- China

- /

- Electrical

- /

- SZSE:002112

Market Might Still Lack Some Conviction On Sanbian Sci Tech Co., Ltd. (SZSE:002112) Even After 26% Share Price Boost

Despite an already strong run, Sanbian Sci Tech Co., Ltd. (SZSE:002112) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 80%.

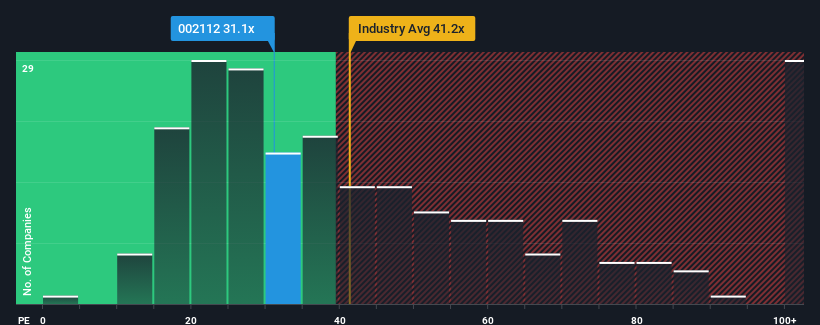

In spite of the firm bounce in price, Sanbian Sci Tech's price-to-earnings (or "P/E") ratio of 31.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 39x and even P/E's above 77x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Sanbian Sci Tech has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Sanbian Sci Tech

Is There Any Growth For Sanbian Sci Tech?

In order to justify its P/E ratio, Sanbian Sci Tech would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 137% gain to the company's bottom line. Pleasingly, EPS has also lifted 573% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 37% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Sanbian Sci Tech is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Sanbian Sci Tech's P/E

The latest share price surge wasn't enough to lift Sanbian Sci Tech's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Sanbian Sci Tech currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Sanbian Sci Tech, and understanding these should be part of your investment process.

You might be able to find a better investment than Sanbian Sci Tech. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002112

Sanbian Sci Tech

Engages in the production, repair, maintenance, and sale of transformers, motors, reactors, low-voltage complete electrical equipment, and power transmission and transformation equipment in China and internationally.

Proven track record with mediocre balance sheet.