- China

- /

- Trade Distributors

- /

- SZSE:002102

Asian Market Insights: China Zheshang Bank And 2 Other Penny Stocks To Watch

Reviewed by Simply Wall St

Amid recent developments in global trade, particularly the U.S.-China tariff pause, Asian markets have seen a positive shift in sentiment. This environment of easing tensions provides a backdrop for investors seeking opportunities in lesser-known corners of the market. Penny stocks, though an older term, continue to capture attention due to their potential for growth at lower price points when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| T.A.C. Consumer (SET:TACC) | THB4.48 | THB2.69B | ✅ 3 ⚠️ 3 View Analysis > |

| North East Rubber (SET:NER) | THB4.24 | THB7.83B | ✅ 5 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.40 | SGD162.12M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.186 | SGD37.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.20 | SGD8.66B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.91 | HK$3.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.60 | HK$52.66B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.19 | HK$750.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.31 | HK$2.19B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.17 | HK$1.81B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,178 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

China Zheshang Bank (SEHK:2016)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Zheshang Bank Co., Ltd. offers a range of commercial banking products and services in Mainland China, with a market cap of HK$88.69 billion.

Operations: The bank's revenue from Mainland China amounts to CN¥39.23 billion.

Market Cap: HK$88.69B

China Zheshang Bank's stock trades significantly below its estimated fair value, offering potential value for investors. The bank's earnings quality is high, supported by a sufficient allowance for bad loans and primarily low-risk funding sources. However, the management team lacks experience with an average tenure of 1.5 years, which could pose challenges in navigating market dynamics. Recent executive changes include the appointment of Mr. Chen Haiqiang as acting president pending regulatory approval, reflecting ongoing leadership adjustments. Despite stable net interest income and earnings year-over-year, dividend sustainability remains uncertain due to an unstable track record and recent decreases.

- Navigate through the intricacies of China Zheshang Bank with our comprehensive balance sheet health report here.

- Assess China Zheshang Bank's future earnings estimates with our detailed growth reports.

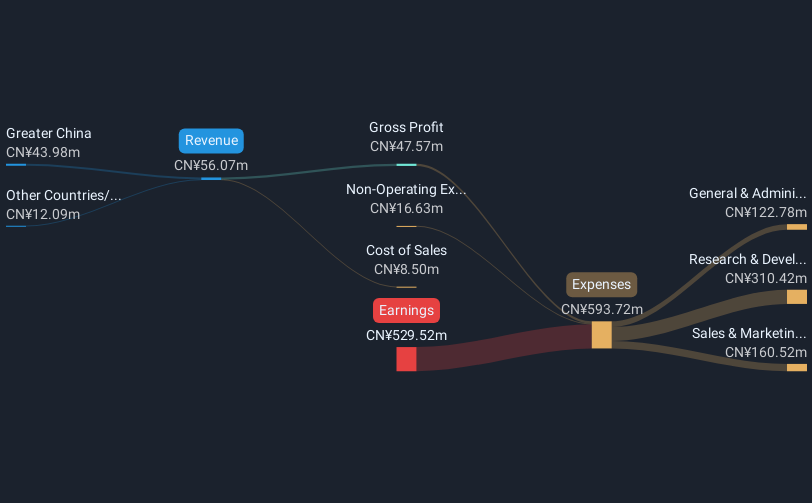

Antengene (SEHK:6996)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antengene Corporation Limited is a biopharmaceutical company focused on developing novel oncology therapies in Greater China and internationally, with a market cap of HK$2.32 billion.

Operations: The company's revenue segment is derived from the research, development, and commercialization of pharmaceutical products, totaling CN¥91.95 million.

Market Cap: HK$2.32B

Antengene Corporation Limited, with a market cap of HK$2.32 billion, operates in the biopharmaceutical sector focusing on oncology therapies. The company reported CN¥91.95 million in revenue for 2024 but remains unprofitable, though it has reduced losses by 25% annually over five years. Recent product announcements include promising preclinical results for ATG-201 and ATG-042, indicating potential future growth as they enter clinical development later in 2025. Despite high volatility and negative return on equity (-37.52%), Antengene maintains a strong cash position with short-term assets surpassing liabilities and sufficient runway to support ongoing operations amidst its innovative pipeline developments.

- Click to explore a detailed breakdown of our findings in Antengene's financial health report.

- Learn about Antengene's future growth trajectory here.

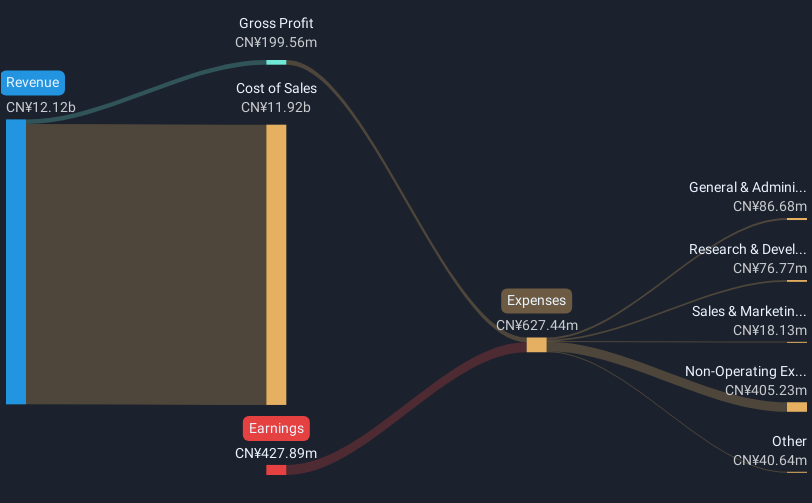

HuBei NengTer TechnologyLtd (SZSE:002102)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HuBei NengTer Technology Ltd operates an ecommerce platform focused on the supply chain of plastic raw materials in China, with a market cap of CN¥7.37 billion.

Operations: HuBei NengTer Technology Ltd has not reported any specific revenue segments.

Market Cap: CN¥7.37B

HuBei NengTer Technology Ltd, with a market cap of CN¥7.37 billion, operates an e-commerce platform for plastic raw materials in China. The company reported first-quarter 2025 revenues of CN¥2.88 billion, down from CN¥3.04 billion the previous year; however, net income increased significantly to CN¥215.9 million from CN¥55.76 million year-over-year. Despite being unprofitable over the past five years and experiencing increased losses at a rate of 39.5% annually, HuBei NengTer has more cash than total debt and maintains a sufficient cash runway for over three years due to positive free cash flow trends and recent share buybacks valued at CN¥329.98 million.

- Click here to discover the nuances of HuBei NengTer TechnologyLtd with our detailed analytical financial health report.

- Gain insights into HuBei NengTer TechnologyLtd's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Gain an insight into the universe of 1,178 Asian Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HuBei NengTer TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002102

HuBei NengTer TechnologyLtd

Operates an ecommerce platform for the supply chain of plastic raw materials in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives