Anhui Yuanchen Environmental Protection Science&Technology Co.,Ltd.'s (SHSE:688659) Shares Lagging The Industry But So Is The Business

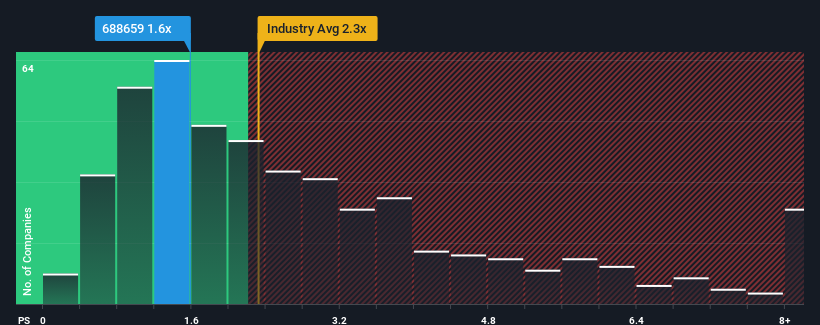

When you see that almost half of the companies in the Machinery industry in China have price-to-sales ratios (or "P/S") above 2.3x, Anhui Yuanchen Environmental Protection Science&Technology Co.,Ltd. (SHSE:688659) looks to be giving off some buy signals with its 1.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Anhui Yuanchen Environmental Protection Science&TechnologyLtd

How Anhui Yuanchen Environmental Protection Science&TechnologyLtd Has Been Performing

For example, consider that Anhui Yuanchen Environmental Protection Science&TechnologyLtd's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Anhui Yuanchen Environmental Protection Science&TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Anhui Yuanchen Environmental Protection Science&TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Anhui Yuanchen Environmental Protection Science&TechnologyLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 10.0% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 22% shows it's noticeably less attractive.

With this information, we can see why Anhui Yuanchen Environmental Protection Science&TechnologyLtd is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Anhui Yuanchen Environmental Protection Science&TechnologyLtd's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Anhui Yuanchen Environmental Protection Science&TechnologyLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 3 warning signs for Anhui Yuanchen Environmental Protection Science&TechnologyLtd (1 is a bit unpleasant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Anhui Yuanchen Environmental Protection Science&TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688659

Anhui Yuanchen Environmental Protection Science&TechnologyLtd

Anhui Yuanchen Environmental Protection Science&Technology Co.,Ltd.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.