- China

- /

- Aerospace & Defense

- /

- SZSE:000768

Some Shareholders Feeling Restless Over AVIC Xi'an Aircraft Industry Group Company Ltd.'s (SZSE:000768) P/E Ratio

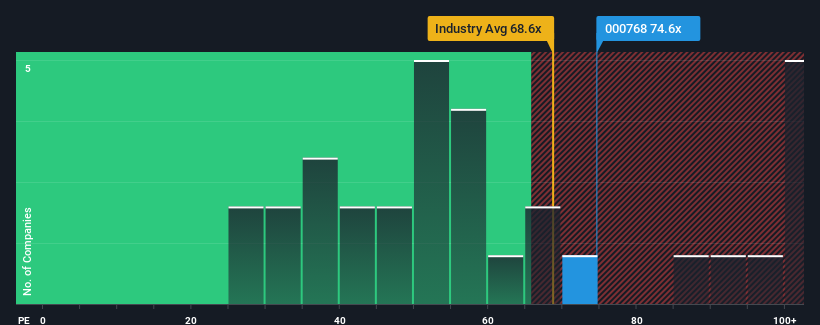

With a price-to-earnings (or "P/E") ratio of 74.6x AVIC Xi'an Aircraft Industry Group Company Ltd. (SZSE:000768) may be sending very bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 36x and even P/E's lower than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

AVIC Xi'an Aircraft Industry Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for AVIC Xi'an Aircraft Industry Group

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, AVIC Xi'an Aircraft Industry Group would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 49%. As a result, it also grew EPS by 28% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 34% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 39% growth forecast for the broader market.

In light of this, it's alarming that AVIC Xi'an Aircraft Industry Group's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of AVIC Xi'an Aircraft Industry Group's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for AVIC Xi'an Aircraft Industry Group with six simple checks.

Of course, you might also be able to find a better stock than AVIC Xi'an Aircraft Industry Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade AVIC Xi'an Aircraft Industry Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000768

AVIC Xi'an Aircraft Industry Group

AVIC Xi'an Aircraft Industry Group Company Ltd.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives