- China

- /

- Electrical

- /

- SHSE:688717

Uncovering Value Stock Picks For January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are reflecting a mixed performance with the U.S. indices closing out a strong year despite recent fluctuations, while economic indicators like the Chicago PMI highlight ongoing challenges in manufacturing. Amidst these dynamics, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities within sectors that may benefit from current market conditions and economic trends.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1878.00 | ¥3755.66 | 50% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.55 | CN¥31.07 | 49.9% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1120.30 | ₹2232.36 | 49.8% |

| Kinaxis (TSX:KXS) | CA$170.99 | CA$340.11 | 49.7% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.30 | 50% |

| Vogo (ENXTPA:ALVGO) | €2.94 | €5.87 | 49.9% |

| Exosens (ENXTPA:EXENS) | €22.505 | €44.77 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥45.41 | CN¥90.65 | 49.9% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2434.90 | CLP4848.26 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Mao Geping Cosmetics (SEHK:1318)

Overview: Mao Geping Cosmetics Co., Ltd. operates in China, offering color cosmetics and skincare products under the MAOGEPING and Love Keeps brands, with a market cap of HK$27.82 billion.

Operations: The company generates CN¥3.46 billion in revenue from its personal products segment.

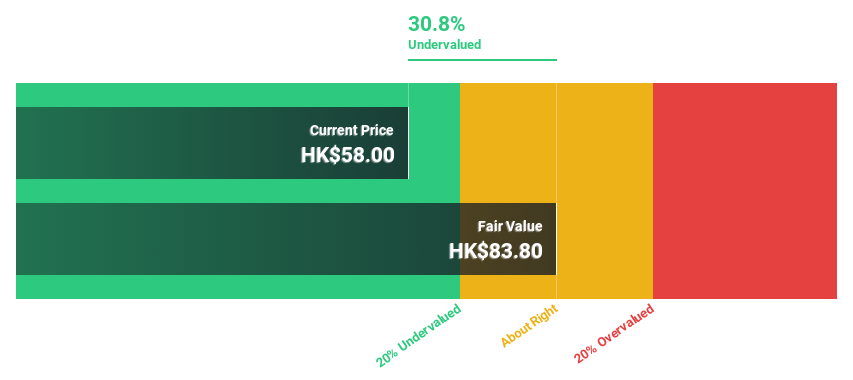

Estimated Discount To Fair Value: 29.2%

Mao Geping Cosmetics is trading at HK$58.15, below its estimated fair value of HK$82.13, suggesting undervaluation based on cash flows. The company recently completed an IPO worth HK$2.34 billion, enhancing its financial position. Earnings grew by 59.2% last year and are expected to grow significantly at 24.3% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.1%, despite shares being highly illiquid.

- Our expertly prepared growth report on Mao Geping Cosmetics implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Mao Geping Cosmetics with our comprehensive financial health report here.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (ticker: SHSE:688717) operates in the renewable energy sector, focusing on the development and manufacturing of solar power products, with a market cap of CN¥7.64 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, totaling CN¥2.87 billion.

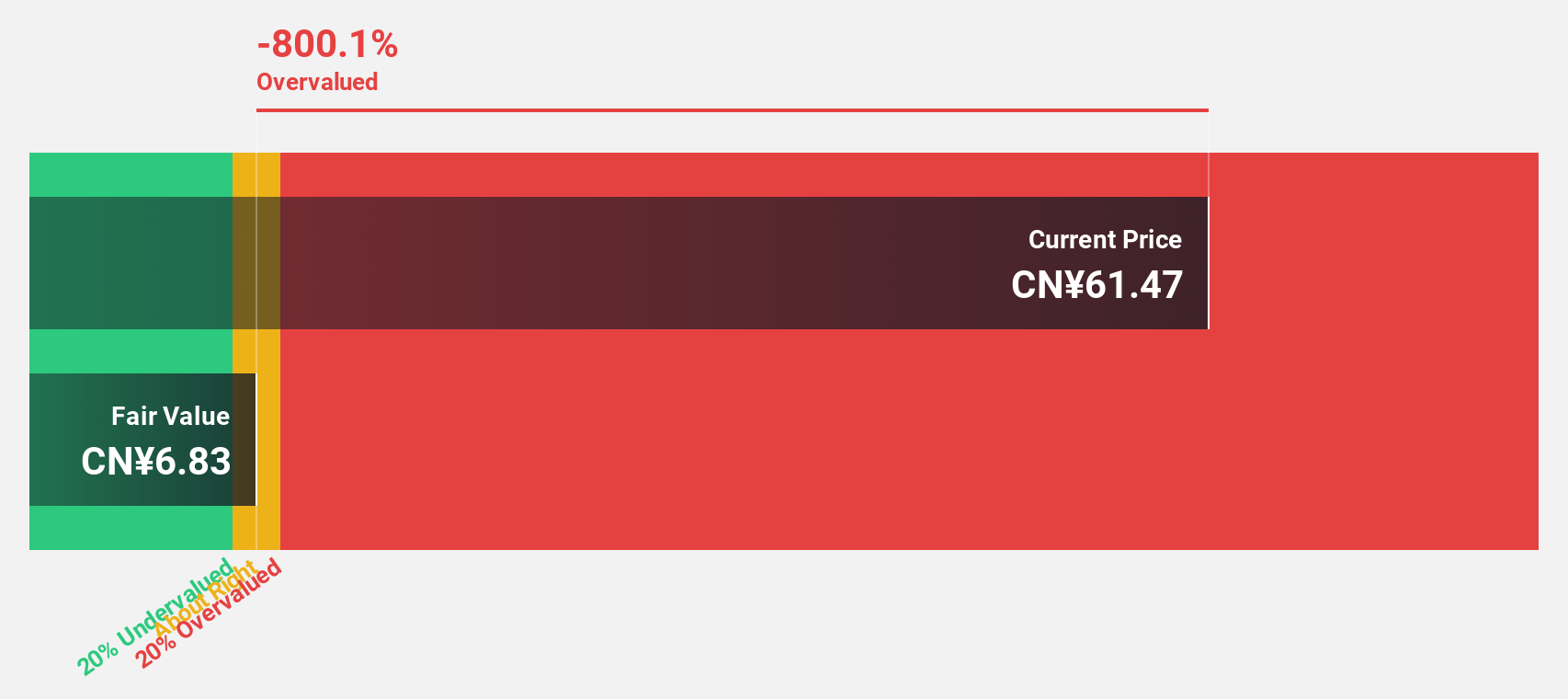

Estimated Discount To Fair Value: 23.9%

SolaX Power Network Technology (Zhejiang) is trading at CN¥47.73, below its estimated fair value of CN¥62.74, indicating potential undervaluation based on cash flows. Despite a decline in net income and profit margins compared to the previous year, earnings are projected to grow significantly at 55% annually over the next three years. Revenue growth is also expected to outpace the broader Chinese market, although return on equity forecasts remain modest at 12.1%.

- Our growth report here indicates SolaX Power Network Technology (Zhejiang) may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of SolaX Power Network Technology (Zhejiang).

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893)

Overview: Zhejiang Songyuan Automotive Safety Systems Co., Ltd. operates in the automotive safety industry, focusing on the production and sale of safety systems, with a market cap of CN¥6.76 billion.

Operations: The company generates revenue of CN¥1.78 billion from its Auto Parts & Accessories segment.

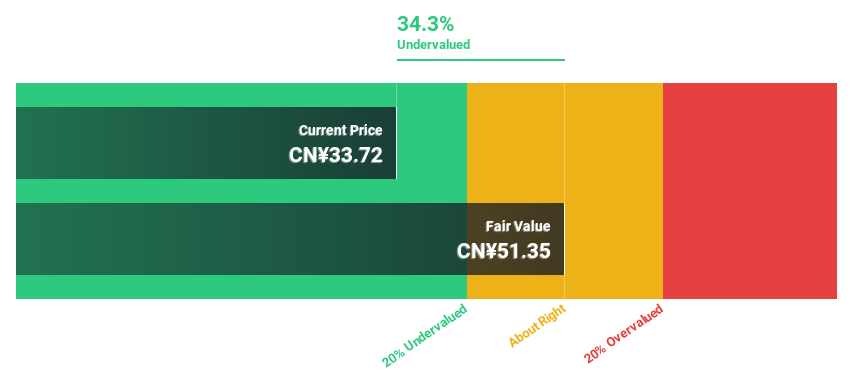

Estimated Discount To Fair Value: 20%

Zhejiang Songyuan Automotive Safety Systems is trading at CN¥29.86, significantly below its estimated fair value of CN¥37.34, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth with net income rising to CNY 190.71 million for the first nine months of 2024. Despite high debt levels and a dividend not well covered by free cash flows, revenue and earnings are forecasted to grow substantially above market rates in the coming years.

- Our comprehensive growth report raises the possibility that Zhejiang Songyuan Automotive Safety SystemsLtd is poised for substantial financial growth.

- Take a closer look at Zhejiang Songyuan Automotive Safety SystemsLtd's balance sheet health here in our report.

Make It Happen

- Click through to start exploring the rest of the 882 Undervalued Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688717

SolaX Power Network Technology (Zhejiang)

SolaX Power Network Technology (Zhejiang) Co., Ltd.

Flawless balance sheet with high growth potential.