- China

- /

- Electrical

- /

- SZSE:002322

We Ran A Stock Scan For Earnings Growth And Ningbo Ligong Environment And Energy TechnologyLtd (SZSE:002322) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Ningbo Ligong Environment And Energy TechnologyLtd (SZSE:002322). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Ningbo Ligong Environment And Energy TechnologyLtd with the means to add long-term value to shareholders.

Check out our latest analysis for Ningbo Ligong Environment And Energy TechnologyLtd

Ningbo Ligong Environment And Energy TechnologyLtd's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. Ningbo Ligong Environment And Energy TechnologyLtd's EPS skyrocketed from CN¥0.58 to CN¥0.74, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 28%.

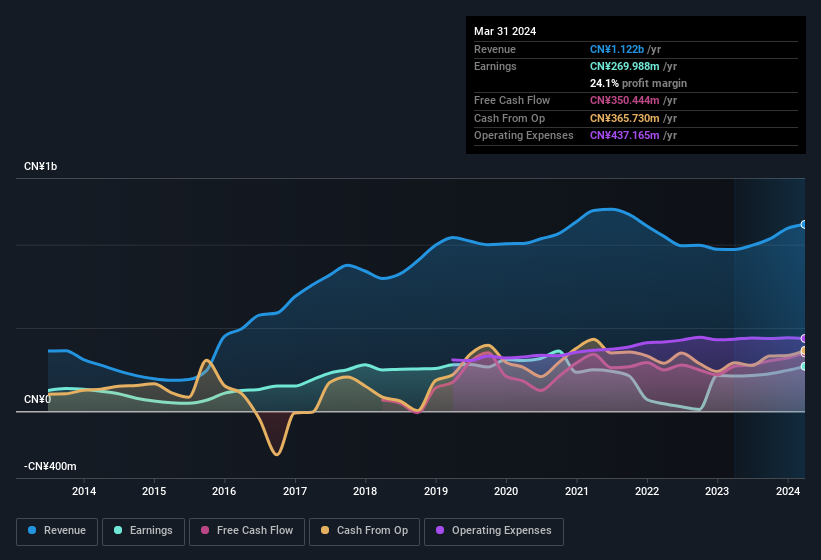

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Ningbo Ligong Environment And Energy TechnologyLtd is growing revenues, and EBIT margins improved by 4.0 percentage points to 24%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Ningbo Ligong Environment And Energy TechnologyLtd Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Ningbo Ligong Environment And Energy TechnologyLtd insiders have a significant amount of capital invested in the stock. Holding CN¥602m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That holding amounts to 11% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Should You Add Ningbo Ligong Environment And Energy TechnologyLtd To Your Watchlist?

You can't deny that Ningbo Ligong Environment And Energy TechnologyLtd has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Still, you should learn about the 2 warning signs we've spotted with Ningbo Ligong Environment And Energy TechnologyLtd (including 1 which is significant).

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Ligong Environment And Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002322

Ningbo Ligong Environment And Energy TechnologyLtd

Engages in the research and development, production, sale, and service of online monitoring equipment for electric power industry in the People’s Republic of China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives