- China

- /

- Electrical

- /

- SZSE:002638

3 Promising Penny Stocks With Market Caps Over US$300M

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, the S&P 500 Index has advanced, driven by sectors like utilities and real estate, while small-cap indices have shown notable outperformance. Penny stocks may be considered a throwback term, yet they remain relevant as an investment area offering unique opportunities. These typically smaller or newer companies can provide significant growth potential at lower price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.59 | MYR2.96B | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £190.6M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.75 | MYR131.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.30 | CN¥2.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.45 | MYR2.57B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.065 | £404.29M | ★★★★☆☆ |

Click here to see the full list of 5,802 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Jiangsu Sihuan Bioengineering (SZSE:000518)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Sihuan Bioengineering Co., Ltd. operates in the pharmaceutical industry in China with a market capitalization of CN¥2.40 billion.

Operations: The company generates revenue primarily from Mainland China, amounting to CN¥216.04 million, with an additional CN¥3.78 million coming from international markets outside the mainland.

Market Cap: CN¥2.4B

Jiangsu Sihuan Bioengineering, operating in China's pharmaceutical sector, has a market cap of CN¥2.40 billion and faces challenges due to its unprofitability despite generating CN¥216.04 million in revenue from Mainland China. The company has seen a reduction in net loss from CN¥37.78 million to CN¥11.06 million over the past year, indicating potential improvement in financial management. Its short-term assets of CN¥505.70 million comfortably cover both short-term and long-term liabilities, suggesting solid liquidity management despite ongoing losses and declining sales figures compared to the previous year’s performance.

- Get an in-depth perspective on Jiangsu Sihuan Bioengineering's performance by reading our balance sheet health report here.

- Gain insights into Jiangsu Sihuan Bioengineering's past trends and performance with our report on the company's historical track record.

Huapont Life SciencesLtd (SZSE:002004)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Huapont Life Sciences Co., Ltd. operates in the fields of medicine, medical care, agrochemicals, new materials, and tourism both in China and internationally, with a market cap of CN¥8.96 billion.

Operations: The company's revenue is comprised of CN¥8.06 billion from China and CN¥3.59 billion from overseas markets.

Market Cap: CN¥8.96B

Huapont Life Sciences Co., Ltd. has a market cap of CN¥8.96 billion, with revenue primarily from China (CN¥8.06 billion) and overseas markets (CN¥3.59 billion). The company's net profit margin decreased slightly to 2%, and it experienced negative earnings growth over the past year, highlighting profitability challenges despite stable revenues. Its debt level is satisfactory with a net debt to equity ratio of 26.1%, but operating cash flow covers only 17.6% of its debt, indicating potential liquidity concerns. Recent share buybacks totaling CNY 29.5 million reflect efforts to enhance shareholder value amidst financial volatility.

- Click here to discover the nuances of Huapont Life SciencesLtd with our detailed analytical financial health report.

- Understand Huapont Life SciencesLtd's track record by examining our performance history report.

Dongguan Kingsun OptoelectronicLtd (SZSE:002638)

Simply Wall St Financial Health Rating: ★★★★★★

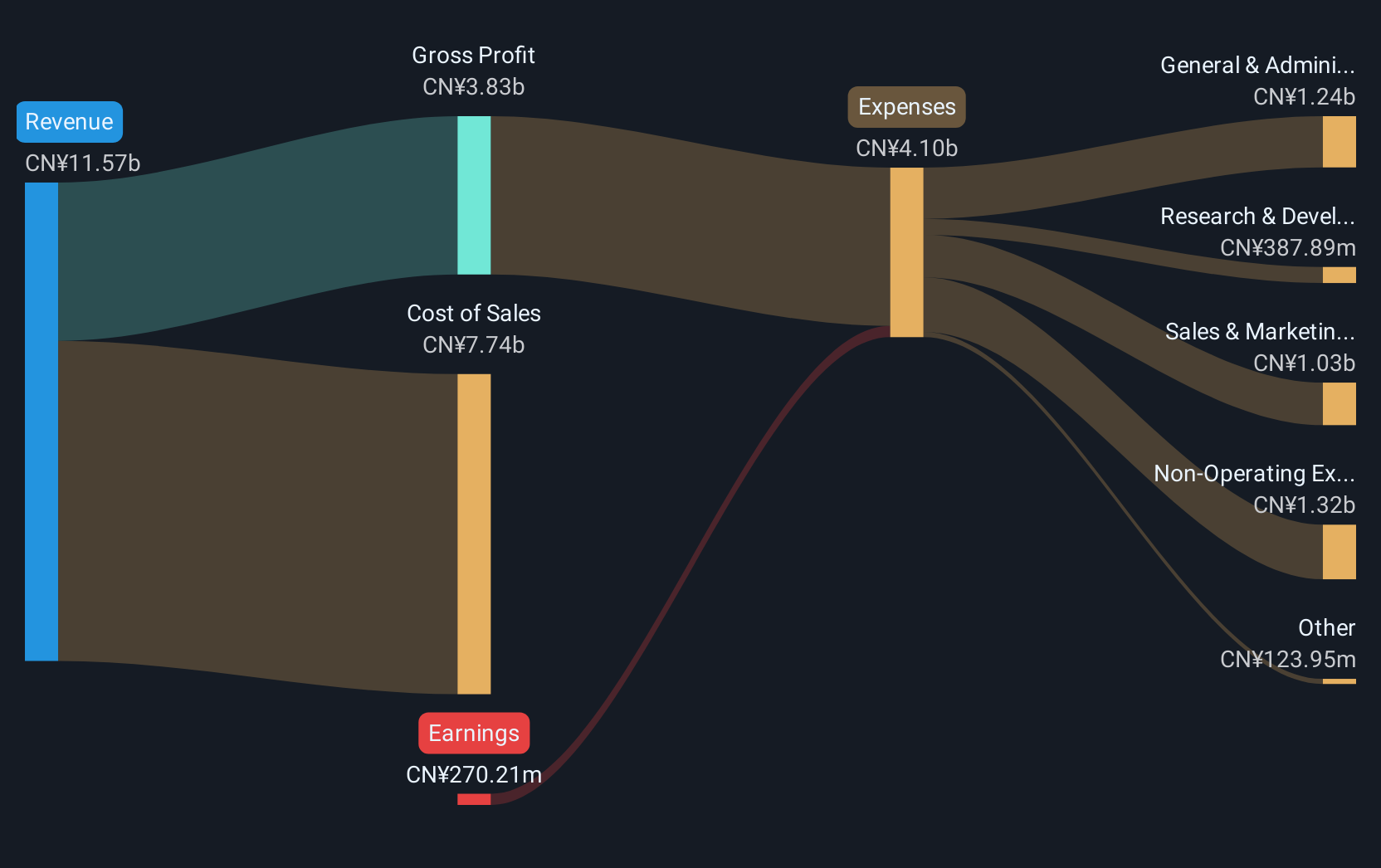

Overview: Dongguan Kingsun Optoelectronic Co., Ltd. is engaged in the manufacturing and sale of LED lighting products both within China and internationally, with a market capitalization of CN¥2.92 billion.

Operations: The company generates its revenue primarily from the Semiconductor Lighting segment, which accounts for CN¥363.54 million.

Market Cap: CN¥2.92B

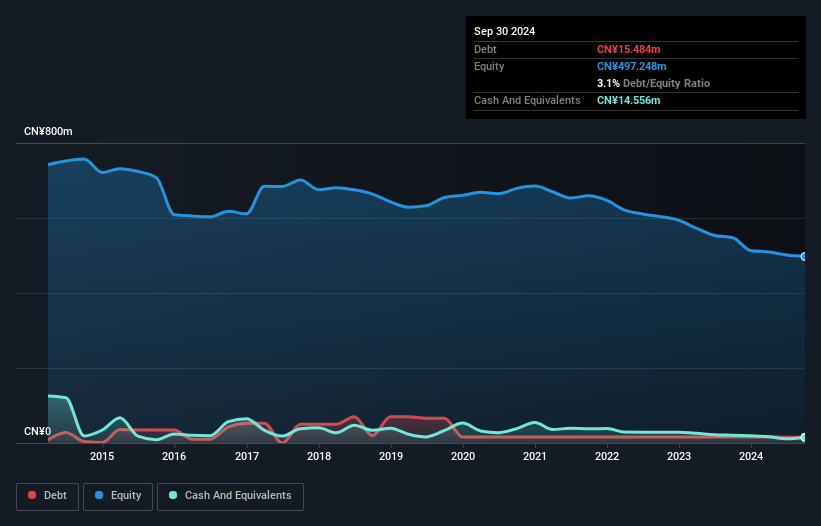

Dongguan Kingsun Optoelectronic Co., Ltd. has a market capitalization of CN¥2.92 billion, primarily generating revenue from its Semiconductor Lighting segment, which amounts to CN¥363.54 million. Despite being unprofitable with a negative return on equity of -6.74%, the company shows financial resilience by having no debt and maintaining sufficient cash runway for over three years based on current free cash flow levels. Recent share buybacks totaling CN¥30.04 million indicate efforts to bolster shareholder confidence amidst financial challenges, including a net loss of CN¥22.54 million for the half year ended June 30, 2024, despite revenue growth compared to the previous year.

- Unlock comprehensive insights into our analysis of Dongguan Kingsun OptoelectronicLtd stock in this financial health report.

- Review our historical performance report to gain insights into Dongguan Kingsun OptoelectronicLtd's track record.

Make It Happen

- Dive into all 5,802 of the Penny Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002638

Dongguan Kingsun OptoelectronicLtd

Manufactures and sells LED lighting products in China and internationally.

Flawless balance sheet minimal.