Should You Be Adding North Industries Group Red Arrow (SZSE:000519) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like North Industries Group Red Arrow (SZSE:000519). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for North Industries Group Red Arrow

How Quickly Is North Industries Group Red Arrow Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that North Industries Group Red Arrow's EPS has grown 34% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

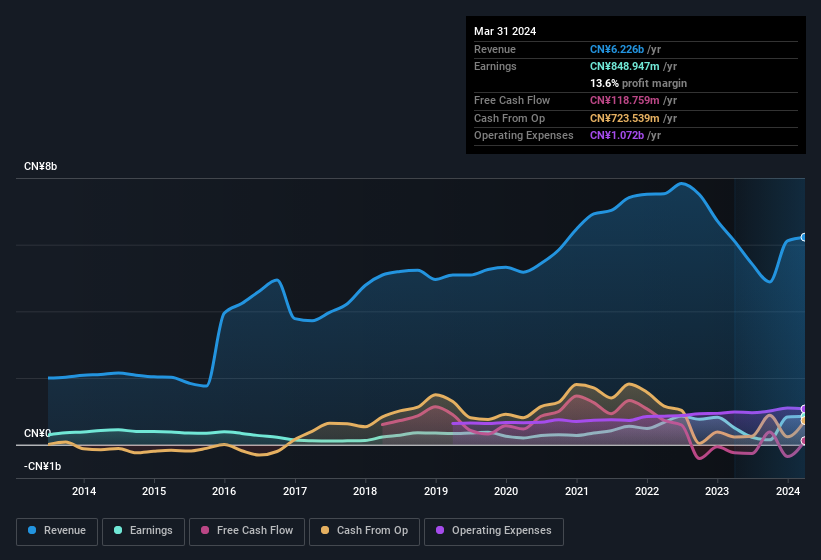

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of North Industries Group Red Arrow's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While revenue is looking a bit flat, the good news is EBIT margins improved by 4.6 percentage points to 13%, in the last twelve months. Which is a great look for the company.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are North Industries Group Red Arrow Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own North Industries Group Red Arrow shares worth a considerable sum. As a matter of fact, their holding is valued at CN¥241m. This considerable investment should help drive long-term value in the business. Even though that's only about 1.3% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is North Industries Group Red Arrow Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into North Industries Group Red Arrow's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Now, you could try to make up your mind on North Industries Group Red Arrow by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if North Industries Group Red Arrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000519

North Industries Group Red Arrow

Manufactures and sells special equipment, superhard materials, special vehicles, and auto parts in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026