- China

- /

- Electronic Equipment and Components

- /

- SHSE:688322

Spotlight On Orbbec And 2 Other Growth Stocks Insiders Favor

Reviewed by Simply Wall St

As global markets react to the Trump administration's policy shifts and optimism surrounding AI investments, U.S. stocks have been reaching record highs, with growth stocks outperforming their value counterparts for the first time this year. In such a buoyant environment, insider ownership can be a key indicator of confidence in a company's future prospects, making it an important factor for investors to consider when evaluating growth companies like Orbbec and others favored by insiders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 20.5% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Here's a peek at a few of the choices from the screener.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors with a market cap of CN¥20.82 billion.

Operations: The company's revenue segments total CN¥0 million.

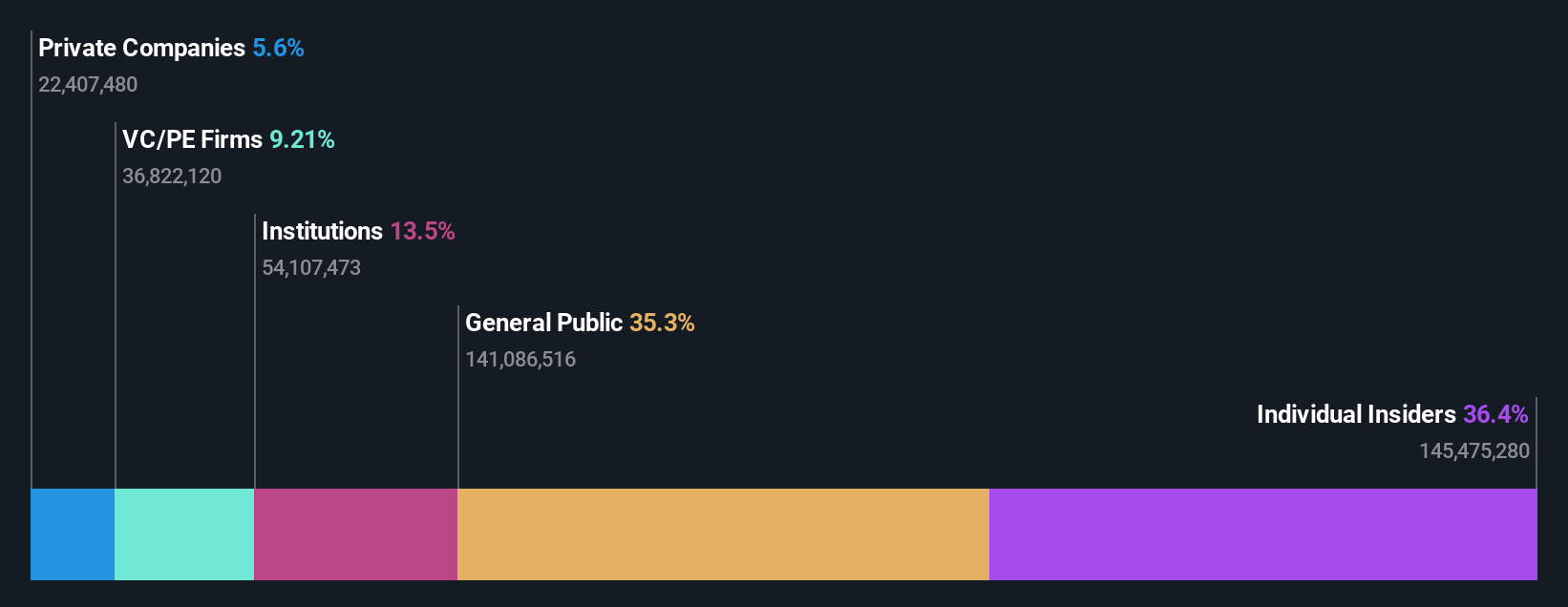

Insider Ownership: 36.5%

Revenue Growth Forecast: 41% p.a.

Orbbec's revenue is forecast to grow significantly at 41% annually, outpacing the Chinese market's average of 13.3%. Despite recent share price volatility, the company is expected to become profitable within three years, with earnings projected to grow by 122.68% annually. However, its future return on equity remains low at an estimated 4.8%. The recent buyback completed involved repurchasing shares worth CNY 33.83 million, indicating strategic financial management without substantial insider trading activity recently noted.

- Navigate through the intricacies of Orbbec with our comprehensive analyst estimates report here.

- The analysis detailed in our Orbbec valuation report hints at an inflated share price compared to its estimated value.

Shijiazhuang Shangtai Technology (SZSE:001301)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shijiazhuang Shangtai Technology Co., Ltd. operates in the technology sector and has a market cap of CN¥14.80 billion.

Operations: The company generates revenue primarily through its operations in the technology sector.

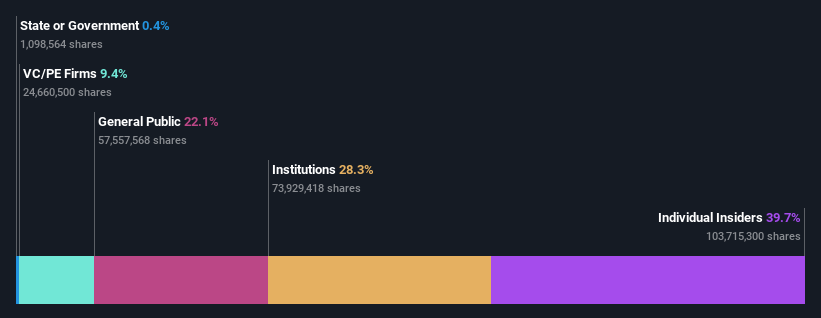

Insider Ownership: 39.7%

Revenue Growth Forecast: 23% p.a.

Shijiazhuang Shangtai Technology's revenue is projected to grow at 23% annually, surpassing the Chinese market's average. Despite a lower return on equity forecast of 15%, its earnings are expected to rise significantly by over 21% per year. The company recently completed a share buyback worth CNY 44.75 million, funded internally, reflecting strategic financial management. The stock trades below analyst price targets and presents good value with a price-to-earnings ratio of 20.2x compared to the market average.

- Get an in-depth perspective on Shijiazhuang Shangtai Technology's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Shijiazhuang Shangtai Technology's share price might be too pessimistic.

Fixstars (TSE:3687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fixstars Corporation is a software company operating in Japan and internationally, with a market cap of ¥55.67 billion.

Operations: Fixstars Corporation generates revenue through its software operations both domestically and internationally.

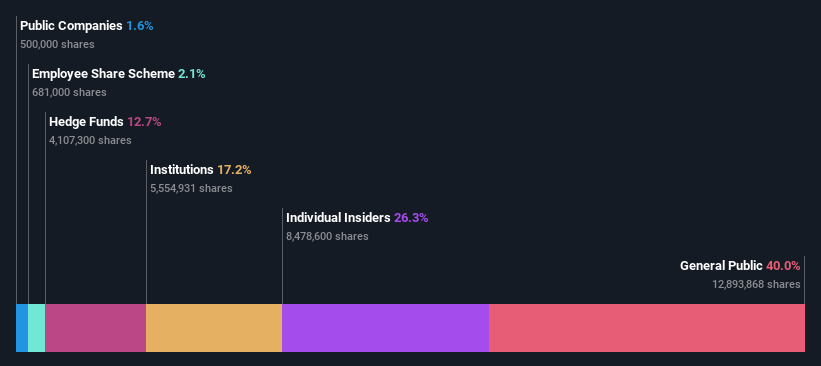

Insider Ownership: 26.3%

Revenue Growth Forecast: 14.7% p.a.

Fixstars Corporation is experiencing robust growth, with earnings projected to increase by 20.5% annually, outpacing the Japanese market average. The company's recent collaboration with AWS Japan to enhance its AI Booster platform underscores its commitment to innovation and cost efficiency in AI applications. Despite a volatile share price, Fixstars' revenue growth of 14.7% per year remains strong compared to the market's 4.3%. The focus on scalable cloud solutions positions it well for future expansion.

- Click here to discover the nuances of Fixstars with our detailed analytical future growth report.

- According our valuation report, there's an indication that Fixstars' share price might be on the expensive side.

Taking Advantage

- Explore the 1482 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688322

High growth potential with excellent balance sheet.

Market Insights

Community Narratives