- Japan

- /

- Hospitality

- /

- TSE:4680

Global Growth Companies With Strong Insider Ownership In May 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by easing trade tensions and mixed economic signals, investors are closely monitoring how these factors influence stock performance. In this environment, companies with strong insider ownership can offer a compelling proposition, as insiders' vested interests often align with shareholder value creation.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.4% | 66.1% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

Let's review some notable picks from our screened stocks.

Suzhou Everbright Photonics (SHSE:688048)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Everbright Photonics Co., Ltd. is engaged in the research, development, design, production, and sale of semiconductor laser chips both in China and internationally, with a market cap of CN¥10.62 billion.

Operations: Suzhou Everbright Photonics Co., Ltd. generates its revenue primarily through the research, development, design, production, and sale of semiconductor laser chips both domestically and internationally.

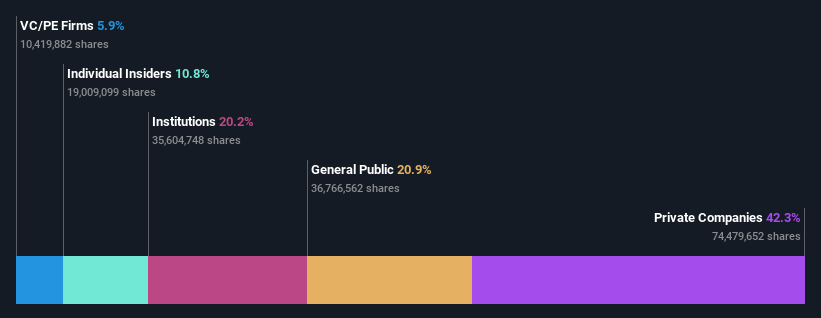

Insider Ownership: 10.8%

Earnings Growth Forecast: 97.2% p.a.

Suzhou Everbright Photonics is experiencing significant revenue growth, with a 24.2% annual increase forecasted, outpacing the broader Chinese market. Despite current losses, the company is expected to achieve profitability within three years. Recent earnings show improved sales at CNY 94.28 million for Q1 2025 compared to CNY 52.49 million a year prior, while net losses have narrowed from CNY 19.45 million to CNY 7.5 million over the same period. However, share price volatility remains high and insider trading data is unavailable for recent months.

- Click here and access our complete growth analysis report to understand the dynamics of Suzhou Everbright Photonics.

- Our comprehensive valuation report raises the possibility that Suzhou Everbright Photonics is priced higher than what may be justified by its financials.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (SHSE:688717) operates in the renewable energy sector, focusing on the development and production of solar power technologies, with a market cap of CN¥8.12 billion.

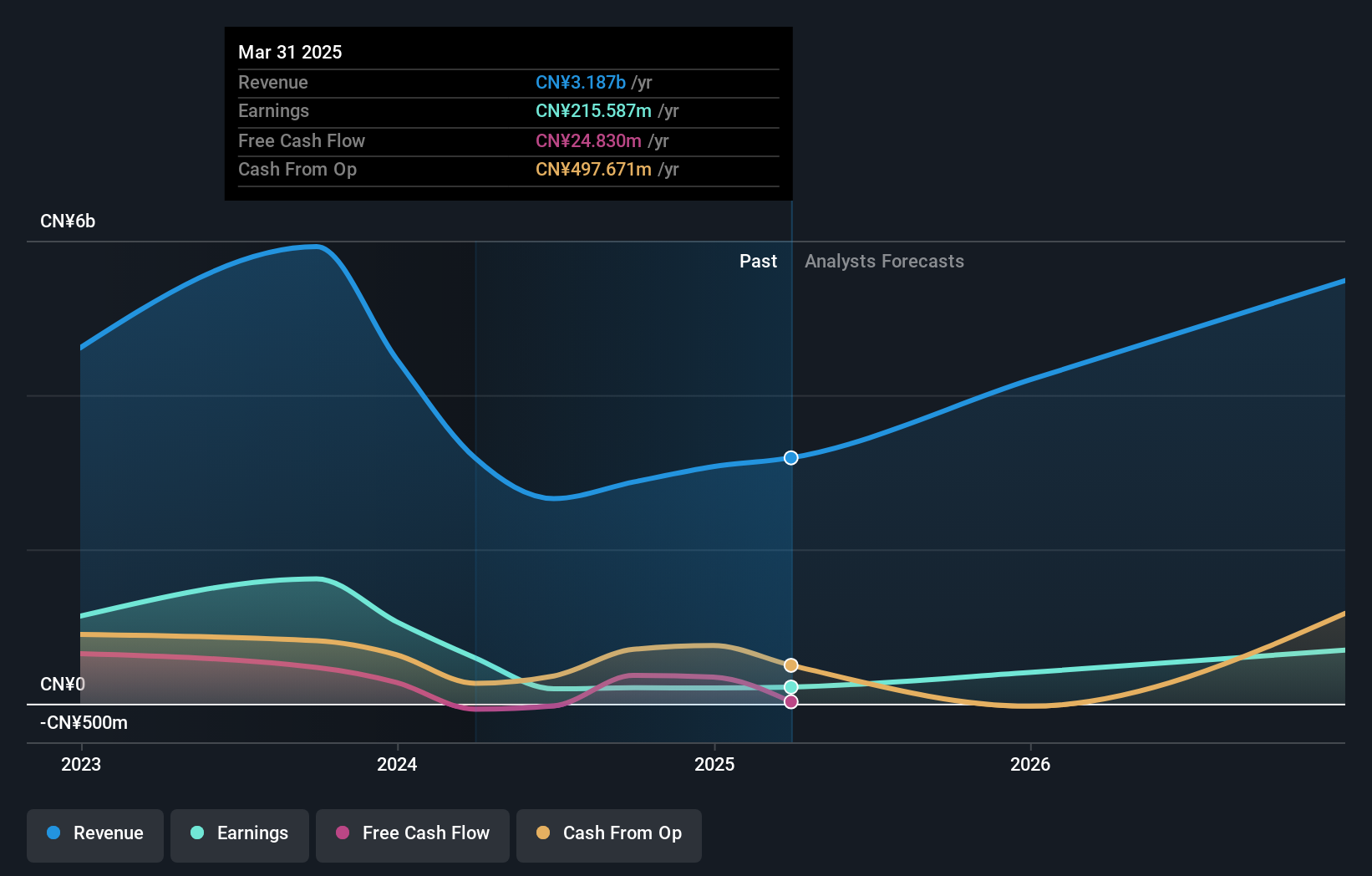

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated CN¥3.19 billion.

Insider Ownership: 35.1%

Earnings Growth Forecast: 62.1% p.a.

SolaX Power Network Technology (Zhejiang) is poised for significant growth, with earnings expected to rise 62.1% annually, surpassing the Chinese market's average. Despite recent volatility in its share price and a drop in profit margins from 18.7% to 6.8%, its revenue is forecasted to grow at 30.5% per year, well above the market rate of 12.6%. The company trades at a discount of approximately 23.3% below estimated fair value, with analysts predicting a potential price increase of over 30%.

- Dive into the specifics of SolaX Power Network Technology (Zhejiang) here with our thorough growth forecast report.

- According our valuation report, there's an indication that SolaX Power Network Technology (Zhejiang)'s share price might be on the cheaper side.

Round One (TSE:4680)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Round One Corporation operates indoor leisure complex facilities and has a market cap of ¥232.07 billion.

Operations: The company's revenue primarily comes from its operations in Japan, generating ¥101.35 billion, and the United States, contributing ¥69.53 billion.

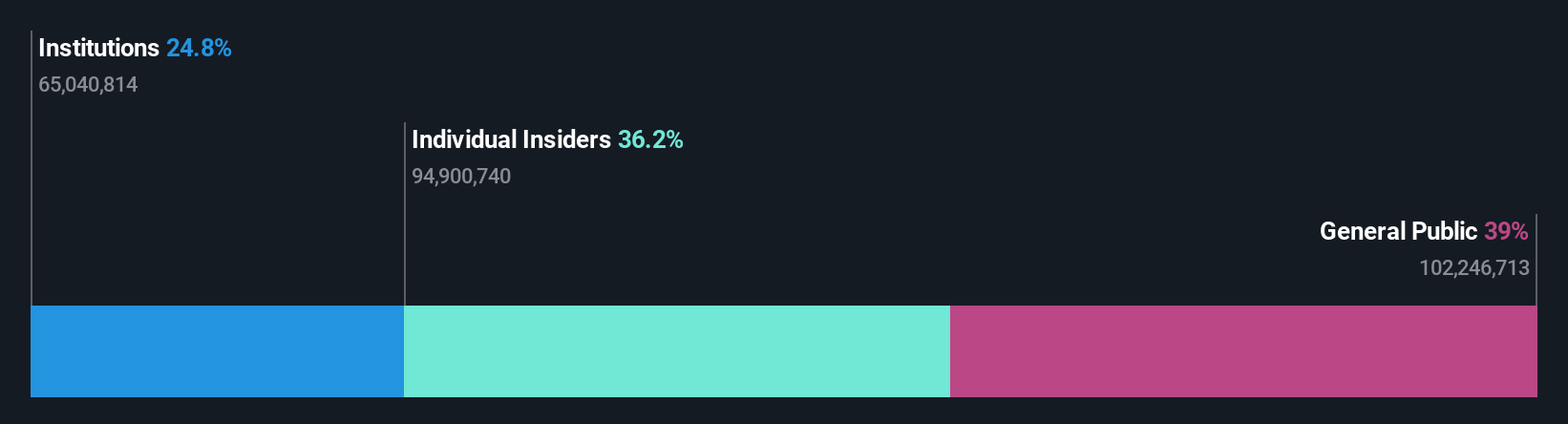

Insider Ownership: 35.9%

Earnings Growth Forecast: 11.3% p.a.

Round One Corporation, trading at 72% below its estimated fair value, is forecasted to grow earnings by 11.25% annually, outpacing the Japanese market's average of 7.4%. Despite recent share price volatility and slower revenue growth projections at 7.4%, the company has shown a robust earnings increase of 31.7% over the past year. Recent activities include completing a share buyback program worth ¥9,999.9 million and being added to the S&P Japan 500 index.

- Get an in-depth perspective on Round One's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Round One is trading behind its estimated value.

Next Steps

- Unlock more gems! Our Fast Growing Global Companies With High Insider Ownership screener has unearthed 835 more companies for you to explore.Click here to unveil our expertly curated list of 838 Fast Growing Global Companies With High Insider Ownership.

- Looking For Alternative Opportunities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Round One, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4680

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives