounting to NT$192.33 billion.

Estimated Discount To Fair Value: 49%

Micro-Star International, trading at NT$188.5, is significantly below its estimated fair value of NT$369.7, indicating potential undervaluation based on cash flows. Earnings are forecast to grow 21.8% annually, outpacing the Taiwan market's growth rate of 19%. Despite a dividend not fully covered by free cash flows and slower revenue growth compared to the market, recent earnings reports show increased net income and sales year-over-year, enhancing its attractiveness for investors seeking undervalued opportunities.

- Upon reviewing our latest growth report, Micro-Star International's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Micro-Star International with our comprehensive financial health report here.

Where To Now?

- Discover the full array of 956 Undervalued Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2377

Micro-Star International

Manufactures and sells motherboards, interface cards, notebook computers, and other electronic products in Asia, Europe, the United States, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives