- China

- /

- Hospitality

- /

- SZSE:000796

Caissa Tosun DevelopmentLtd And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, uncertainty looms as U.S. stocks faced declines amid tariff concerns, while economic data reveals mixed signals with a cooling labor market and a surprising expansion in manufacturing activity. As investors navigate these turbulent waters, identifying undiscovered gems like Caissa Tosun Development Ltd becomes crucial; such stocks often exhibit strong fundamentals and growth potential that can withstand broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Caissa Tosun DevelopmentLtd (SZSE:000796)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caissa Tosun Development Co., Ltd. operates in the travel and tourism industry both within China and internationally, with a market capitalization of CN¥6.06 billion.

Operations: Caissa Tosun generates revenue primarily from its travel and tourism operations in China and internationally. The company has a market capitalization of approximately CN¥6.06 billion.

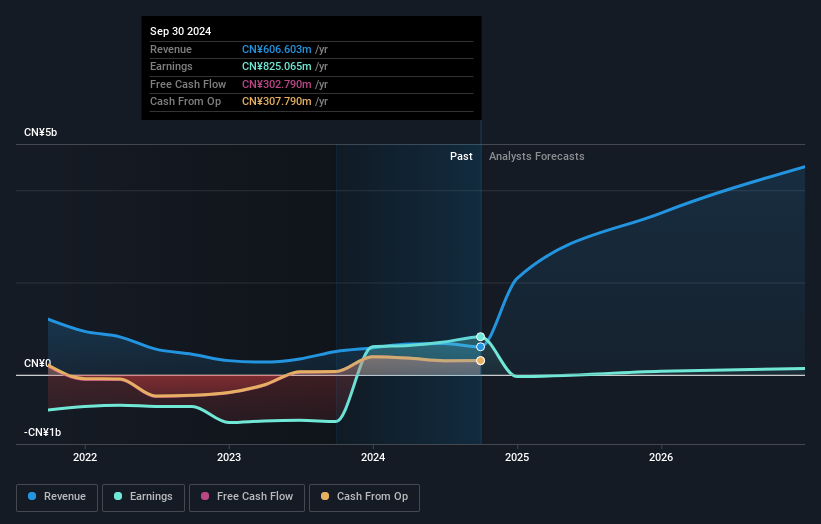

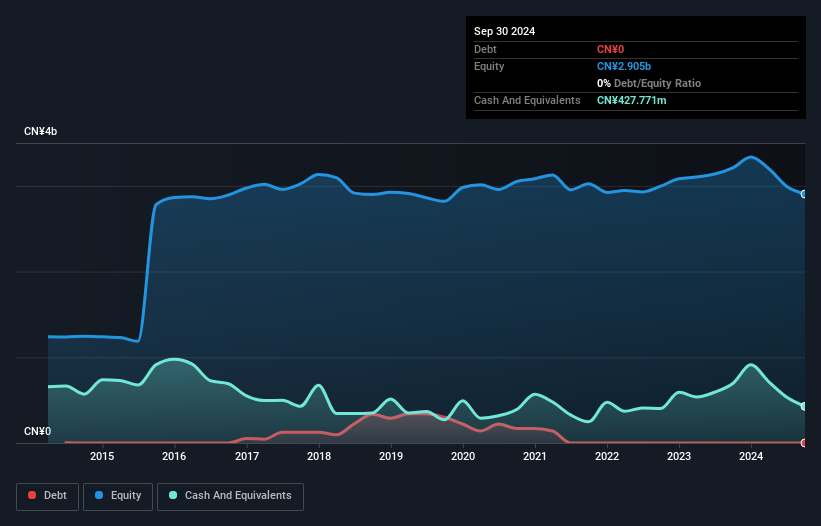

Caissa Tosun Development Ltd. has recently turned profitable, marking a significant milestone as it outpaces the Hospitality industry's -6.9% earnings trend. Trading at 82.5% below its estimated fair value, it presents a compelling investment opportunity with strong relative value compared to peers. Over the past five years, its debt-to-equity ratio has improved from 56.3% to 24.9%, indicating better financial health and reduced leverage risk. Despite these positives, future earnings are projected to fall by an average of 63.9% annually over the next three years, highlighting potential challenges ahead for this small-cap entity in maintaining growth momentum.

Ningbo Ligong Environment And Energy TechnologyLtd (SZSE:002322)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Ligong Environment And Energy Technology Co., Ltd focuses on the R&D, production, sale, and service of online monitoring equipment for the electric power industry in China, with a market cap of CN¥5.05 billion.

Operations: Ningbo Ligong generates revenue primarily from the sale of online monitoring equipment for the electric power industry. The company has a market cap of CN¥5.05 billion.

Ningbo Ligong Environment and Energy Technology, a nimble player in its field, has shown impressive earnings growth of 32.8% over the past year, outpacing the Electrical industry's modest 1.1%. The company operates debt-free, enhancing its financial stability and eliminating concerns about interest coverage. Trading at 23.7% below estimated fair value suggests potential for appreciation compared to industry peers. Recently announced plans for a CNY 180 million share repurchase program indicate strategic capital management aimed at reducing registered capital through share cancellation post-approval. Earnings are projected to grow by an additional 23.18% annually, highlighting robust future prospects.

DaikokutenbussanLtd (TSE:2791)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daikokutenbussan Co., Ltd. operates discount stores and has a market capitalization of ¥107.85 billion.

Operations: The primary revenue stream for Daikokutenbussan Co., Ltd. is its retail segment, generating ¥279.11 billion. Segment adjustments account for an additional ¥1.34 billion in revenue.

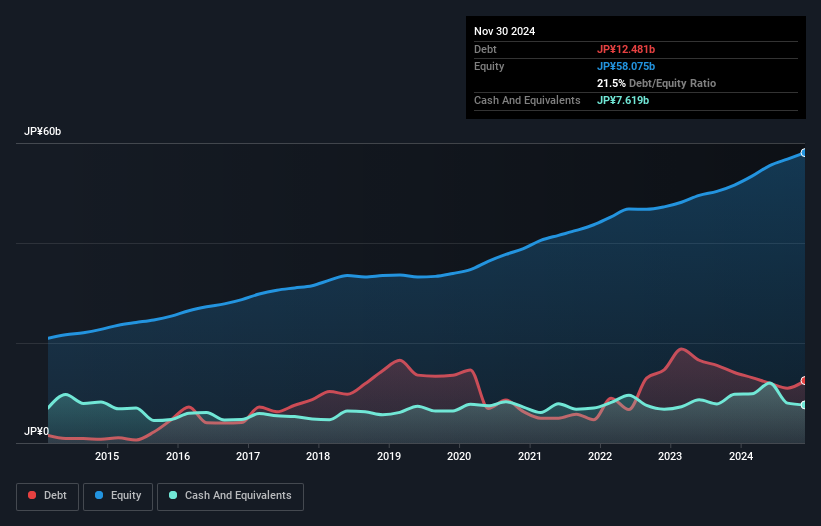

Daikokutenbussan, a nimble player in its industry, showcases robust financial health with high-quality earnings and impressive growth. Over the past year, earnings surged by 41.7%, outpacing the Consumer Retailing sector's 10.5%. The company's net debt to equity ratio stands at a satisfactory 8.4%, down from 39.9% five years ago, indicating prudent financial management. Interest payments are comfortably covered by EBIT at an impressive 3353 times coverage level. Recent half-year results reveal sales of ¥142 billion and net income of ¥3 billion, reflecting solid operational performance with basic EPS from continuing operations at ¥217.11.

- Navigate through the intricacies of DaikokutenbussanLtd with our comprehensive health report here.

Evaluate DaikokutenbussanLtd's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Reveal the 4703 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000796

Caissa Tosun DevelopmentLtd

Engages in travel and tourism related businesses in China and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives