- China

- /

- Electrical

- /

- SZSE:002635

Uncovering Three Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In a week where major U.S. stock indexes such as the S&P 500 and Nasdaq Composite reached record highs, the Russell 2000 Index, which tracks small-cap stocks, experienced a decline following weeks of notable outperformance. Amidst this mixed market environment and ongoing economic updates like job growth rebounds and potential interest rate cuts by the Federal Reserve, identifying small-cap stocks with strong fundamentals can be crucial for investors looking to navigate these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Time Interconnect Technology Limited is an investment holding company that manufactures and sells cable assembly and networking cable products in various international markets, with a market cap of HK$8.44 billion.

Operations: The company generates revenue primarily from its Server and Cable Assembly segments, contributing HK$2.57 billion each. Digital Cable adds HK$1.36 billion to the total revenue stream.

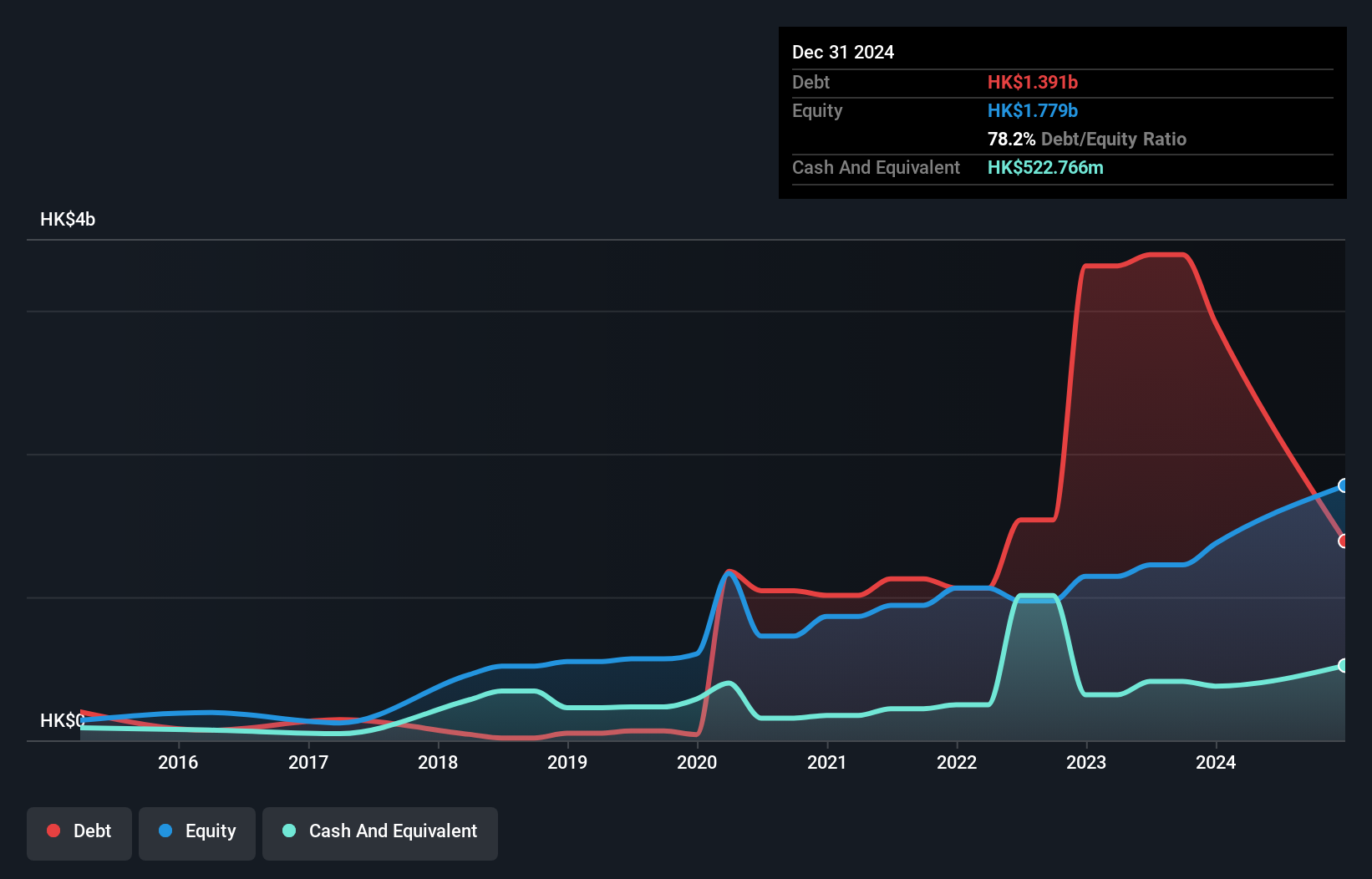

Time Interconnect Technology, a small player in the electrical industry, has shown impressive earnings growth of 71.6% over the past year, outpacing the industry's 7.7%. Despite a high net debt to equity ratio of 83.3%, its interest payments are well covered with an EBIT coverage of 10.4 times. Trading at a significant discount of 94.5% below estimated fair value adds to its appeal for potential investors seeking undervalued opportunities. The company seems to be leveraging its high-quality earnings effectively, although its rising debt levels from 11.5% to 151.1% over five years warrant cautious optimism moving forward.

Shenzhen Rapoo Technology (SZSE:002577)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Rapoo Technology Co., Ltd. engages in the research, development, design, manufacturing, and sale of wired and wireless peripheral products globally with a market cap of CN¥4.75 billion.

Operations: Rapoo Technology generates revenue primarily from the sale of wired and wireless peripheral products. The company's net profit margin has shown variability, reflecting fluctuations in profitability over recent periods.

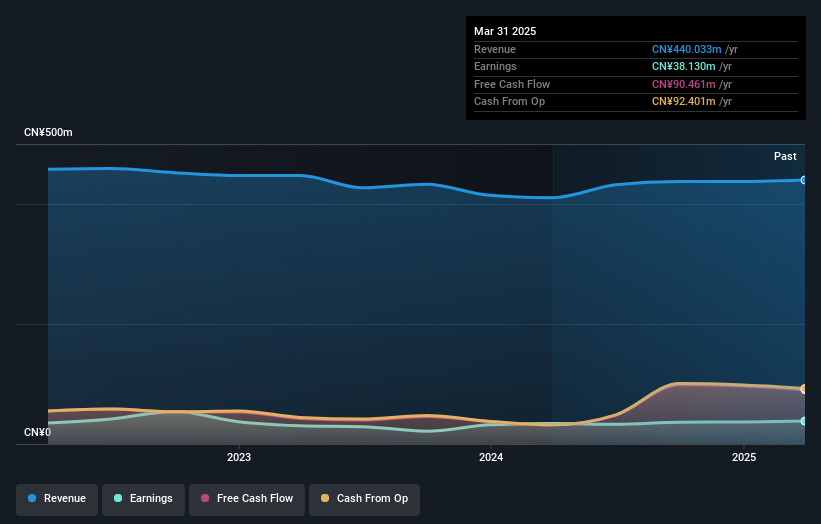

Shenzhen Rapoo Technology, a nimble player in the tech space, has shown impressive earnings growth of 69% over the past year, outpacing the broader industry. The company reported sales of CN¥328.54 million for nine months ending September 2024, up from CN¥305.45 million a year earlier. Net income rose to CN¥34.18 million compared to last year's CN¥29.97 million, with basic earnings per share at CNY 0.1208 from CNY 0.1059 previously. Additionally, the firm executed a share buyback program repurchasing over one million shares for CN¥13.47 million by late September 2024 and remains debt-free with positive free cash flow generation capabilities despite recent non-recurring gains impacting financial results by CN¥11.7M as of September's end.

Suzhou Anjie Technology (SZSE:002635)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Anjie Technology Co., Ltd. specializes in the research, development, production, and sale of intelligent terminal components both in China and internationally, with a market cap of CN¥10.81 billion.

Operations: Anjie Technology generates revenue primarily from the sale of intelligent terminal components. The company's net profit margin is 8.5%, reflecting its efficiency in managing costs relative to its revenue streams.

Anjie Technology, a smaller player in its sector, has shown promising financial health with more cash than total debt and positive free cash flow. Over the past five years, its debt-to-equity ratio rose from 0.7% to 11%, yet it remains profitable with interest payments well-covered by earnings. Recent earnings reveal sales of CNY 3.59 billion for the first nine months of 2024, up from CNY 3.07 billion last year, though net income dipped slightly to CNY 221.51 million from CNY 236.7 million previously. With a price-to-earnings ratio of 37x below the market average and high-quality past earnings, Anjie appears poised for continued growth in revenue and profitability at rates exceeding industry norms.

Key Takeaways

- Delve into our full catalog of 4644 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002635

Suzhou Anjie Technology

Engages in research and development, production, and sales of precision functional devices, precision structural parts, and module products.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives