- China

- /

- Construction

- /

- SZSE:002051

There Is A Reason China CAMC Engineering Co., Ltd.'s (SZSE:002051) Price Is Undemanding

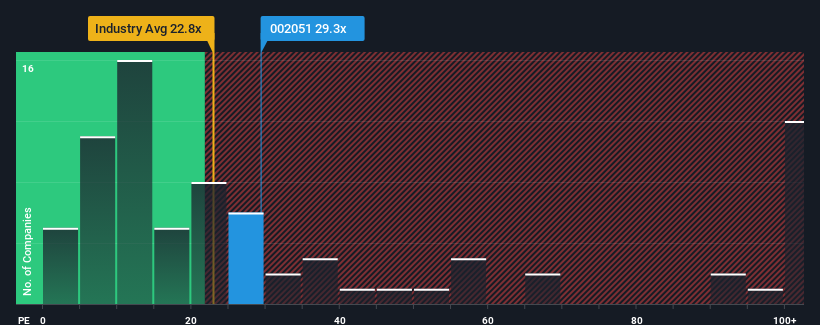

China CAMC Engineering Co., Ltd.'s (SZSE:002051) price-to-earnings (or "P/E") ratio of 29.3x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 72x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

China CAMC Engineering has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for China CAMC Engineering

Is There Any Growth For China CAMC Engineering?

The only time you'd be truly comfortable seeing a P/E as low as China CAMC Engineering's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.1%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 1,498% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 23% during the coming year according to the one analyst following the company. Meanwhile, the rest of the market is forecast to expand by 37%, which is noticeably more attractive.

In light of this, it's understandable that China CAMC Engineering's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that China CAMC Engineering maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - China CAMC Engineering has 1 warning sign we think you should be aware of.

You might be able to find a better investment than China CAMC Engineering. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002051

China CAMC Engineering

Engages in construction, project management, machine operation, and maintenance business.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026