- China

- /

- Electrical

- /

- SZSE:000922

Slammed 27% Harbin Electric Corporation Jiamusi Electric Machine CO.,Ltd (SZSE:000922) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Harbin Electric Corporation Jiamusi Electric Machine CO.,Ltd (SZSE:000922) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

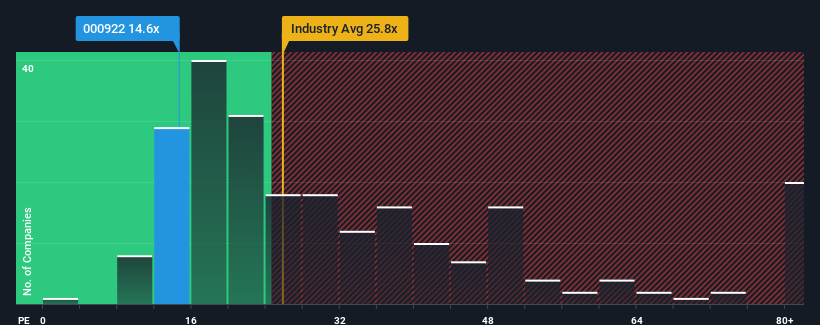

Since its price has dipped substantially, Harbin Electric Corporation Jiamusi Electric MachineLtd may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.6x, since almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 50x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Harbin Electric Corporation Jiamusi Electric MachineLtd has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Harbin Electric Corporation Jiamusi Electric MachineLtd

Is There Any Growth For Harbin Electric Corporation Jiamusi Electric MachineLtd?

There's an inherent assumption that a company should underperform the market for P/E ratios like Harbin Electric Corporation Jiamusi Electric MachineLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 6.8% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 21% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% per annum, which is not materially different.

In light of this, it's peculiar that Harbin Electric Corporation Jiamusi Electric MachineLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Harbin Electric Corporation Jiamusi Electric MachineLtd's P/E?

Harbin Electric Corporation Jiamusi Electric MachineLtd's P/E has taken a tumble along with its share price. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Harbin Electric Corporation Jiamusi Electric MachineLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Harbin Electric Corporation Jiamusi Electric MachineLtd that you need to be mindful of.

Of course, you might also be able to find a better stock than Harbin Electric Corporation Jiamusi Electric MachineLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Harbin Electric Corporation Jiamusi Electric MachineLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harbin Electric Corporation Jiamusi Electric MachineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000922

Harbin Electric Corporation Jiamusi Electric MachineLtd

Manufactures and sells electric motors in the People’s Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives