- China

- /

- Electrical

- /

- SHSE:688779

Investors Aren't Buying Hunan Changyuan Lico Co.,Ltd.'s (SHSE:688779) Revenues

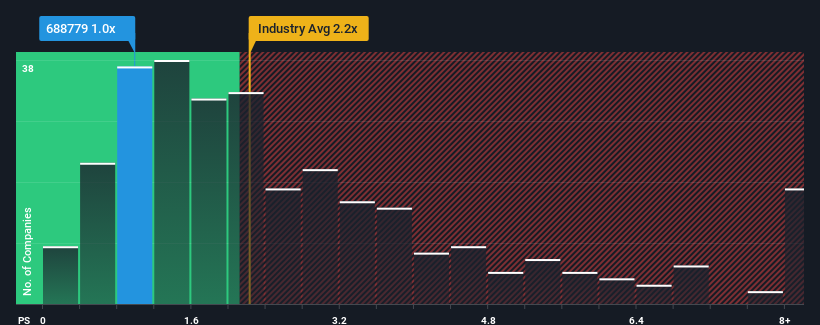

When close to half the companies operating in the Electrical industry in China have price-to-sales ratios (or "P/S") above 2.2x, you may consider Hunan Changyuan Lico Co.,Ltd. (SHSE:688779) as an attractive investment with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Hunan Changyuan LicoLtd

What Does Hunan Changyuan LicoLtd's Recent Performance Look Like?

Hunan Changyuan LicoLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Hunan Changyuan LicoLtd will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Hunan Changyuan LicoLtd?

Hunan Changyuan LicoLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. Even so, admirably revenue has lifted 228% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 7.8% over the next year. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

With this in consideration, its clear as to why Hunan Changyuan LicoLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Hunan Changyuan LicoLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Hunan Changyuan LicoLtd with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Changyuan LicoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688779

Hunan Changyuan LicoLtd

Hunan Changyuan Lico Co.,Ltd. is involved in the research, production, and sale of battery materials.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives