- China

- /

- Basic Materials

- /

- SZSE:300234

November 2024's Top Penny Stocks To Consider

Reviewed by Simply Wall St

Global markets have experienced a tumultuous period, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before facing sharp declines amid a busy earnings and data week. Despite these fluctuations, investors continue to seek opportunities in various market segments, including penny stocks. Although often seen as remnants of past trading eras, penny stocks represent potential growth avenues when backed by strong financials. In this article, we explore three such stocks that stand out for their financial strength and offer intriguing possibilities for investors looking to uncover hidden value in smaller companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.795 | MYR137.71M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.85 | £476.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.415 | £347M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.00 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.9644 | £397.82M | ★★★★☆☆ |

Click here to see the full list of 5,800 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Guizhou Yibai Pharmaceutical (SHSE:600594)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guizhou Yibai Pharmaceutical Co., Ltd. engages in the research, development, production, and sale of pharmaceutical products in China with a market cap of CN¥3.06 billion.

Operations: The company's revenue primarily comes from its operations in China, totaling CN¥2.40 billion.

Market Cap: CN¥3.06B

Guizhou Yibai Pharmaceutical, with a market cap of CN¥3.06 billion, has faced financial challenges recently. The company reported a net loss of CN¥169.15 million for the first nine months of 2024, compared to a net income of CN¥169.87 million the previous year, indicating significant earnings volatility and declining revenue from CN¥2.14 billion to CN¥1.71 billion over the same period. Despite its unprofitability and increased losses over five years at 21.9% annually, Guizhou Yibai maintains satisfactory debt management with short-term assets exceeding liabilities and has completed a share buyback worth CNY 15 million for 5,037,400 shares.

- Unlock comprehensive insights into our analysis of Guizhou Yibai Pharmaceutical stock in this financial health report.

- Gain insights into Guizhou Yibai Pharmaceutical's historical outcomes by reviewing our past performance report.

Tianrun Industry Technology (SZSE:002283)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tianrun Industry Technology Co., Ltd. manufactures and sells internal combustion engine crankshafts in China and internationally, with a market cap of CN¥5.54 billion.

Operations: Tianrun Industry Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥5.54B

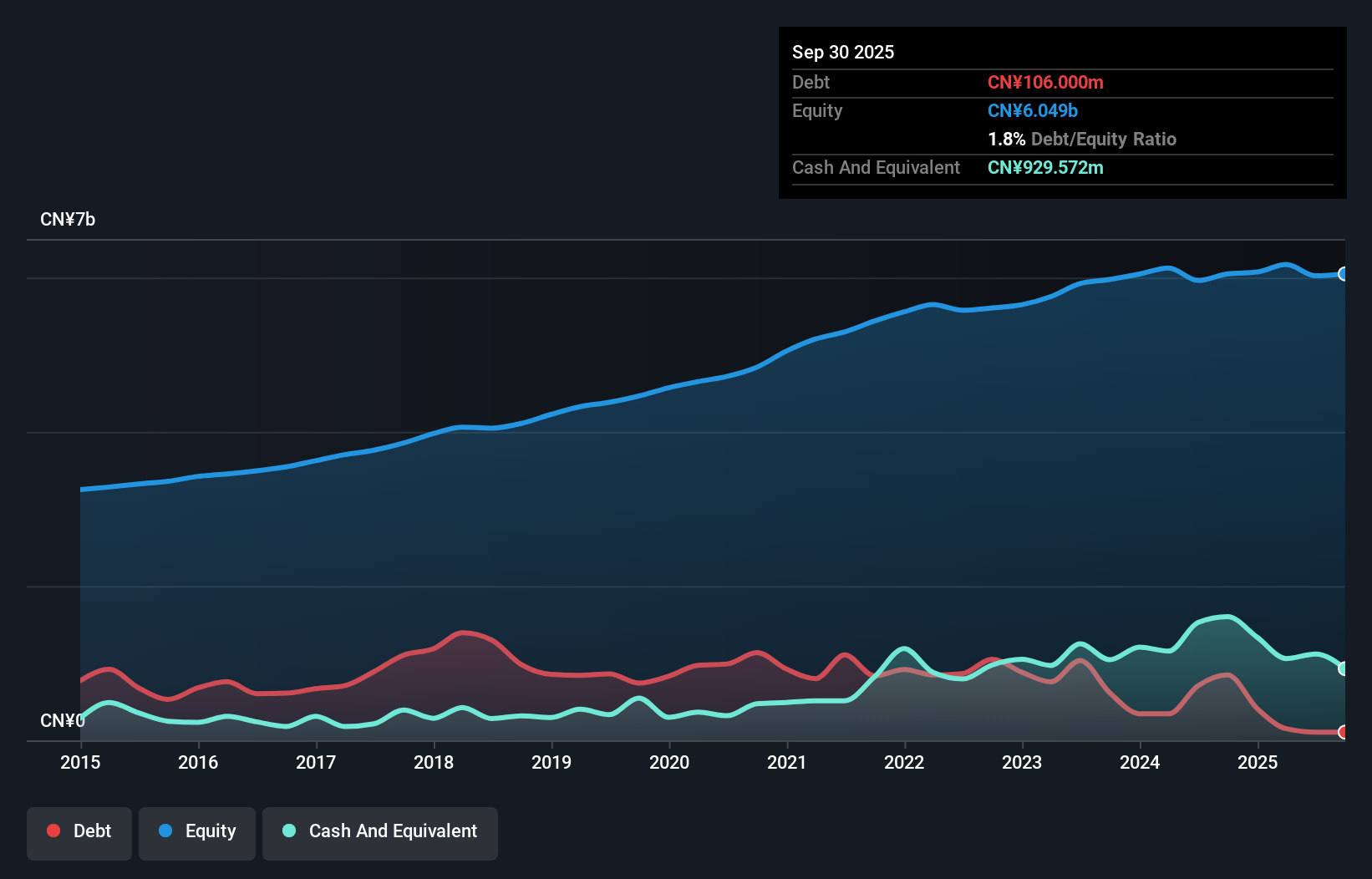

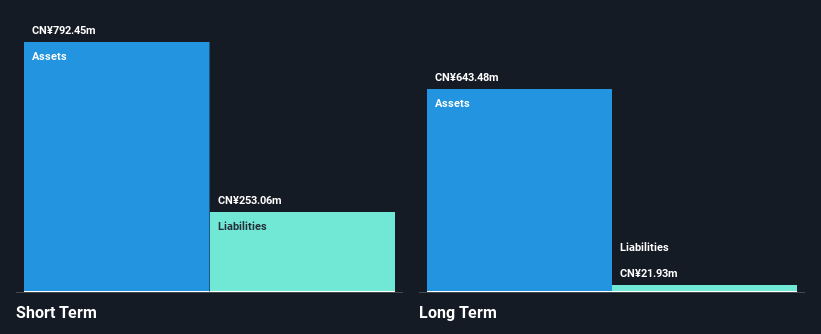

Tianrun Industry Technology, with a market cap of CN¥5.54 billion, has demonstrated financial stability despite recent challenges. The company reported earnings for the first nine months of 2024 showing a slight decline in revenue to CN¥2,766.22 million from CN¥2,947.02 million the prior year and net income decreased to CN¥268.96 million. Its price-to-earnings ratio is favorable compared to the broader Chinese market, indicating potential value for investors seeking opportunities in this sector. Tianrun's strong balance sheet shows short-term assets exceeding both short and long-term liabilities significantly, ensuring robust financial health amidst industry fluctuations.

- Click here to discover the nuances of Tianrun Industry Technology with our detailed analytical financial health report.

- Learn about Tianrun Industry Technology's future growth trajectory here.

Zhejiang Kaier New MaterialsLtd (SZSE:300234)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Kaier New Materials Co., Ltd. specializes in the research, development, manufacture, and sale of vitreous enamel panels both in China and internationally, with a market cap of CN¥2.48 billion.

Operations: There are no specific revenue segments reported for Zhejiang Kaier New Materials Co., Ltd.

Market Cap: CN¥2.48B

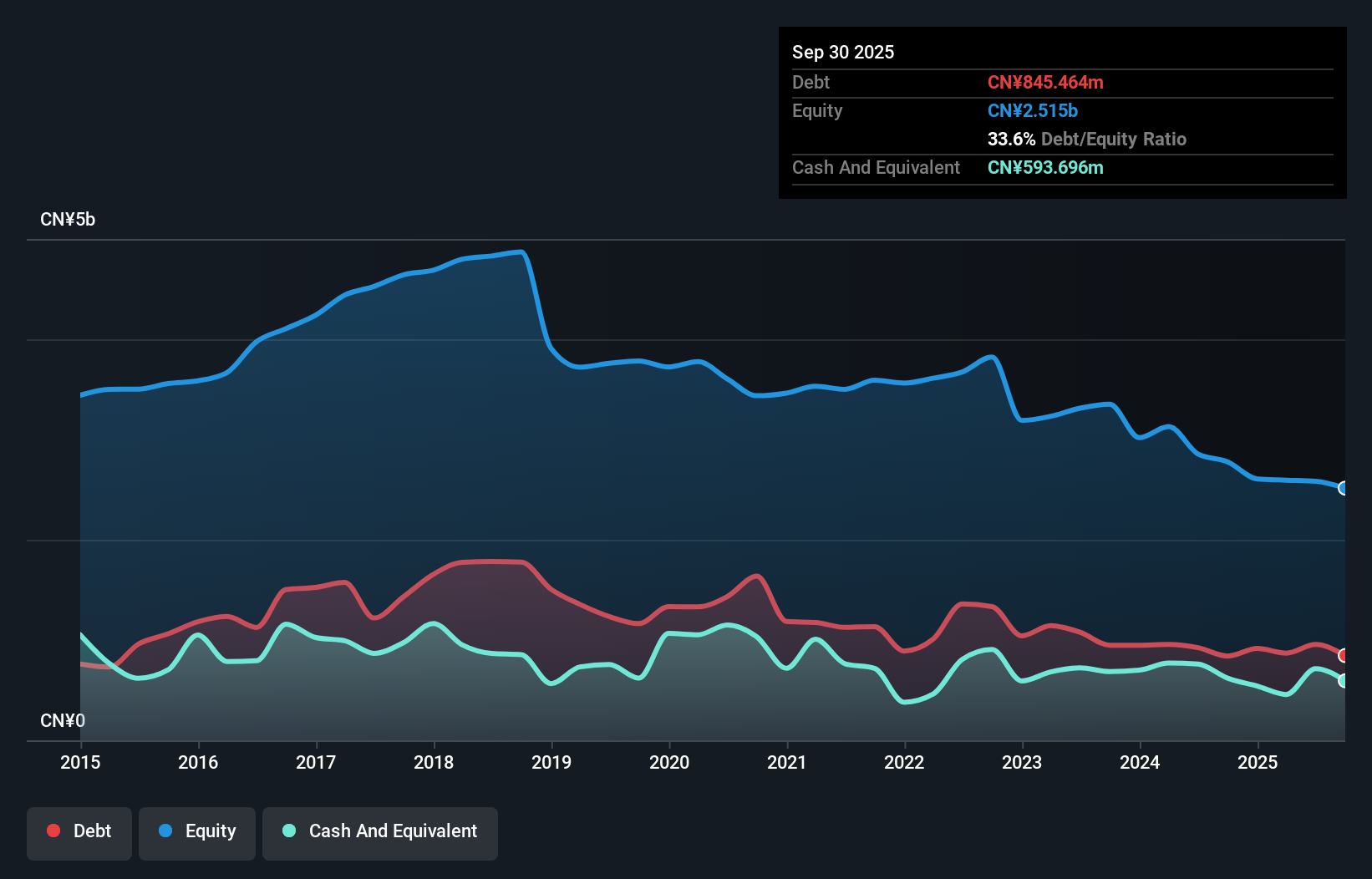

Zhejiang Kaier New Materials Ltd., with a market cap of CN¥2.48 billion, showcases a seasoned management team and financial resilience despite recent sales declines. For the nine months ending September 2024, sales decreased to CN¥301.34 million from CN¥323.58 million the previous year, yet net income rose to CN¥39.5 million from CN¥36.31 million, reflecting improved profit margins and earnings per share stability at CNY 0.0785. The company's debt is well-covered by cash flow, with more cash than total debt and reduced debt-to-equity ratio over five years, suggesting prudent financial management in a competitive market environment.

- Click to explore a detailed breakdown of our findings in Zhejiang Kaier New MaterialsLtd's financial health report.

- Evaluate Zhejiang Kaier New MaterialsLtd's historical performance by accessing our past performance report.

Where To Now?

- Click this link to deep-dive into the 5,800 companies within our Penny Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Kaier New MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300234

Zhejiang Kaier New MaterialsLtd

Engages in the design, research, development, manufacture, promotion, and sale of functional enamel materials in China.

Flawless balance sheet average dividend payer.