- China

- /

- Electrical

- /

- SHSE:688778

Investors Appear Satisfied With XTC New Energy Materials(Xiamen) Co.,Ltd.'s (SHSE:688778) Prospects As Shares Rocket 26%

XTC New Energy Materials(Xiamen) Co.,Ltd. (SHSE:688778) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 53%.

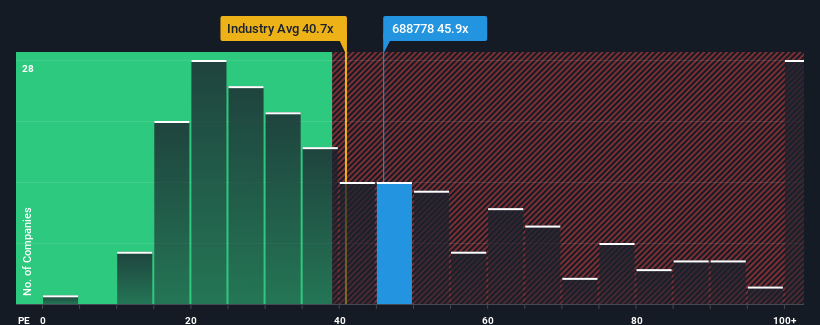

Since its price has surged higher, XTC New Energy Materials(Xiamen)Ltd's price-to-earnings (or "P/E") ratio of 45.9x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 38x and even P/E's below 21x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

XTC New Energy Materials(Xiamen)Ltd has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for XTC New Energy Materials(Xiamen)Ltd

What Are Growth Metrics Telling Us About The High P/E?

XTC New Energy Materials(Xiamen)Ltd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 5.6%. The last three years don't look nice either as the company has shrunk EPS by 40% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 55% during the coming year according to the four analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 36%, which is noticeably less attractive.

With this information, we can see why XTC New Energy Materials(Xiamen)Ltd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From XTC New Energy Materials(Xiamen)Ltd's P/E?

XTC New Energy Materials(Xiamen)Ltd's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of XTC New Energy Materials(Xiamen)Ltd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for XTC New Energy Materials(Xiamen)Ltd with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade XTC New Energy Materials(Xiamen)Ltd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688778

XTC New Energy Materials(Xiamen)Ltd

XTC New Energy Materials(Xiamen) Co.,Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives