3 Growth Companies With High Insider Ownership And Up To 48% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by AI competition fears and fluctuating interest rates, investors are paying close attention to corporate earnings and economic indicators. In this environment, stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company’s operations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Will Semiconductor (SHSE:603501)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Will Semiconductor Co., Ltd. is a semiconductor design company offering sensor, analog, and touch screen display solutions with a market cap of CN¥126.49 billion.

Operations: Revenue Segments (in millions of CN¥): Sensor solutions: CN¥8,340; Analog solutions: CN¥6,750; Touch screen and display solutions: CN¥5,210.

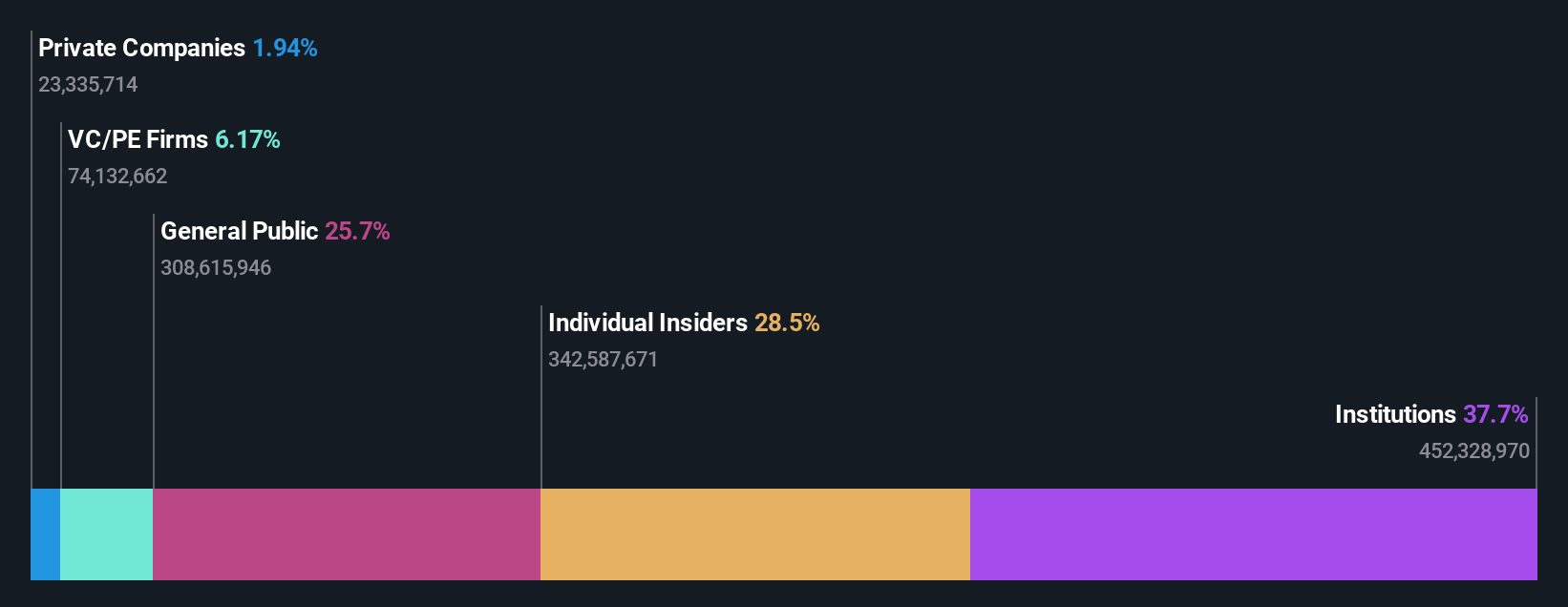

Insider Ownership: 28.6%

Earnings Growth Forecast: 32.6% p.a.

Will Semiconductor demonstrates potential as a growth company with high insider ownership. Its price-to-earnings ratio of 51.7x is below the industry average, suggesting relative value. Analysts expect a 20.3% stock price increase, supported by forecasted earnings growth of 32.6% annually, outpacing the CN market's 25.1%. Revenue is projected to grow at 13.8%, faster than the market's rate of 13.3%. The company recently became profitable this year, enhancing its growth narrative.

- Click to explore a detailed breakdown of our findings in Will Semiconductor's earnings growth report.

- Our valuation report unveils the possibility Will Semiconductor's shares may be trading at a discount.

Xi'an Bright Laser TechnologiesLtd (SHSE:688333)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xi'an Bright Laser Technologies Co., Ltd. provides metal additive manufacturing and repairing solutions in China, with a market cap of CN¥13.51 billion.

Operations: The company's revenue segments include metal additive manufacturing solutions and repair services in the People's Republic of China.

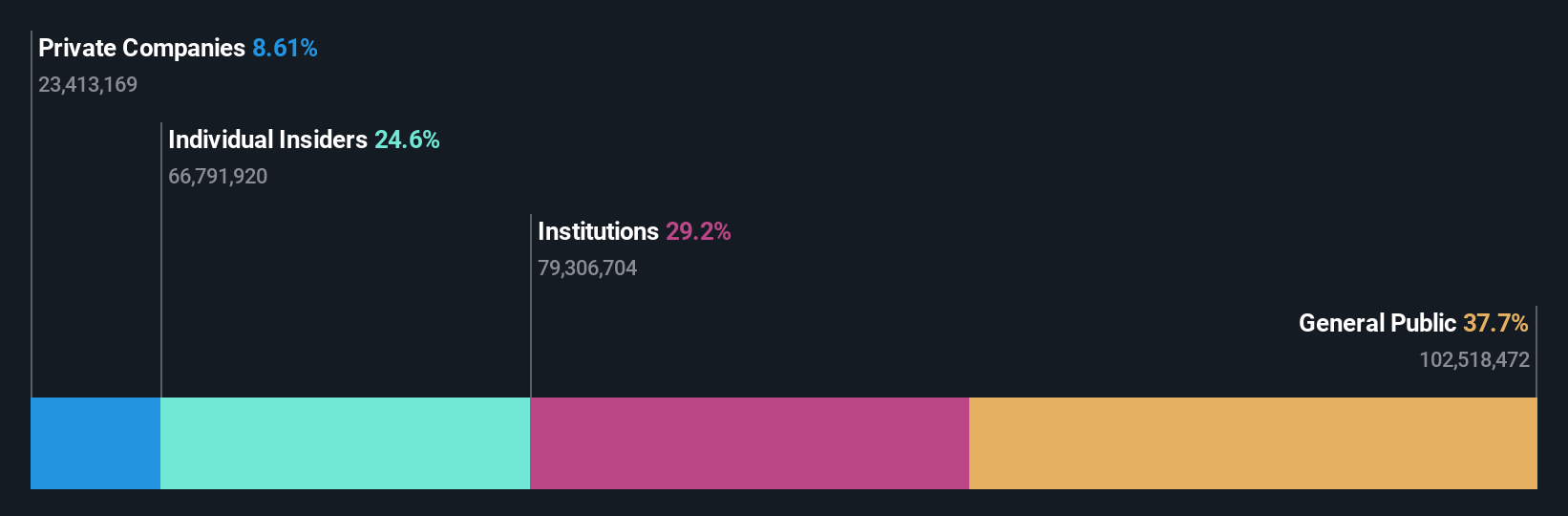

Insider Ownership: 24.6%

Earnings Growth Forecast: 48.5% p.a.

Xi'an Bright Laser Technologies is experiencing strong growth, with revenue projected to increase by 38% annually, outpacing the CN market's 13.3%. Earnings are expected to grow significantly at 48.5% per year. The company recently completed a share buyback program worth CNY 37.31 million, aimed at enhancing long-term value and employee motivation. Despite high non-cash earnings quality, its forecasted return on equity remains modest at 8% over three years.

- Click here and access our complete growth analysis report to understand the dynamics of Xi'an Bright Laser TechnologiesLtd.

- Our valuation report here indicates Xi'an Bright Laser TechnologiesLtd may be overvalued.

Shijiazhuang Yiling Pharmaceutical (SZSE:002603)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shijiazhuang Yiling Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on the development and sale of traditional Chinese medicine products, with a market cap of CN¥22.74 billion.

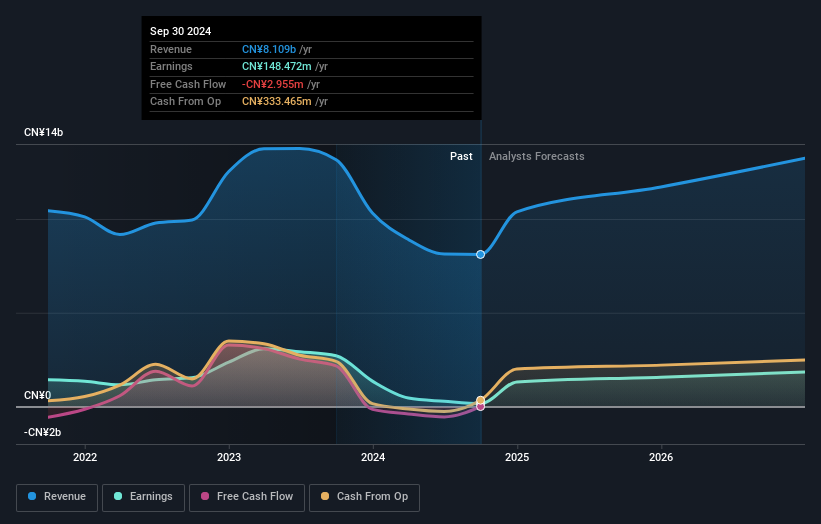

Operations: The company's revenue primarily comes from Pharmaceutical Manufacturing, amounting to CN¥8.11 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 48.4% p.a.

Shijiazhuang Yiling Pharmaceutical is positioned for substantial growth, with earnings projected to rise significantly at 48.38% annually, outpacing the CN market's 25.1%. Although revenue growth of 18.3% per year lags behind the ideal mark of 20%, it still surpasses market averages. The company's return on equity is forecasted to be modest at 12.2% in three years, and while trading at good value compared to peers, its dividend remains inadequately covered by earnings or cash flows.

- Navigate through the intricacies of Shijiazhuang Yiling Pharmaceutical with our comprehensive analyst estimates report here.

- The analysis detailed in our Shijiazhuang Yiling Pharmaceutical valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Navigate through the entire inventory of 1478 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Shijiazhuang Yiling Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002603

Shijiazhuang Yiling Pharmaceutical

Shijiazhuang Yiling Pharmaceutical Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives