- China

- /

- Trade Distributors

- /

- SZSE:000415

Bohai Leasing (SZSE:000415) delivers shareholders notable 76% return over 1 year, surging 3.6% in the last week alone

While Bohai Leasing Co., Ltd. (SZSE:000415) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. Looking at the full year, the company has easily bested an index fund by gaining 76%.

The past week has proven to be lucrative for Bohai Leasing investors, so let's see if fundamentals drove the company's one-year performance.

View our latest analysis for Bohai Leasing

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Bohai Leasing went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 8.7% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

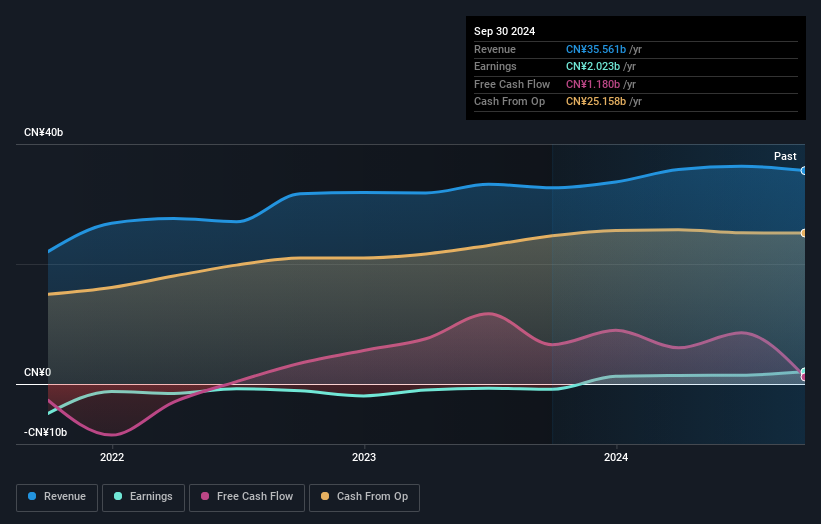

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Bohai Leasing stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Bohai Leasing shareholders have received a total shareholder return of 76% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.8% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Bohai Leasing better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Bohai Leasing (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

But note: Bohai Leasing may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bohai Leasing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000415

Bohai Leasing

Operates as a leasing company in the People's Republic of China.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives