- China

- /

- Electrical

- /

- SZSE:002249

Zhongshan Broad-Ocean Motor Co., Ltd. (SZSE:002249) Stock Rockets 25% But Many Are Still Ignoring The Company

Despite an already strong run, Zhongshan Broad-Ocean Motor Co., Ltd. (SZSE:002249) shares have been powering on, with a gain of 25% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

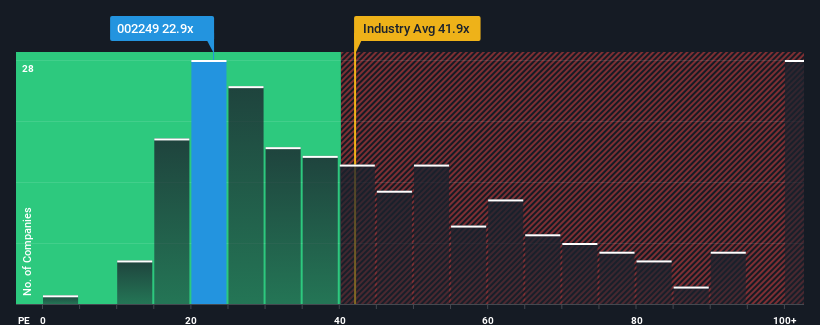

In spite of the firm bounce in price, Zhongshan Broad-Ocean Motor's price-to-earnings (or "P/E") ratio of 22.9x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 40x and even P/E's above 78x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's exceedingly strong of late, Zhongshan Broad-Ocean Motor has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Zhongshan Broad-Ocean Motor

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhongshan Broad-Ocean Motor's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 51% gain to the company's bottom line. The latest three year period has also seen an excellent 183% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Zhongshan Broad-Ocean Motor's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Zhongshan Broad-Ocean Motor's P/E?

The latest share price surge wasn't enough to lift Zhongshan Broad-Ocean Motor's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Zhongshan Broad-Ocean Motor revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Zhongshan Broad-Ocean Motor that you need to be mindful of.

You might be able to find a better investment than Zhongshan Broad-Ocean Motor. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Zhongshan Broad-Ocean Motor, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhongshan Broad-Ocean Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002249

Zhongshan Broad-Ocean Motor

Engages in the motor systems business in China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives