- China

- /

- Semiconductors

- /

- SHSE:688508

October 2024's High Insider Ownership Growth Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and fluctuations in consumer spending, investors are keenly observing sectors that show resilience and growth potential. In this environment, companies with high insider ownership often attract attention due to the confidence their leaders have in long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Zhejiang Dafeng Industry (SHSE:603081)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Dafeng Industry Co., Ltd operates in the smart stage, lighting, sound, decoration, seating, and construction fields both in China and internationally with a market cap of CN¥4.31 billion.

Operations: Zhejiang Dafeng Industry Co., Ltd generates revenue from its operations in smart stage, lighting, sound, decoration, seating, and construction sectors across domestic and international markets.

Insider Ownership: 23.6%

Zhejiang Dafeng Industry demonstrates strong growth prospects with forecasted earnings growth of 46.86% annually, outpacing the Chinese market's 23.8%. Despite trading at a significant discount to its estimated fair value, its current financial position is challenged by insufficient operating cash flow coverage for debt. Recent earnings reports show a decline in revenue and net income compared to last year, highlighting potential volatility despite high insider ownership stability.

- Click to explore a detailed breakdown of our findings in Zhejiang Dafeng Industry's earnings growth report.

- The analysis detailed in our Zhejiang Dafeng Industry valuation report hints at an deflated share price compared to its estimated value.

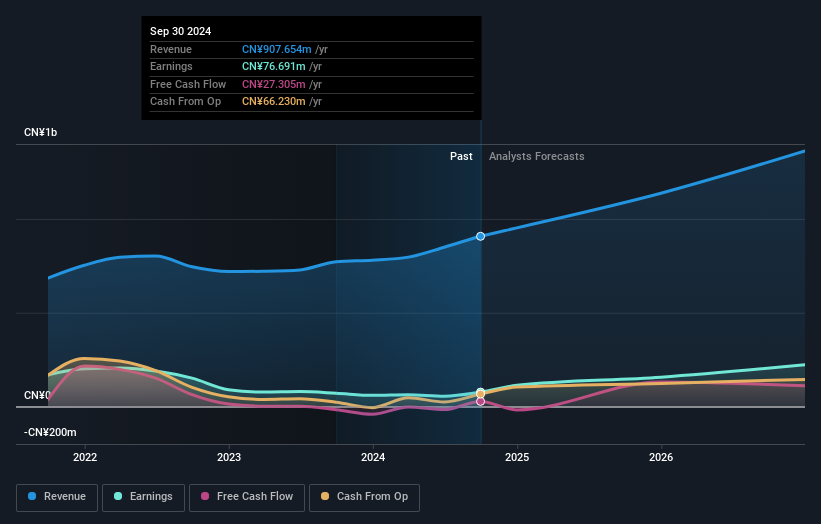

Wuxi Chipown Micro-electronics (SHSE:688508)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Chipown Micro-electronics specializes in the research, design, and supply of analog and mixed signal integrated circuits (ICs) in China, with a market capitalization of CN¥5.42 billion.

Operations: The company's revenue is derived from its Integrated Circuit segment, amounting to CN¥849.39 million.

Insider Ownership: 34.9%

Wuxi Chipown Micro-electronics shows potential with earnings forecasted to grow significantly at 47.34% annually, surpassing the Chinese market's average. Despite this, recent earnings reveal a decrease in net income and profit margins compared to last year, indicating some financial challenges. The company's revenue growth of 19.9% per year is expected to outpace the broader market but remains below high-growth thresholds. Insider ownership stability could be advantageous amid share price volatility.

- Navigate through the intricacies of Wuxi Chipown Micro-electronics with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Wuxi Chipown Micro-electronics is trading beyond its estimated value.

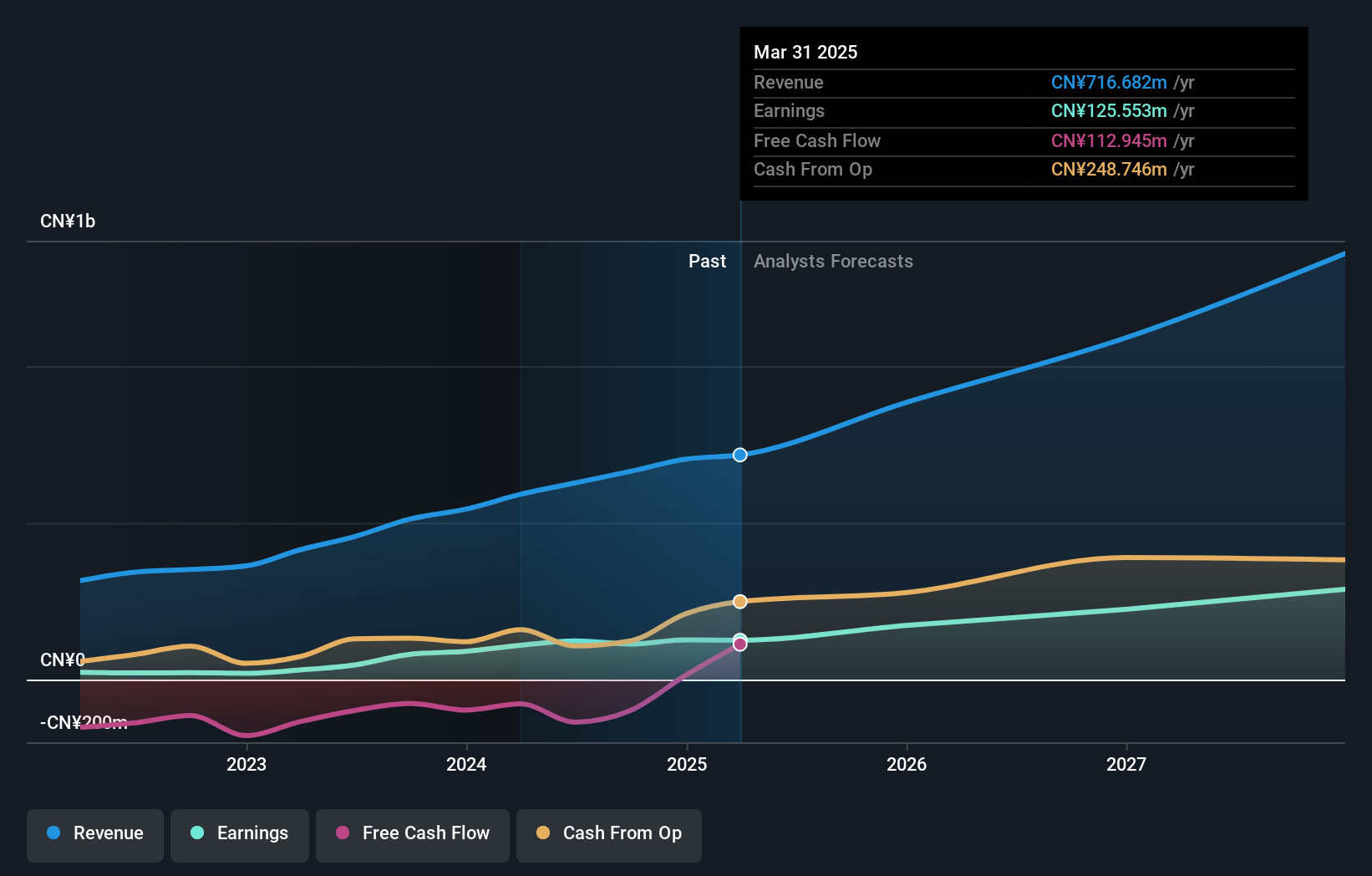

Wuxi HyatechLtd (SHSE:688510)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Hyatech Co., Ltd. specializes in the manufacturing of aero-engines and medical orthopedic implant forging system integration components, with a market capitalization of CN¥4.43 billion.

Operations: Wuxi Hyatech Co., Ltd. generates revenue from manufacturing aero-engines and components for medical orthopedic implant forging system integration.

Insider Ownership: 29.7%

Wuxi Hyatech Ltd. demonstrates robust growth potential with earnings forecasted to increase by 27.1% annually, outpacing the Chinese market average. Revenue is also set to grow significantly at 25.7% per year. Recent half-year results showed a strong performance, with net income doubling from CNY 33.99 million to CNY 67.21 million year-on-year, highlighting effective revenue generation despite low projected return on equity and limited dividend coverage by free cash flows.

- Unlock comprehensive insights into our analysis of Wuxi HyatechLtd stock in this growth report.

- Our valuation report here indicates Wuxi HyatechLtd may be overvalued.

Taking Advantage

- Reveal the 1486 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Chipown Micro-electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688508

Wuxi Chipown Micro-electronics

Engages in the research and development, design, and supply of analog and mixed signal integrated circuits (ICs) in China.

Excellent balance sheet with reasonable growth potential.