- China

- /

- Electrical

- /

- SZSE:002638

Asian Penny Stocks Under US$1B Market Cap: 3 Promising Picks

Reviewed by Simply Wall St

As global markets navigate a landscape of easing trade tensions and mixed economic signals, investors are increasingly eyeing opportunities in the Asian market. Penny stocks, while often seen as niche investments, continue to offer intriguing prospects for those willing to explore smaller or newer companies with potential for growth. These stocks can represent a blend of affordability and opportunity, especially when backed by strong financial health.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.84 | THB3B | ✅ 4 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.42 | THB2.65B | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.188 | SGD37.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.13 | SGD8.38B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.88 | HK$3.25B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$46.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.10 | HK$694.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.44 | HK$2.4B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.06 | HK$1.72B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,176 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

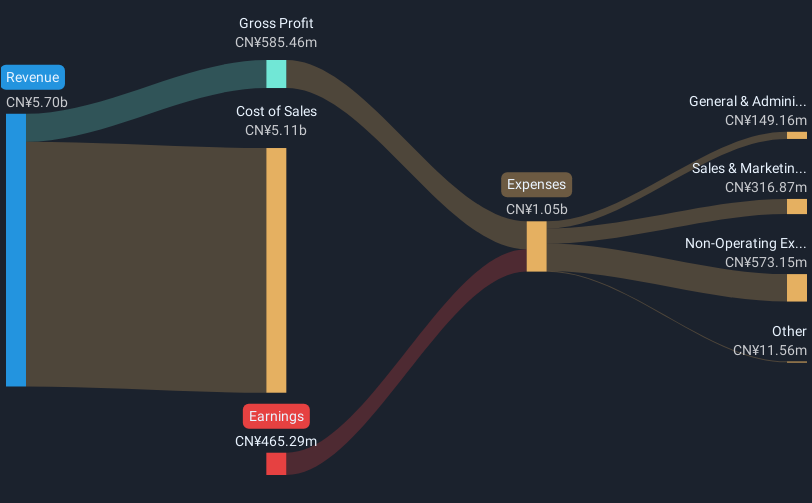

Qinghai Spring Medicinal Resources Technology (SHSE:600381)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Spring Medicinal Resources Technology Co., Ltd. operates in the pharmaceutical industry, focusing on medicinal resources technology, with a market capitalization of approximately CN¥2.05 billion.

Operations: Qinghai Spring Medicinal Resources Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.05B

Qinghai Spring Medicinal Resources Technology, with a market cap of CN¥2.05 billion, has shown some improvement despite being unprofitable. Recent financial results indicate a reduction in net loss from CN¥267.87 million to CN¥198.77 million year-over-year and a positive shift in Q1 2025 with net income of CN¥8.92 million compared to a loss the previous year. The company remains debt-free and has sufficient short-term assets to cover liabilities, providing stability amidst its volatility of 8%. However, its negative return on equity highlights ongoing profitability challenges in the competitive pharmaceutical sector.

- Dive into the specifics of Qinghai Spring Medicinal Resources Technology here with our thorough balance sheet health report.

- Learn about Qinghai Spring Medicinal Resources Technology's historical performance here.

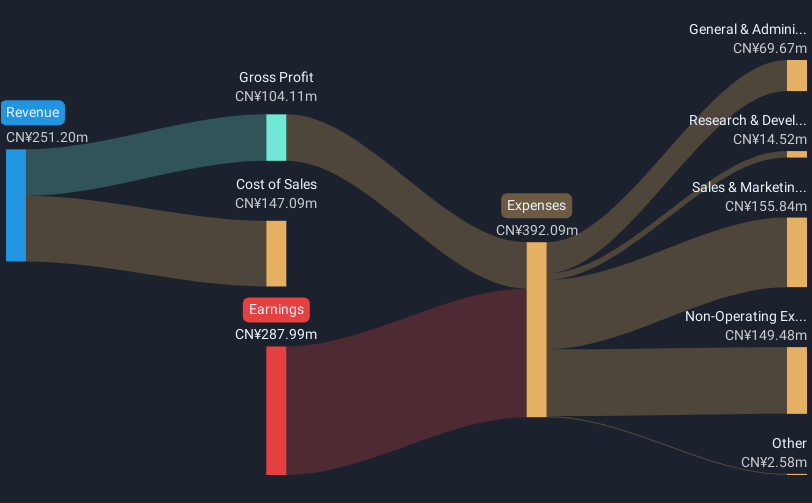

Dongguan Kingsun OptoelectronicLtd (SZSE:002638)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Kingsun Optoelectronic Co., Ltd. is a company that manufactures and sells LED lighting products both in China and internationally, with a market cap of CN¥3.08 billion.

Operations: No specific revenue segments are reported for Dongguan Kingsun Optoelectronic Ltd.

Market Cap: CN¥3.08B

Dongguan Kingsun Optoelectronic Ltd., with a market cap of CN¥3.08 billion, reported increased revenue for Q1 2025 at CN¥149.63 million compared to the previous year, yet remains unprofitable with a net loss of CN¥7.03 million. Despite its challenges in profitability, the company is debt-free and has substantial short-term assets (CN¥1.4 billion) covering both short and long-term liabilities, ensuring financial stability for over three years based on current cash flow. The management team is relatively experienced; however, the board's lack of seasoned tenure could impact strategic decision-making as it navigates industry volatility and competition.

- Click here and access our complete financial health analysis report to understand the dynamics of Dongguan Kingsun OptoelectronicLtd.

- Evaluate Dongguan Kingsun OptoelectronicLtd's historical performance by accessing our past performance report.

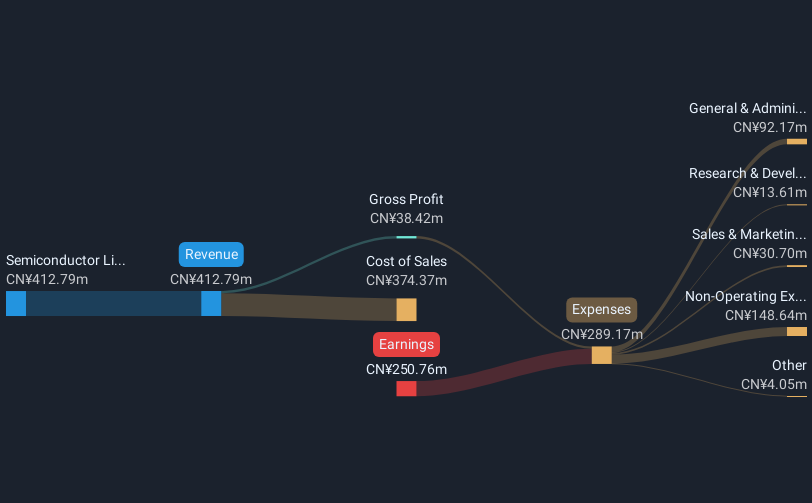

Global Top E-Commerce (SZSE:002640)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Top E-Commerce Co., Ltd. operates in the cross-border e-commerce sector both within China and internationally, with a market cap of CN¥6.95 billion.

Operations: Global Top E-Commerce Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥6.95B

Global Top E-Commerce Co., Ltd., with a market cap of CN¥6.95 billion, reported Q1 2025 revenue of CN¥1,253.66 million and a reduced net loss of CN¥3.89 million compared to the previous year. Despite its unprofitability and high share price volatility, the company is debt-free and maintains a positive cash flow, ensuring a cash runway exceeding three years. While its short-term assets (CN¥1.6 billion) fall slightly short of covering liabilities (CN¥1.7 billion), the board's experienced tenure contrasts with an inexperienced management team, potentially affecting strategic execution in this competitive sector.

- Get an in-depth perspective on Global Top E-Commerce's performance by reading our balance sheet health report here.

- Gain insights into Global Top E-Commerce's historical outcomes by reviewing our past performance report.

Summing It All Up

- Investigate our full lineup of 1,176 Asian Penny Stocks right here.

- Looking For Alternative Opportunities? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dongguan Kingsun OptoelectronicLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002638

Dongguan Kingsun OptoelectronicLtd

Manufactures and sells LED lighting products in China and internationally.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives