- China

- /

- Construction

- /

- SZSE:002081

Global Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

As global markets experience fluctuations, with the Fed hinting at potential rate cuts and various indices showing mixed results, investors are closely monitoring economic indicators for guidance. Penny stocks, though often associated with speculative investments, can still hold significant promise when backed by strong financials. In this context, we explore a selection of penny stocks that stand out for their financial robustness and potential to offer valuable opportunities in the current market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.47 | A$116.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$958.71M | ✅ 4 ⚠️ 1 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.665 | MYR338.14M | ✅ 4 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.64 | SGD259.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.53 | MYR614.38M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.91 | SGD11.45B | ✅ 5 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.1953 | £191.81M | ✅ 4 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.105 | €290.95M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.93 | €31.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,768 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Linklogis (SEHK:9959)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linklogis Inc. is an investment holding company that offers supply chain finance technology and data-driven emerging solutions in China and internationally, with a market cap of HK$4.36 billion.

Operations: The company's revenue is derived from its Supply Chain Finance Technology Solutions, comprising FI Cloud at CN¥306.89 million and Anchor Cloud at CN¥663.66 million, as well as Emerging Solutions, including Cross-Border Cloud at CN¥51.06 million and SME Credit Tech Solutions at CN¥9.57 million.

Market Cap: HK$4.36B

Linklogis Inc. operates with a market cap of HK$4.36 billion, deriving revenue from its Supply Chain Finance Technology Solutions and Emerging Solutions, including FI Cloud and Anchor Cloud. Despite being unprofitable, the company has reduced losses over the past five years and maintains a strong cash position with reserves of approximately RMB5.4 billion as of June 2025. However, recent guidance indicates an expected increase in net loss due to declining revenues and increased impairment losses on financial assets. Nonetheless, Linklogis benefits from positive free cash flow growth and sufficient cash runway exceeding three years.

- Click here to discover the nuances of Linklogis with our detailed analytical financial health report.

- Understand Linklogis' earnings outlook by examining our growth report.

Yunnan Yunwei (SHSE:600725)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yunnan Yunwei Company Limited operates in China, focusing on the production and operation of coal coke and chemical products, with a market cap of CN¥4.19 billion.

Operations: The company generates revenue of CN¥684.34 million from its operations within China.

Market Cap: CN¥4.19B

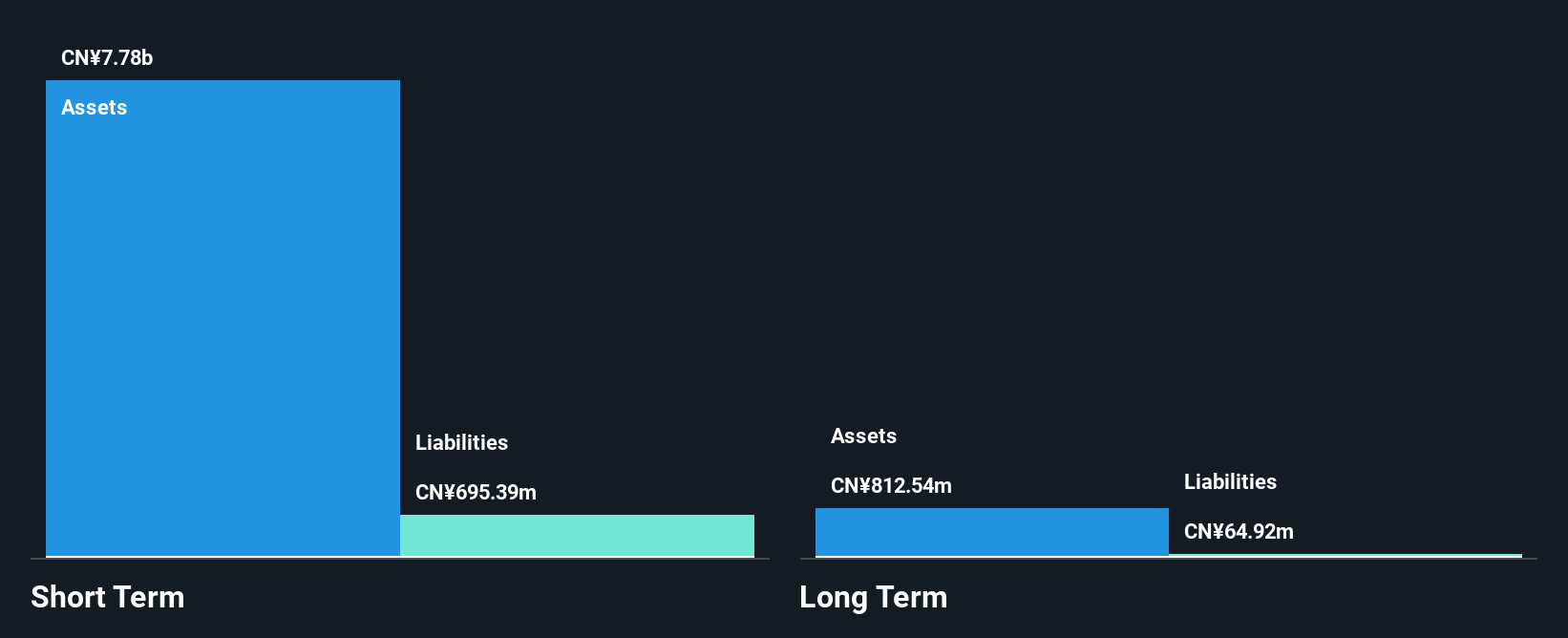

Yunnan Yunwei Company Limited, with a market cap of CN¥4.19 billion, focuses on coal coke and chemical products in China. Despite being unprofitable with negative return on equity, the company has more cash than debt and a stable weekly volatility of 3%. Its short-term assets (CN¥375.2M) exceed both short-term (CN¥81.1M) and long-term liabilities (CN¥11M). The company maintains a positive free cash flow growing at 24% annually, ensuring over three years of cash runway. However, management's average tenure is only 1.6 years, indicating an inexperienced team amidst ongoing financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Yunnan Yunwei.

- Explore historical data to track Yunnan Yunwei's performance over time in our past results report.

Suzhou Gold Mantis Construction Decoration (SZSE:002081)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Suzhou Gold Mantis Construction Decoration Co., Ltd. specializes in the design and construction of interior decoration, curtain walls, furniture, and landscape projects in China, with a market cap of CN¥9.61 billion.

Operations: Revenue segments for the company are not reported.

Market Cap: CN¥9.61B

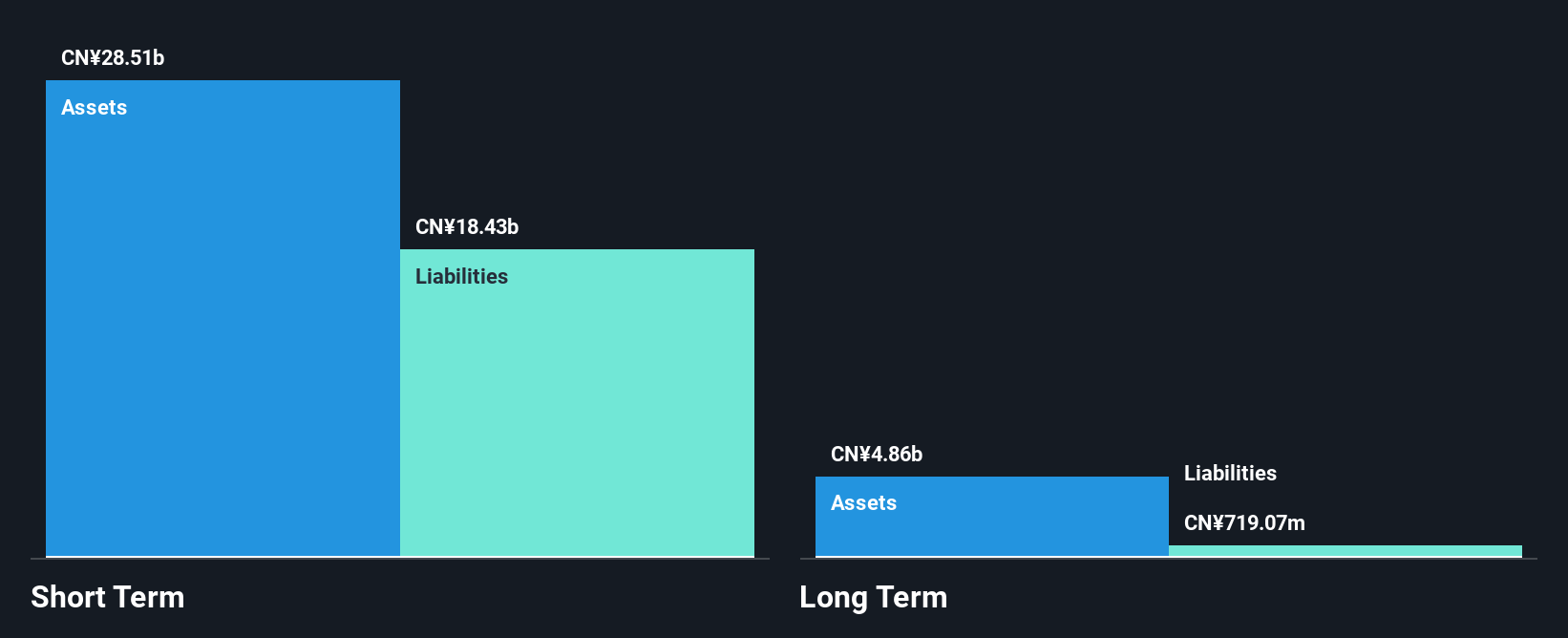

Suzhou Gold Mantis Construction Decoration Co., Ltd. recently reported half-year revenues of CN¥9.53 billion, showing a modest increase from the previous year, with net income at CN¥357.89 million. Despite low return on equity and declining earnings over five years, the company maintains strong financial health with short-term assets of CN¥29.1 billion surpassing both short-term and long-term liabilities significantly. Debt is well-covered by operating cash flow, and interest payments are comfortably managed by EBIT coverage of 25.8 times. The board is experienced with an average tenure of 3.2 years, but profit margins have decreased from last year’s figures.

- Dive into the specifics of Suzhou Gold Mantis Construction Decoration here with our thorough balance sheet health report.

- Learn about Suzhou Gold Mantis Construction Decoration's future growth trajectory here.

Summing It All Up

- Click this link to deep-dive into the 3,768 companies within our Global Penny Stocks screener.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002081

Suzhou Gold Mantis Construction Decoration

Engages in the design and construction of interior decoration, curtain walls, furniture, and landscape in China.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives