- Switzerland

- /

- Insurance

- /

- SWX:SREN

3 Top Dividend Stocks Yielding Up To 5.5%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by stronger-than-expected U.S. labor market data and persistent inflation concerns, investors have witnessed significant volatility across major indices. With the Federal Reserve's cautious stance on interest rates and economic uncertainties looming, many are turning their attention to dividend stocks for potential stability and income in turbulent times. In such an environment, a good dividend stock often combines a reliable yield with strong fundamentals, offering investors a measure of resilience amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.37% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1995 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

China Everbright Bank (SHSE:601818)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Everbright Bank Company Limited offers a variety of financial products and services to corporate, government, and individual clients across Mainland China and several international locations, with a market cap of CN¥207.35 billion.

Operations: China Everbright Bank's revenue is derived from providing financial products and services to corporate clients, government entities, and individual customers in regions including Mainland China, Hong Kong, Luxembourg, Macao, Seoul, and Sydney.

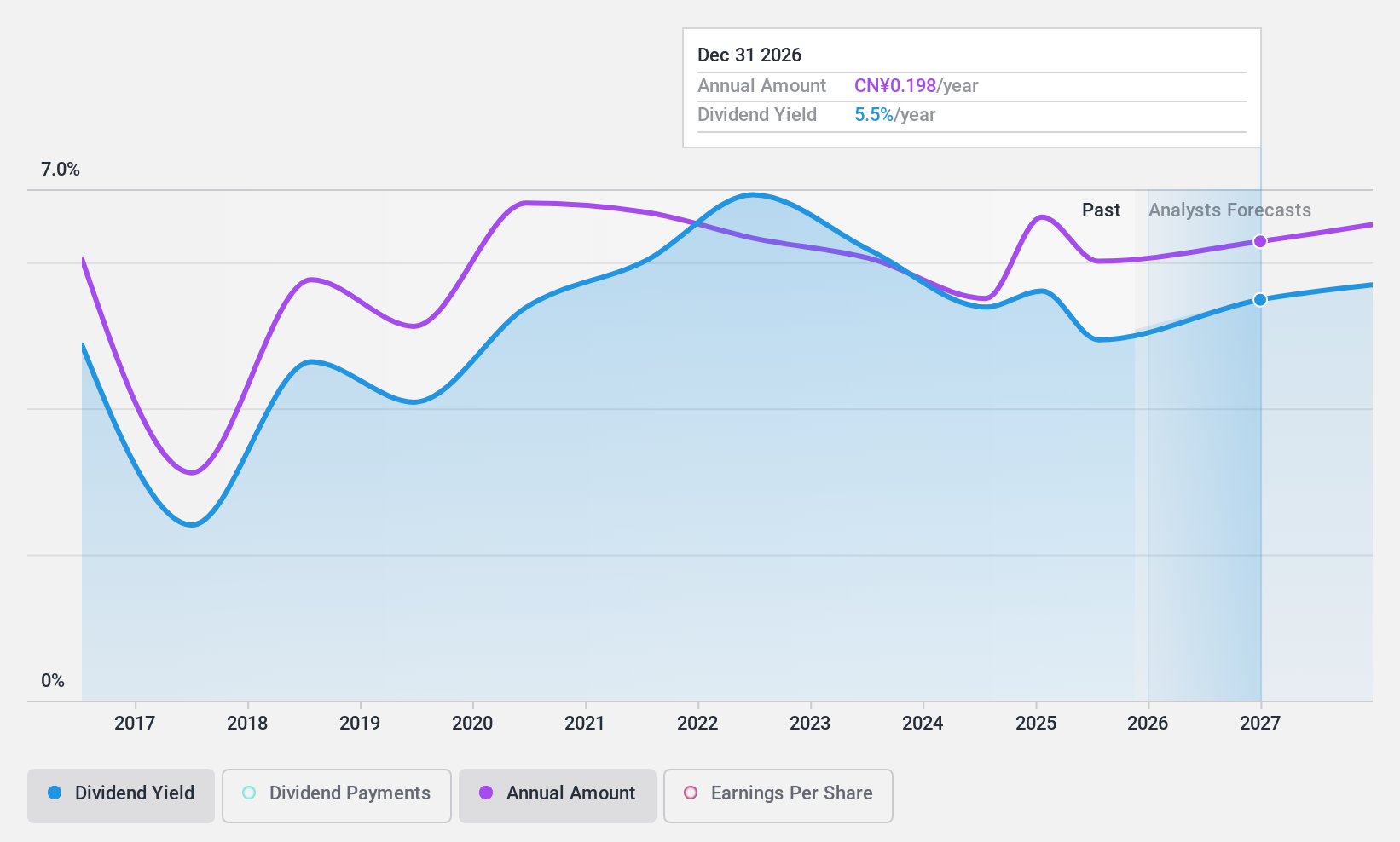

Dividend Yield: 5.6%

China Everbright Bank approved an interim cash dividend of RMB 1.04 per 10 shares, with a payout date set for February 2025. The bank's dividend yield is among the top in China's market, yet its historical volatility raises reliability concerns. Despite this, dividends are currently well-covered by earnings with a payout ratio of 45.5%, and future forecasts suggest even stronger coverage at 28.1%. Earnings growth is projected at approximately 9.49% annually.

- Click here to discover the nuances of China Everbright Bank with our detailed analytical dividend report.

- Our valuation report here indicates China Everbright Bank may be overvalued.

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF39.26 billion, operates globally through its subsidiaries to offer wholesale reinsurance, insurance, various risk transfer solutions, and other insurance-related services.

Operations: Swiss Re AG generates revenue primarily from its Property & Casualty Reinsurance segment ($20.99 billion), Life & Health Reinsurance segment ($17.47 billion), and Corporate Solutions segment ($6.38 billion).

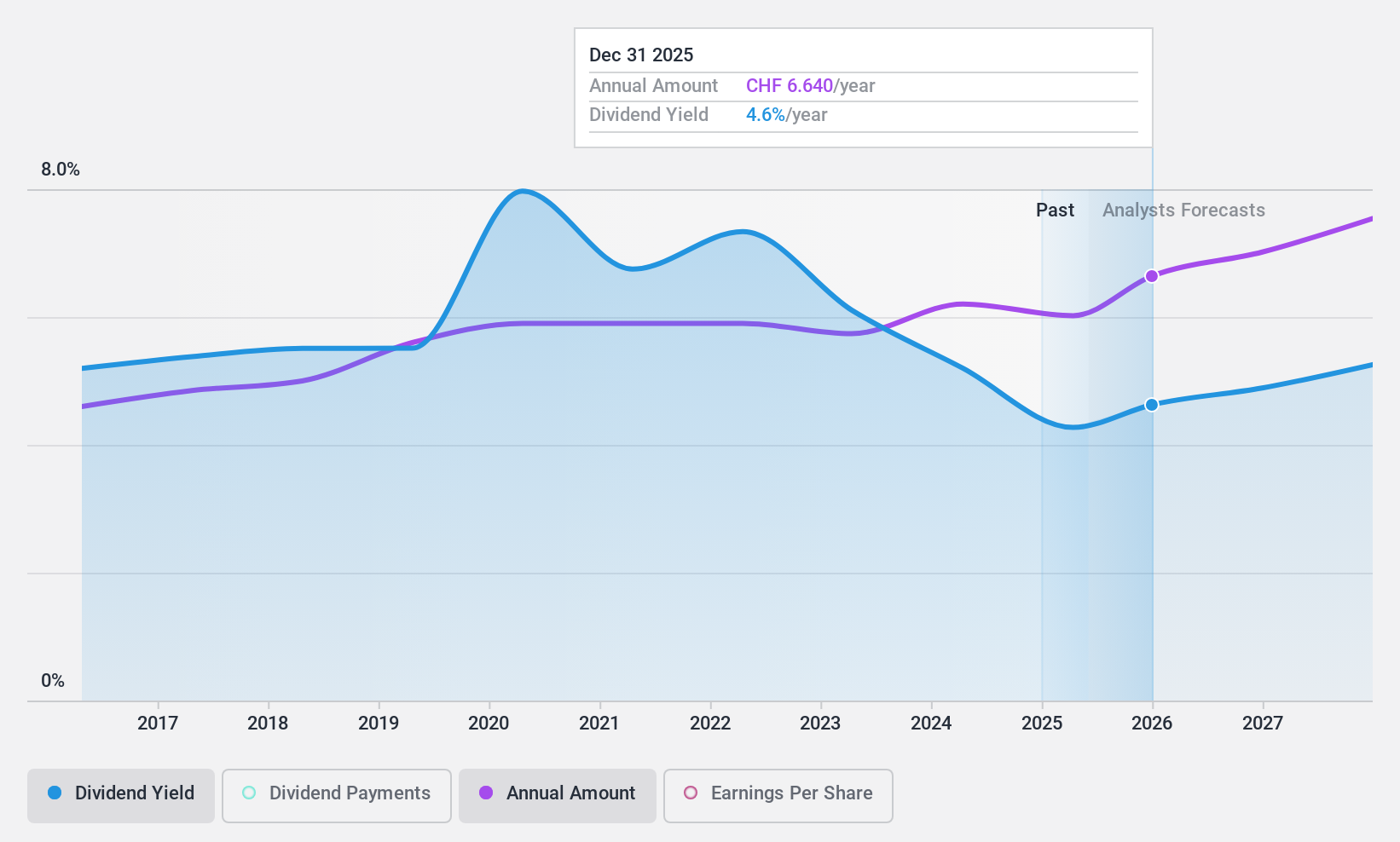

Dividend Yield: 4.6%

Swiss Re's dividend yield of 4.58% ranks in the top 25% of Swiss market payers, supported by a payout ratio of 67.4% and a cash payout ratio of 50%, indicating coverage by earnings and cash flows. However, its dividends have been volatile over the past decade, with inconsistent growth. Recent guidance suggests net income targets exceeding US$4.4 billion for 2025, potentially influencing future dividend stability and growth prospects.

- Dive into the specifics of Swiss Re here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Swiss Re is trading behind its estimated value.

Zhejiang Communications Technology (SZSE:002061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Communications Technology Co., Ltd. operates in the infrastructure and construction sector, focusing on transportation projects, with a market cap of approximately CN¥10.01 billion.

Operations: Zhejiang Communications Technology Co., Ltd. generates its revenue primarily from infrastructure and construction activities, specifically in transportation projects.

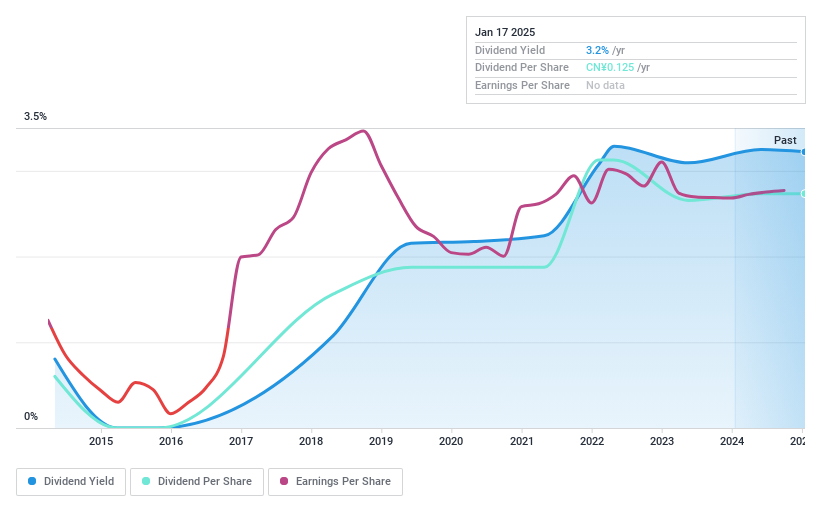

Dividend Yield: 3.2%

Zhejiang Communications Technology offers a 3.25% dividend yield, ranking in the top 25% of CN market payers, yet its dividends are not covered by free cash flows despite a low payout ratio of 22.7%. The company has experienced volatile dividend payments over the past decade, with earnings growing by 8.7% last year and forecasted to grow annually by 9.71%. Recent earnings show net income at CNY 838.95 million for nine months ended September 2024.

- Get an in-depth perspective on Zhejiang Communications Technology's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Zhejiang Communications Technology is priced lower than what may be justified by its financials.

Summing It All Up

- Reveal the 1995 hidden gems among our Top Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SREN

Swiss Re

Provides wholesale reinsurance, insurance, other insurance-based forms of risk transfer, and other insurance-related services worldwide.

Excellent balance sheet, good value and pays a dividend.