- China

- /

- Electronic Equipment and Components

- /

- SHSE:688378

Exploring High Growth Tech Stocks with Potential Expansion

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with key indices like the S&P 500 and Nasdaq Composite showing resilience despite recent economic concerns such as declining PMI figures and revised GDP forecasts, investors are paying close attention to sectors that demonstrate robust growth potential. In this environment, high-growth tech stocks can be attractive due to their capacity for innovation and expansion even amidst broader market fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| AVITA Medical | 33.76% | 52.47% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1255 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sky ICT (SET:SKY)

Simply Wall St Growth Rating: ★★★★★☆

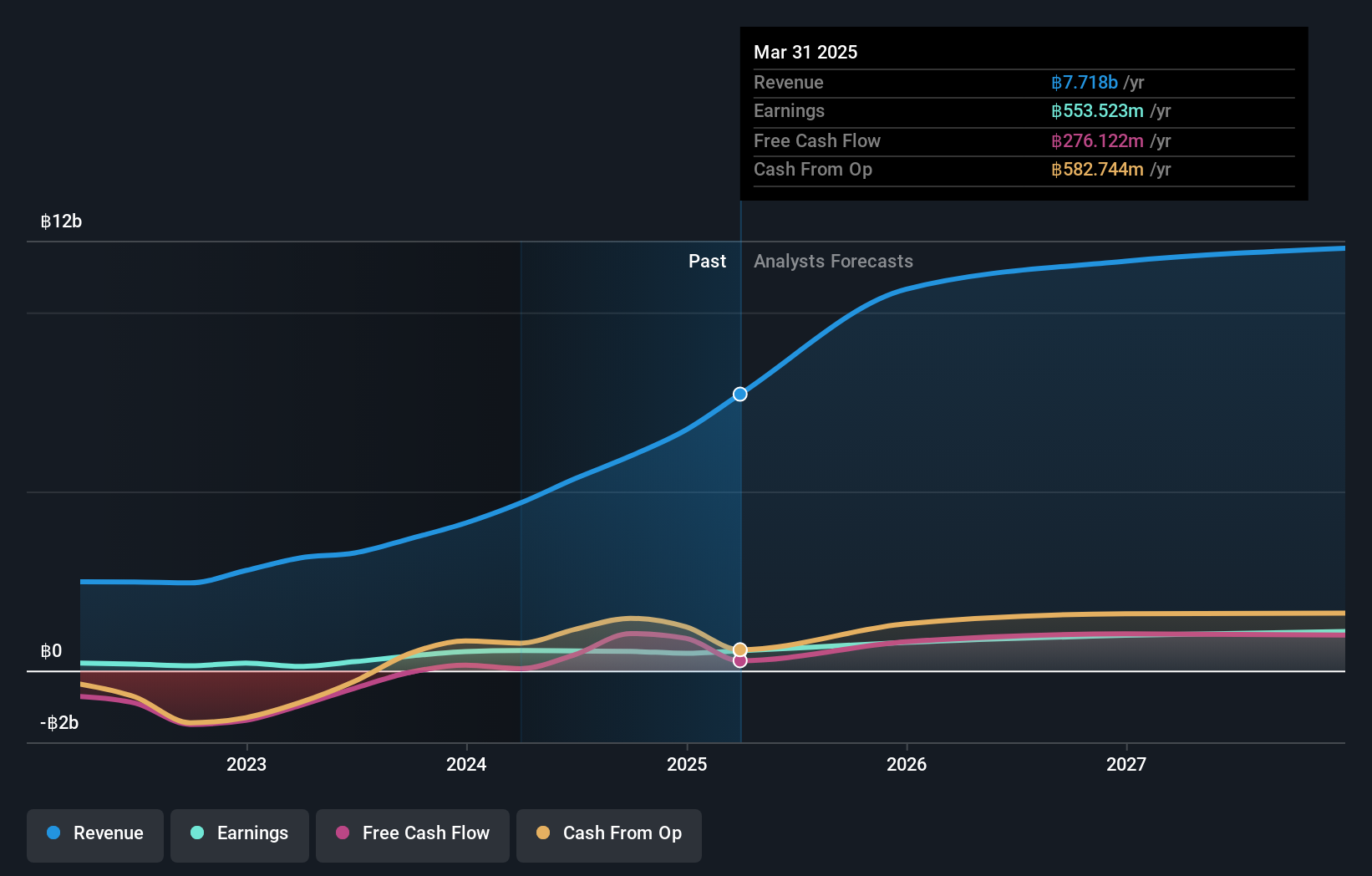

Overview: Sky ICT Public Company Limited operates in the information and communication technology and system integration sectors in Thailand, with a market capitalization of THB16.74 billion.

Operations: Sky ICT generates revenue primarily through system integration services and sales and services, including finance lease contracts, with the latter contributing THB5.02 billion. The company focuses on providing ICT solutions in Thailand's market.

Sky ICT has demonstrated a robust growth trajectory, with revenue soaring by 30.7% annually, outpacing the Thai market's average. This surge is reflected in its recent earnings report for Q3 2024, where revenue reached THB 1.71 billion, up from THB 1.08 billion year-over-year, though net income slightly dipped to THB 112.69 million from THB 123.22 million in the same period last year. The company's commitment to innovation is evident from its R&D investments which are crucial for maintaining its competitive edge in the tech sector. Despite facing challenges like lower net income this quarter and interest payments not well covered by earnings, Sky ICT's significant annual earnings growth of 32.7% positions it well for future advancements and potential market leadership within Thailand's IT industry.

- Take a closer look at Sky ICT's potential here in our health report.

Gain insights into Sky ICT's historical performance by reviewing our past performance report.

