In a week marked by volatility, global markets experienced mixed performance as U.S. corporate earnings and AI competition fears influenced investor sentiment. While the Fed held interest rates steady, the ECB cut rates, boosting European stocks to record highs amidst varied economic signals from major regions like Japan and China. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to navigate current market dynamics.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.09% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Zhongshan Broad-Ocean Motor (SZSE:002249)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhongshan Broad-Ocean Motor Co., Ltd. operates in the motor systems business in China and has a market cap of CN¥13.95 billion.

Operations: Zhongshan Broad-Ocean Motor Co., Ltd. generates its revenue primarily from the motor systems sector within China.

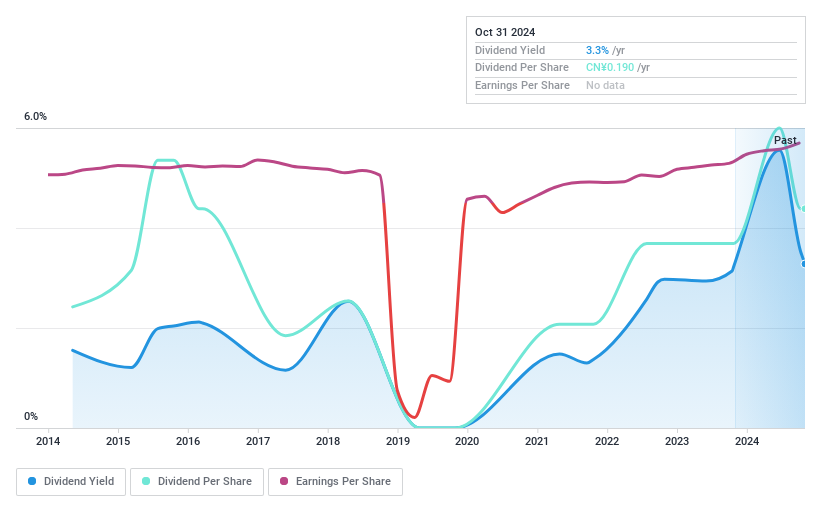

Dividend Yield: 3.2%

Zhongshan Broad-Ocean Motor's dividend payments have grown over the past decade, yet they remain volatile and unreliable, with a payout ratio of 59.5% indicating coverage by earnings. The cash payout ratio is a low 30.3%, suggesting dividends are well covered by cash flows. Despite trading at 47.5% below estimated fair value, recent buyback activities have stalled, with no shares repurchased from November to December 2024 under its announced program.

- Dive into the specifics of Zhongshan Broad-Ocean Motor here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Zhongshan Broad-Ocean Motor is trading behind its estimated value.

Univacco Technology (TPEX:3303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Univacco Technology Inc. is engaged in the stamping foil industry under the UNIVACCO brand, serving both Taiwan and international markets, with a market cap of NT$4.81 billion.

Operations: Univacco Technology Inc. generates its revenue from the Vacuum-Evaporated Thin Films and Optoelectronic Materials segment, amounting to NT$2.93 billion.

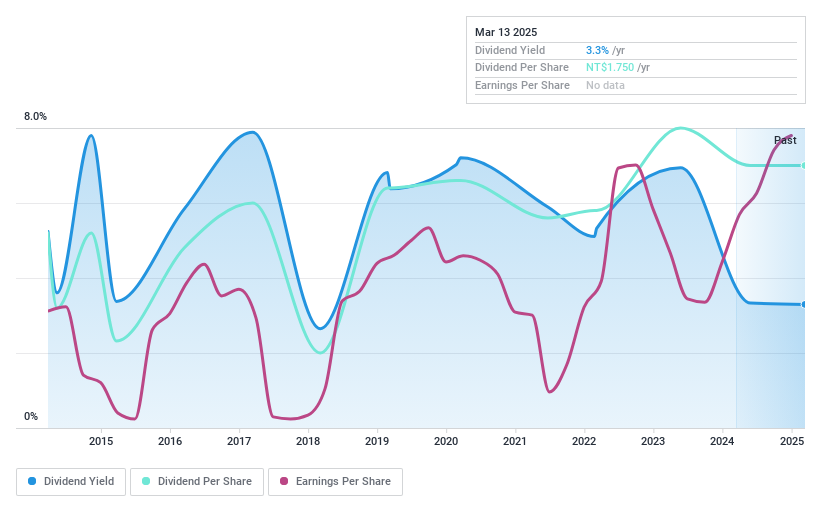

Dividend Yield: 3.4%

Univacco Technology's dividend reliability is questionable due to a volatile track record over the past decade, despite recent growth in payments. The dividend yield of 3.4% is below Taiwan's top quartile, but with a payout ratio of 47.2%, dividends are well covered by earnings and cash flow. Recent earnings reports show significant profit increases, suggesting potential for future stability if sustained, though share price volatility remains a concern.

- Click here and access our complete dividend analysis report to understand the dynamics of Univacco Technology.

- Our comprehensive valuation report raises the possibility that Univacco Technology is priced lower than what may be justified by its financials.

Welldone (TPEX:6170)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Welldone Company, along with its subsidiaries, operates in the telecommunication and digital entertainment sectors mainly in Taiwan, with a market capitalization of NT$4.69 billion.

Operations: Welldone Company generates revenue from its IC and Other Channel Segment, amounting to NT$582 million, and its Communications Service Department, which brings in NT$2.17 billion.

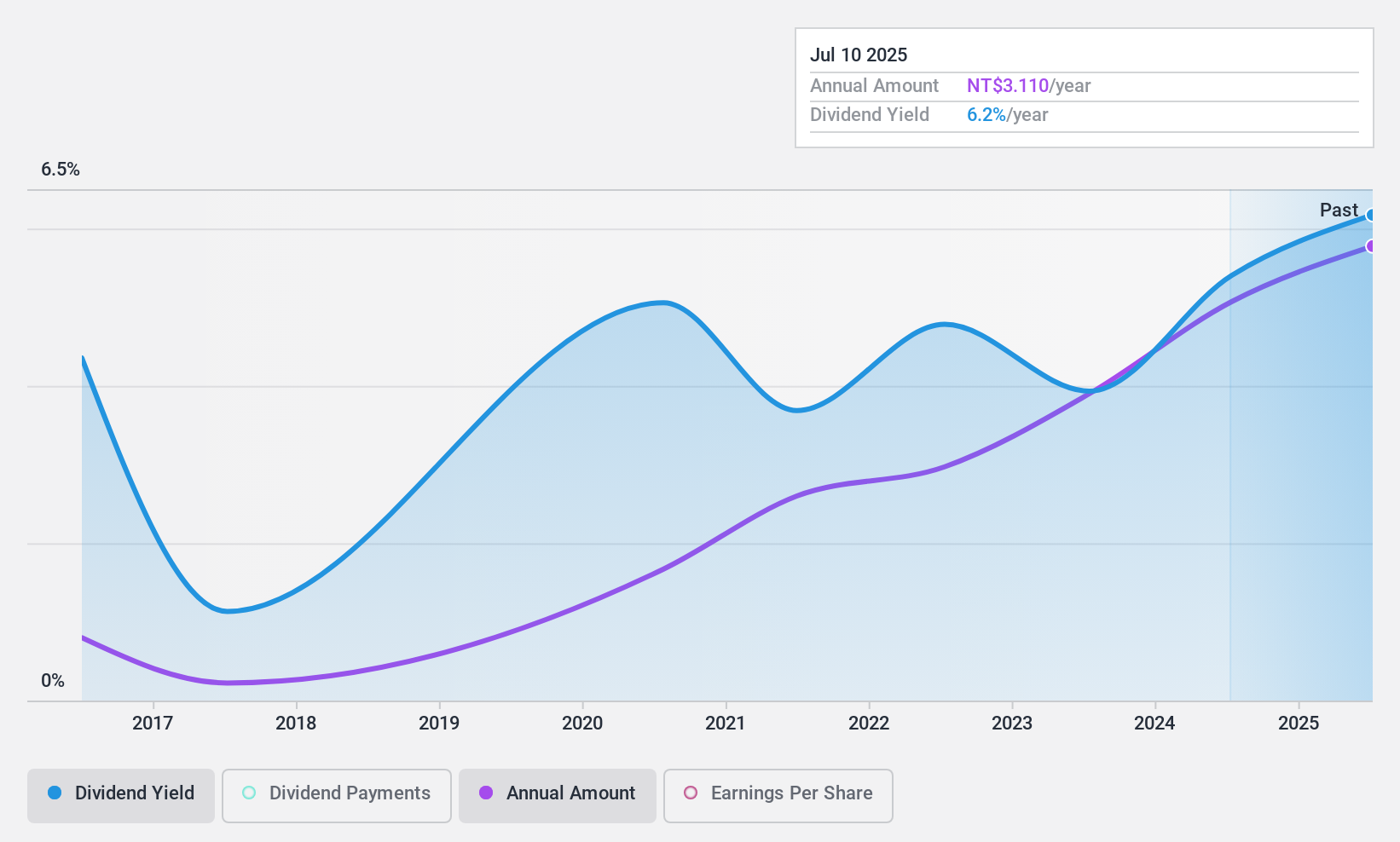

Dividend Yield: 5.4%

Welldone's dividend yield of 5.43% ranks among the top 25% in Taiwan, yet its sustainability is questionable due to a high payout ratio of 133.5%, indicating dividends are not well covered by earnings despite adequate cash flow coverage with a low cash payout ratio of 19.4%. Recent earnings show increased sales but decreased net income and profit margins, reflecting financial challenges. The company's dividends have been volatile over the past decade, raising concerns about reliability amidst high debt levels.

- Click to explore a detailed breakdown of our findings in Welldone's dividend report.

- According our valuation report, there's an indication that Welldone's share price might be on the cheaper side.

Next Steps

- Delve into our full catalog of 1960 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3303

Univacco Technology

Operates in the stamping foil industry under the UNIVACCO brand in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives