- China

- /

- Construction

- /

- SZSE:002062

Discover Hongrun Construction Group And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets react to rising U.S. Treasury yields, with the S&P 500 Index finishing lower after a streak of gains, investors are keeping a close eye on smaller-cap stocks and their potential for growth. Penny stocks, although often considered niche investments, can offer unique opportunities in this fluctuating market landscape. These stocks represent smaller or newer companies that may possess strong financial foundations and the potential for significant returns. In this article, we will explore several penny stocks that demonstrate financial strength and long-term potential amidst current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR122.98M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$495.14M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.32 | THB1.88B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.765 | £473.73M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.125 | £806.26M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.12 | £426.67M | ★★★★☆☆ |

Click here to see the full list of 5,797 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Hongrun Construction Group (SZSE:002062)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hongrun Construction Group Co., Ltd. operates in the construction industry primarily within China, with a market capitalization of CN¥4.34 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for Hongrun Construction Group Co., Ltd.

Market Cap: CN¥4.34B

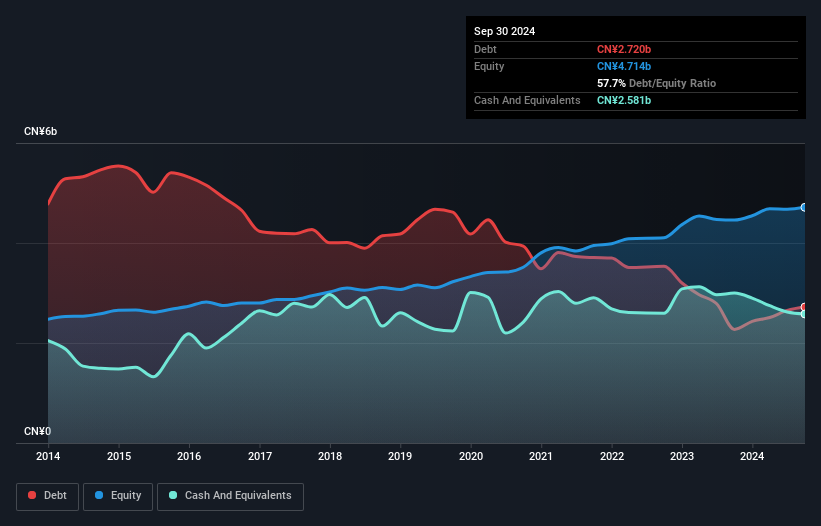

Hongrun Construction Group, with a market cap of CN¥4.34 billion, recently reported earnings for the nine months ending September 2024. Sales were CN¥4.28 billion, slightly down from the previous year, while net income also saw a minor decrease to CN¥249.63 million. The company maintains a satisfactory net debt to equity ratio and has not diluted shareholder value recently. Its price-to-earnings ratio is favorable compared to the broader Chinese market, and short-term assets exceed both short and long-term liabilities significantly. However, earnings growth has been negative over recent years despite having high-quality past earnings and experienced management.

- Take a closer look at Hongrun Construction Group's potential here in our financial health report.

- Explore historical data to track Hongrun Construction Group's performance over time in our past results report.

Zhefu Holding Group (SZSE:002266)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhefu Holding Group Co., Ltd. operates through its subsidiaries in the research, development, manufacture, installation, and service of hydropower equipment both in China and internationally, with a market cap of CN¥17.28 billion.

Operations: Revenue segments for Zhefu Holding Group are not reported.

Market Cap: CN¥17.28B

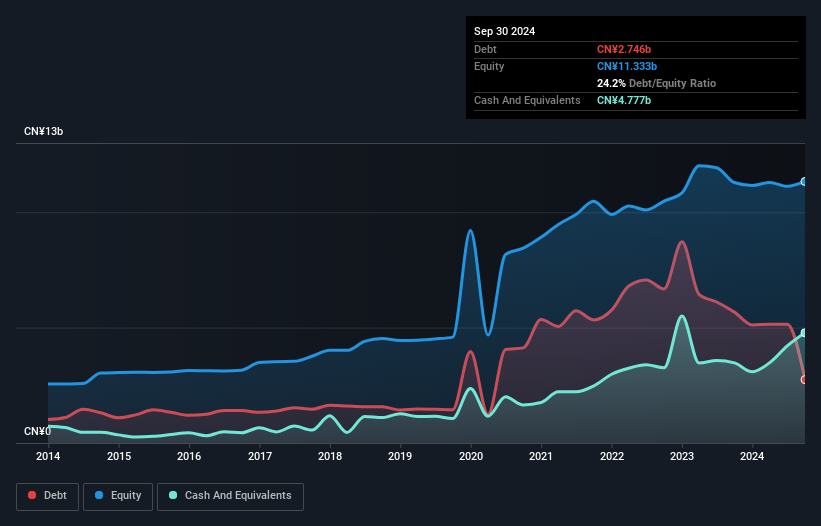

Zhefu Holding Group, with a market cap of CN¥17.28 billion, reported sales of CN¥15.26 billion for the nine months ending September 2024, up from the previous year. However, net income decreased to CN¥775.69 million from CN¥986.56 million due to lower profit margins and significant one-off gains impacting results. The company has reduced its debt-to-equity ratio over five years and maintains strong interest coverage with EBIT at 9.5x interest payments. Despite recent stock buybacks totaling 1.02% of shares for CN¥172.5 million, earnings growth remains negative compared to industry averages, posing challenges in profitability improvement efforts.

- Unlock comprehensive insights into our analysis of Zhefu Holding Group stock in this financial health report.

- Assess Zhefu Holding Group's future earnings estimates with our detailed growth reports.

Anhui Shenjian New MaterialsLtd (SZSE:002361)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anhui Shenjian New Materials Co., Ltd. researches, produces, markets, and sells saturated polyester resins for powder coatings both in China and internationally, with a market cap of CN¥3.77 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: CN¥3.77B

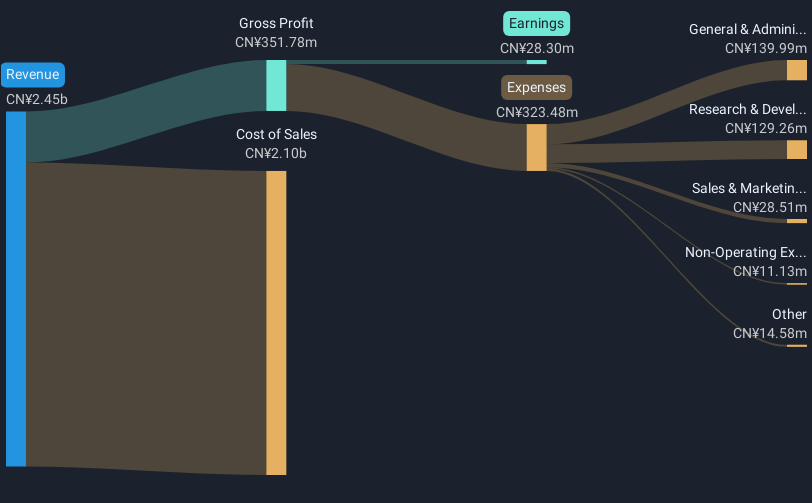

Anhui Shenjian New Materials Co., Ltd. recently reported sales of CN¥1,735.87 million for the nine months ending September 2024, with net income rising to CN¥29.21 million year-over-year despite a decline in revenue from the previous period. The company's short-term assets significantly exceed its liabilities, and interest payments are well covered by EBIT at 5.1x coverage. However, high debt levels persist with a net debt to equity ratio of 43.9%. Earnings have shown substantial growth over the past year but remain volatile due to large one-off items impacting results and historically declining profits over five years.

- Navigate through the intricacies of Anhui Shenjian New MaterialsLtd with our comprehensive balance sheet health report here.

- Understand Anhui Shenjian New MaterialsLtd's track record by examining our performance history report.

Key Takeaways

- Discover the full array of 5,797 Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hongrun Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002062

Hongrun Construction Group

Engages in construction business primarily in China.

Excellent balance sheet second-rate dividend payer.