- China

- /

- Electrical

- /

- SHSE:688707

The Market Doesn't Like What It Sees From Guizhou Zhenhua E-chem Inc.'s (SHSE:688707) Revenues Yet

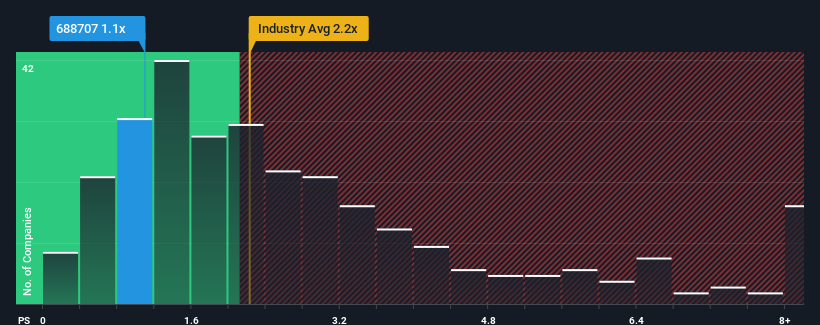

When you see that almost half of the companies in the Electrical industry in China have price-to-sales ratios (or "P/S") above 2.2x, Guizhou Zhenhua E-chem Inc. (SHSE:688707) looks to be giving off some buy signals with its 1.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Guizhou Zhenhua E-chem

How Guizhou Zhenhua E-chem Has Been Performing

While the industry has experienced revenue growth lately, Guizhou Zhenhua E-chem's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guizhou Zhenhua E-chem.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Guizhou Zhenhua E-chem's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 59%. Still, the latest three year period has seen an excellent 201% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 21% as estimated by the dual analysts watching the company. With the industry predicted to deliver 24% growth, that's a disappointing outcome.

In light of this, it's understandable that Guizhou Zhenhua E-chem's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Guizhou Zhenhua E-chem's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Guizhou Zhenhua E-chem maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Guizhou Zhenhua E-chem you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688707

Guizhou Zhenhua E-chem

Engages in the research, development, manufacture, and sale of lithium-ion battery cathode materials for new energy vehicles and consumer electronics in the People's Republic of China and internationally.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives