- China

- /

- Commercial Services

- /

- SZSE:000010

Asian Market Highlights: May 2025's Prominent Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape of trade negotiations and economic uncertainties, the Asian market continues to capture attention with its unique opportunities and challenges. Amidst this backdrop, penny stocks—often seen as smaller or newer companies—remain an intriguing area for investors seeking potential growth at a lower entry cost. Though the term may seem outdated, these stocks can offer surprising value when backed by solid financials, making them worth exploring for those interested in uncovering hidden potential in today's market climate.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.78 | THB2.96B | ✅ 4 ⚠️ 3 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.60 | THB1.65B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.186 | SGD37.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.86 | HK$3.22B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.06 | HK$46.48B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.09 | HK$687.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.35 | HK$2.25B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.16 | HK$1.8B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,181 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Shenzhen Ecobeauty (SZSE:000010)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Ecobeauty Co., Ltd. operates in the civil engineering and construction sector with a market cap of CN¥3.29 billion.

Operations: Shenzhen Ecobeauty Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.29B

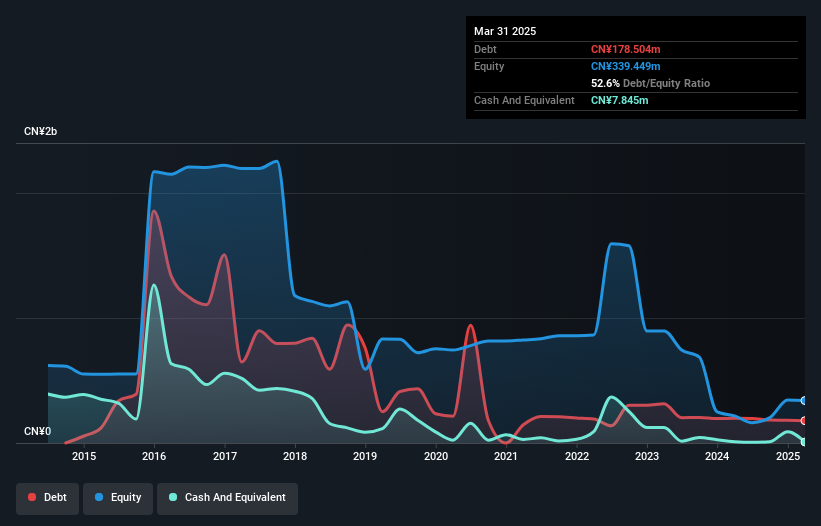

Shenzhen Ecobeauty Co., Ltd. has seen significant improvement in its financial performance, reporting a net income of CN¥17.62 million for 2024 compared to a substantial loss the previous year. The company also reported first-quarter 2025 sales of CN¥93.5 million, indicating growth from the prior year. Despite this progress, Shenzhen Ecobeauty's short-term assets do not fully cover its short-term liabilities, and it relies on one-off gains to bolster earnings quality. However, its debt is well covered by operating cash flow with satisfactory net debt levels and interest coverage not being a concern, reflecting improved financial stability amidst volatility in share value trading below estimated fair value.

- Navigate through the intricacies of Shenzhen Ecobeauty with our comprehensive balance sheet health report here.

- Assess Shenzhen Ecobeauty's previous results with our detailed historical performance reports.

Zhejiang Yasha DecorationLtd (SZSE:002375)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yasha Decoration Co., Ltd operates in building decoration, curtain wall decoration, and intelligent system integration, with a market cap of CN¥4.91 billion.

Operations: Zhejiang Yasha Decoration Ltd has not reported any specific revenue segments.

Market Cap: CN¥4.91B

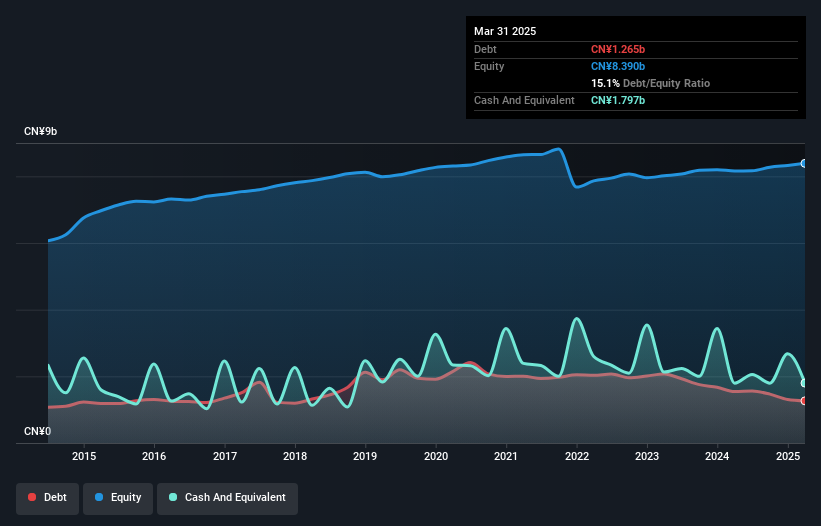

Zhejiang Yasha Decoration Co., Ltd has demonstrated resilience with a recent net income of CN¥66.74 million, up from CN¥64.94 million the previous year, despite a decline in revenue to CN¥1,781.34 million from CN¥2,217.53 million. The company's earnings growth of 24.6% over the past year surpasses its five-year average decline and exceeds industry growth rates, indicating a positive shift in financial performance. With short-term assets covering both short- and long-term liabilities comfortably and no significant shareholder dilution recently, Zhejiang Yasha maintains stable operations supported by strong cash flow coverage for its debt obligations amidst low return on equity challenges.

- Click here to discover the nuances of Zhejiang Yasha DecorationLtd with our detailed analytical financial health report.

- Gain insights into Zhejiang Yasha DecorationLtd's historical outcomes by reviewing our past performance report.

Shenzhen Zhongzhuang Construction GroupLtd (SZSE:002822)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Zhongzhuang Construction Group Co., Ltd, along with its subsidiaries, provides architectural decoration construction and design services in China and has a market cap of CN¥2.62 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥2.62B

Shenzhen Zhongzhuang Construction Group Co., Ltd faces significant challenges with declining financial performance, reporting a net loss of CN¥1.79 billion for 2024, up from CN¥702.1 million the previous year, alongside a substantial drop in sales to CN¥2.32 billion from CN¥3.86 billion. Despite these setbacks, the company maintains strong short-term asset coverage over both its short- and long-term liabilities and possesses a cash runway exceeding three years at current free cash flow levels. However, high debt levels and an inexperienced board pose additional risks while ongoing unprofitability complicates growth comparisons within the construction industry.

- Dive into the specifics of Shenzhen Zhongzhuang Construction GroupLtd here with our thorough balance sheet health report.

- Examine Shenzhen Zhongzhuang Construction GroupLtd's past performance report to understand how it has performed in prior years.

Summing It All Up

- Unlock our comprehensive list of 1,181 Asian Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shenzhen Ecobeauty, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000010

Shenzhen Ecobeauty

Engages in the civil engineering and construction business.

Adequate balance sheet and fair value.

Market Insights

Community Narratives