Amidst global economic uncertainties, Asian markets have been navigating a complex landscape influenced by trade tensions and evolving monetary policies. In this context, investors often look beyond established giants to explore opportunities in smaller or newer companies. Penny stocks, though an older term, continue to represent these promising ventures with potential value. This article will explore three such stocks that offer financial stability and growth potential for those interested in tapping into the vibrant world of Asian penny stocks.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.38 | SGD9.4B | ★★★★★☆ |

| Lever Style (SEHK:1346) | HK$1.28 | HK$812.53M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.10 | HK$46.99B | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.88 | HK$655.37M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.03 | CN¥3.51B | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.24 | THB2.54B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.475 | SGD452.86M | ★★★★★★ |

| Interlink Telecom (SET:ITEL) | THB1.52 | THB2.11B | ★★★★☆☆ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.08 | HK$4.3B | ★★★★★★ |

Click here to see the full list of 1,166 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Brii Biosciences (SEHK:2137)

Simply Wall St Financial Health Rating: ★★★★★★

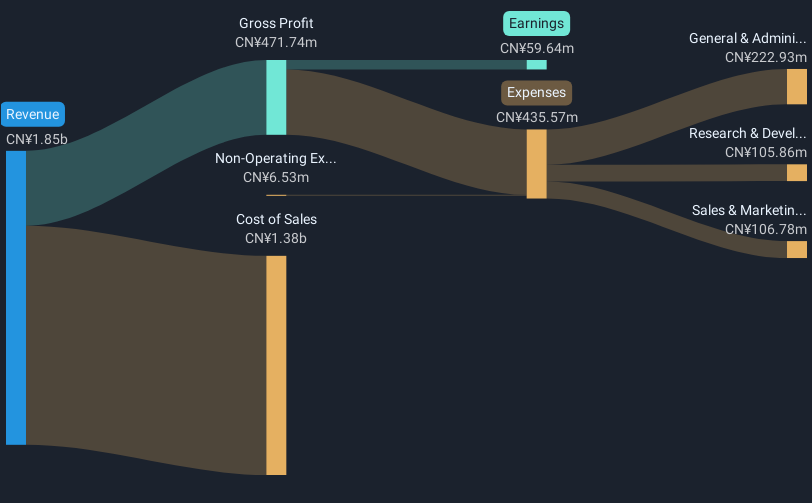

Overview: Brii Biosciences Limited focuses on developing therapies for infectious and central nervous system diseases in China and the United States, with a market cap of HK$1.48 billion.

Operations: The company's revenue is derived from its Biotechnology (Startups) segment, amounting to CN¥38.38 million.

Market Cap: HK$1.48B

Brii Biosciences, with a market cap of HK$1.48 billion, is currently pre-revenue and unprofitable but has reduced its losses by 41.3% annually over the past five years. The company is debt-free and possesses a cash runway exceeding three years based on current free cash flow trends. Recent volatility in its share price highlights potential risks for investors, although no significant shareholder dilution occurred in the past year. Despite an inexperienced board with an average tenure of 2.5 years, Brii's management team averages 3.3 years of experience, contributing to strategic stability amidst ongoing share repurchase activities aimed at enhancing shareholder value.

- Navigate through the intricacies of Brii Biosciences with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Brii Biosciences' future.

Sunshine Insurance Group (SEHK:6963)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sunshine Insurance Group Company Limited offers a range of insurance products and related services in the People’s Republic of China, with a market capitalization of HK$35.54 billion.

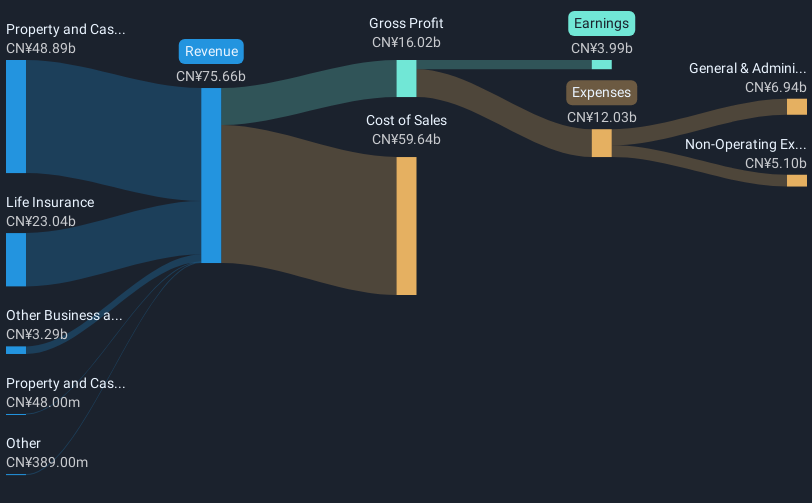

Operations: The company generates revenue from three primary segments: Life Insurance (CN¥23.04 billion), Property and Casualty Insurance through Sunshine P&C (CN¥48.89 billion), and Property and Casualty Insurance via Sunshine Surety (CN¥48 million).

Market Cap: HK$35.54B

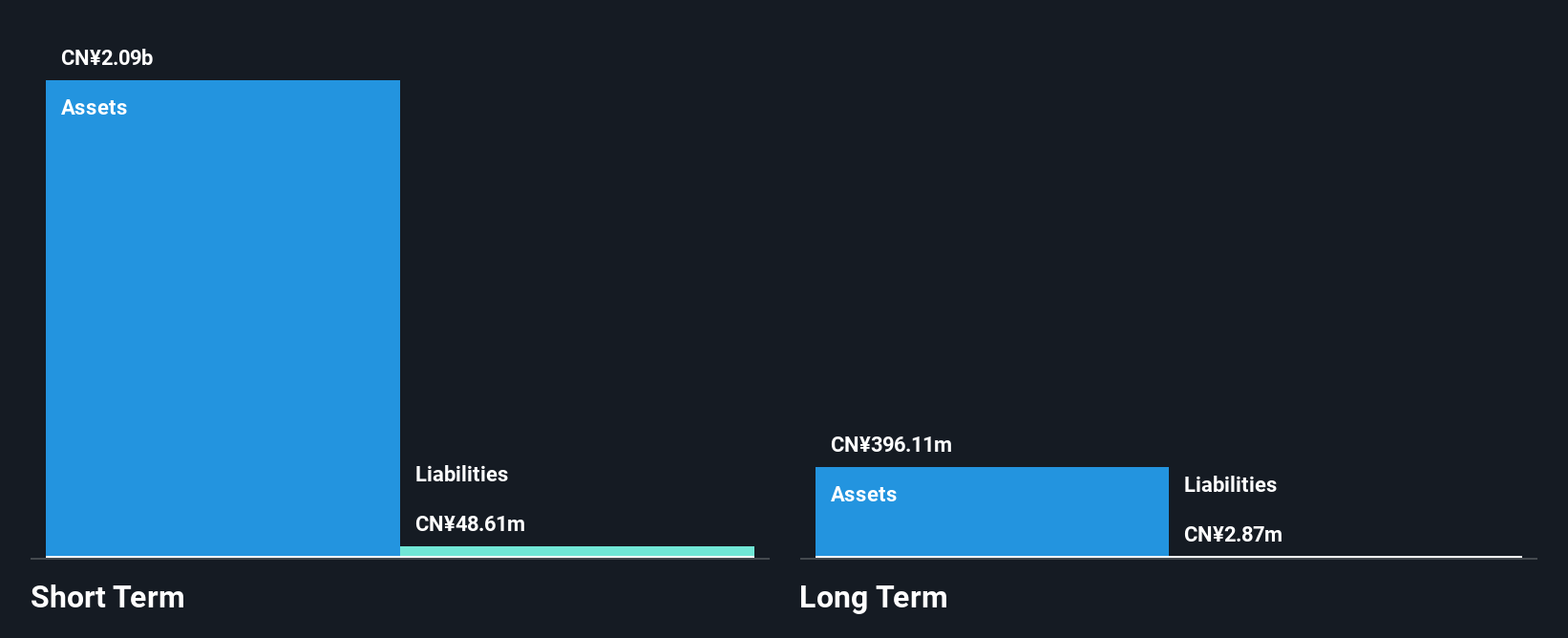

Sunshine Insurance Group, with a market cap of HK$35.54 billion, demonstrates financial stability through its strong short-term asset position (CN¥165.2B) against liabilities and well-covered interest payments by EBIT (6.9x coverage). Despite trading at a good value compared to peers, the company faces challenges with negative earnings growth (-15.8%) over the past year and declining profit margins from 6.8% to 5.3%. While its management and board are experienced, Sunshine's long-term liabilities (CN¥449.4B) overshadow short-term assets, indicating potential risks in debt management despite having more cash than total debt.

- Unlock comprehensive insights into our analysis of Sunshine Insurance Group stock in this financial health report.

- Learn about Sunshine Insurance Group's future growth trajectory here.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and sells material handling equipment for industries such as electrolytic aluminum, steel, construction machinery, and non-ferrous sectors both in China and internationally, with a market cap of CN¥5.72 billion.

Operations: Zhuzhou Tianqiao Crane Co., Ltd. does not report distinct revenue segments, focusing on the production and sale of material handling equipment across various industries domestically and abroad.

Market Cap: CN¥5.72B

Zhuzhou Tianqiao Crane, with a market cap of CN¥5.72 billion, shows mixed signals for investors in the penny stock space. Its earnings saw an extraordinary increase of over 6,000% last year, surpassing industry averages despite a five-year decline trend. The company maintains financial health with more cash than debt and strong short-term asset coverage over liabilities. However, its return on equity is low at 2.2%, and share price volatility remains high compared to peers. Recent amendments to its articles of association could indicate strategic shifts as it navigates through evolving market dynamics with an inexperienced board averaging 1.8 years tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhuzhou Tianqiao Crane.

- Gain insights into Zhuzhou Tianqiao Crane's historical outcomes by reviewing our past performance report.

Key Takeaways

- Take a closer look at our Asian Penny Stocks list of 1,166 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6963

Sunshine Insurance Group

Provides various insurance products and related services in the People’s Republic of China.

Undervalued with adequate balance sheet.