Revenues Not Telling The Story For Chengdu Leejun Industrial Co., Ltd. (SZSE:002651) After Shares Rise 31%

Chengdu Leejun Industrial Co., Ltd. (SZSE:002651) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 8.4% isn't as attractive.

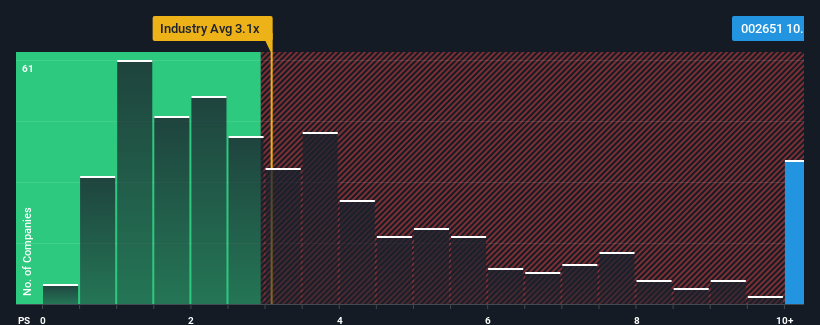

Since its price has surged higher, you could be forgiven for thinking Chengdu Leejun Industrial is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 10.6x, considering almost half the companies in China's Machinery industry have P/S ratios below 3.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Chengdu Leejun Industrial

What Does Chengdu Leejun Industrial's P/S Mean For Shareholders?

For instance, Chengdu Leejun Industrial's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chengdu Leejun Industrial will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Chengdu Leejun Industrial's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 42%. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 26% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Chengdu Leejun Industrial's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Shares in Chengdu Leejun Industrial have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Chengdu Leejun Industrial revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Chengdu Leejun Industrial (of which 1 is a bit unpleasant!) you should know about.

If you're unsure about the strength of Chengdu Leejun Industrial's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002651

Chengdu Leejun Industrial

Researches and develops, designs, manufactures, sells, and services grinding process system equipment in the People’s Republic of China and internationally.

Excellent balance sheet with questionable track record.