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Growth Rating: ★★★★★☆

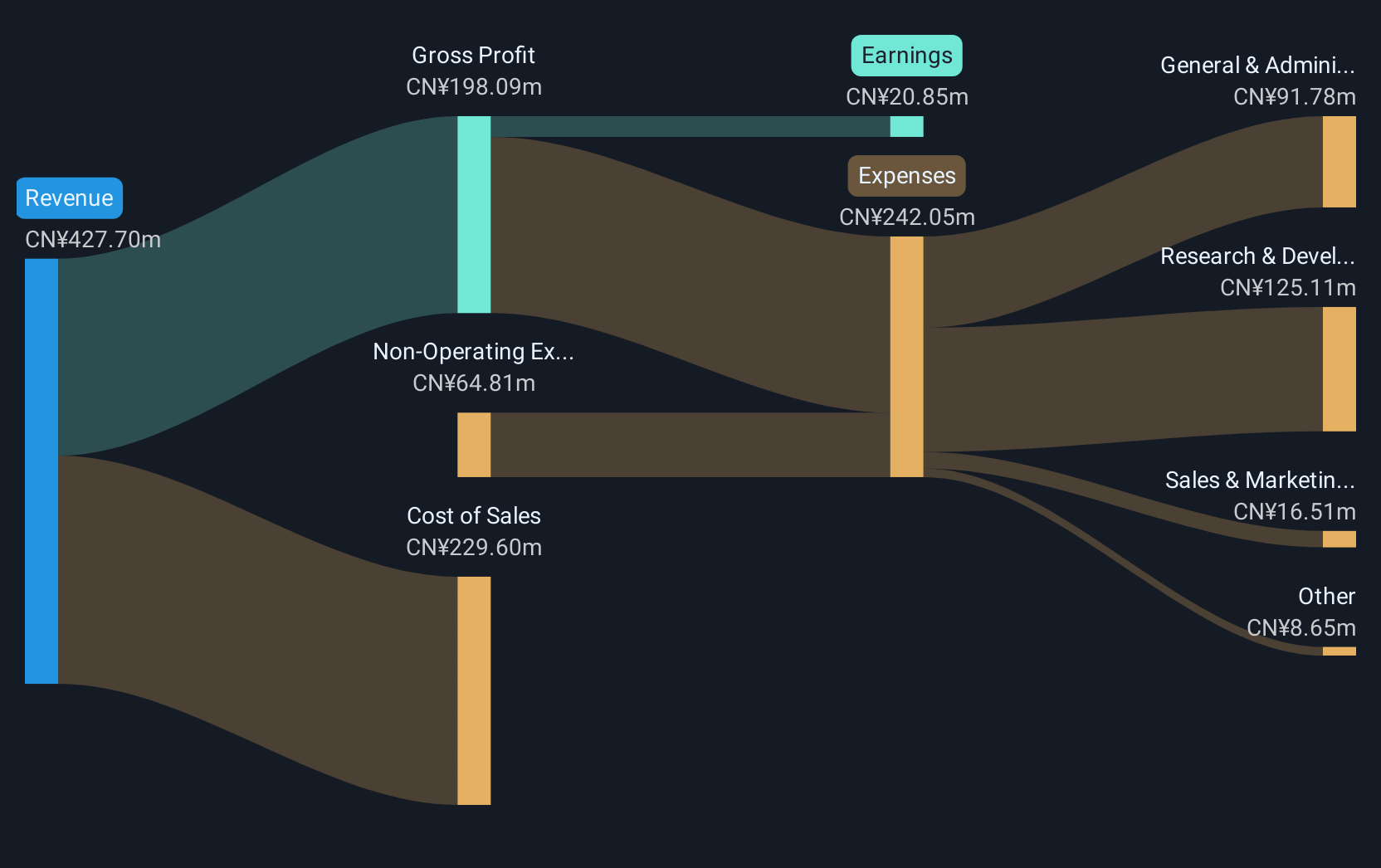

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry, with a market cap of CN¥4.26 billion.

Operations: Jilin OLED Material Tech specializes in developing and manufacturing organic electroluminescent materials and equipment, catering to the new display industry in China. The company generates revenue through the sale of these advanced materials and equipment, with a market capitalization of CN¥4.26 billion.

Jilin OLED Material Tech has shown impressive growth, with its revenue climbing 45.1% annually, outstripping the Chinese market's average of 13.5%. This surge is backed by significant R&D investments that totaled CNY 50 million last year, demonstrating a commitment to innovation in the OLED sector. Despite a highly volatile share price recently, their earnings have expanded by 49.9% per year, suggesting robust internal gains and potential for sustained advancement in a competitive industry where technological leadership is crucial.

- Dive into the specifics of Jilin OLED Material Tech here with our thorough health report.

Understand Jilin OLED Material Tech's track record by examining our Past report.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Growth Rating: ★★★★☆☆

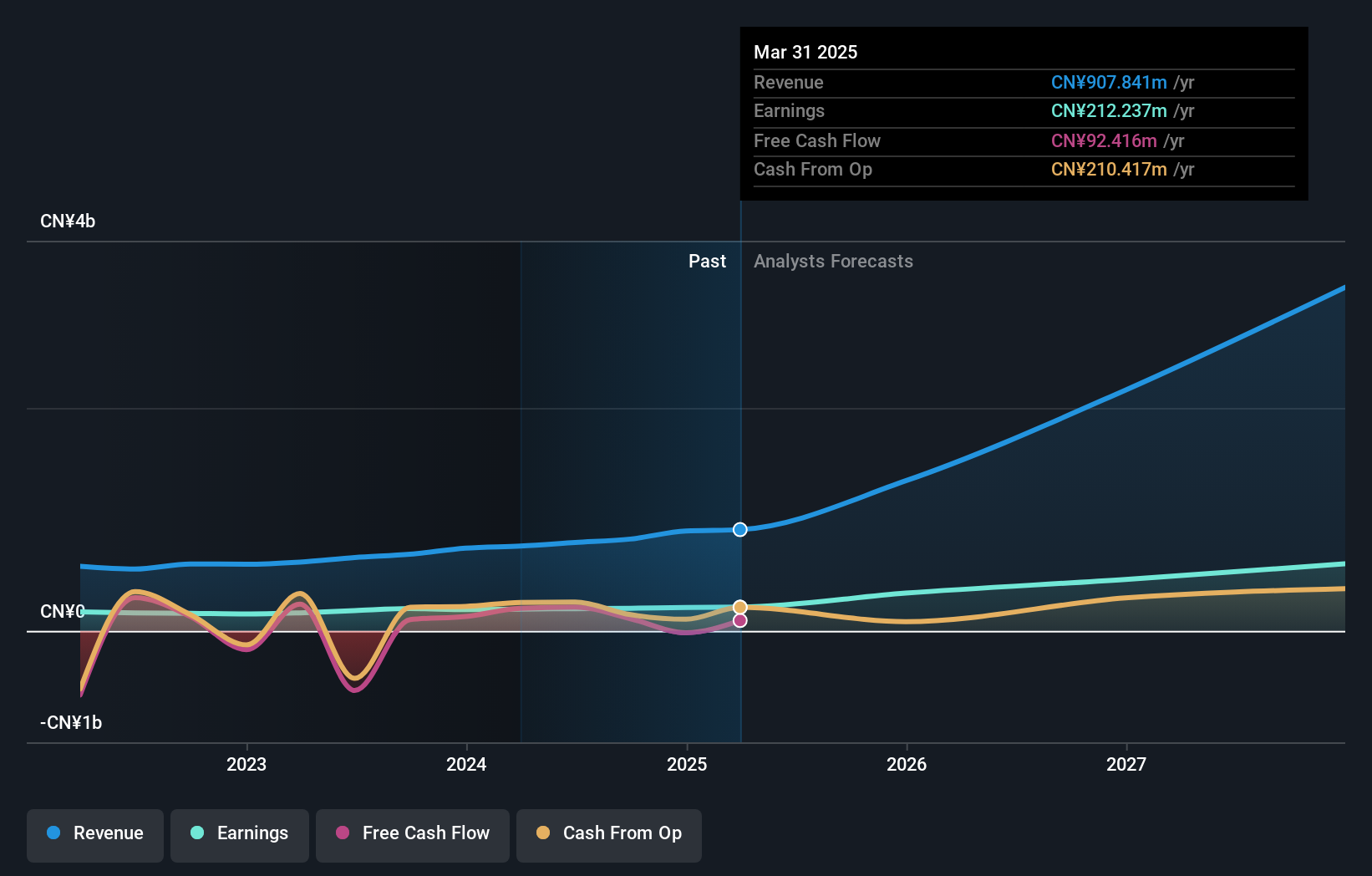

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China, with a market cap of CN¥7.84 billion.

Operations: Tongxingbao, along with its subsidiaries, focuses on smart transportation platform solutions in China, primarily generating revenue from computer peripherals amounting to CN¥823.39 million.

Jiangsu Tongxingbao Intelligent Transportation Technology has demonstrated a robust growth trajectory with annual revenue and earnings increases of 24% and 24.1%, respectively, outpacing the broader Chinese market's averages. The company's commitment to innovation is evident from its R&D spending, which significantly contributes to its strategic positioning in the intelligent transportation sector. Despite a competitive landscape, its recent earnings report shows a solid financial performance with net income rising to CNY 167.11 million from CNY 155.33 million year-over-year, underscoring strong operational execution and potential for continued market penetration.

- Navigate through the intricacies of Jiangsu Tongxingbao Intelligent Transportation Technology with our comprehensive health report here.

Learn about Jiangsu Tongxingbao Intelligent Transportation Technology's historical performance.

Turning Ideas Into Actions

- Investigate our full lineup of 1255 High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688378

Jilin OLED Material Tech

Engages in the research and development, production, sale, and after-sales technical services of terminal materials and evaporation source equipment of organic light-emitting materials in the OLED industry chain in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives