- China

- /

- Semiconductors

- /

- SHSE:688556

Asian Growth Companies With High Insider Ownership Unveiled

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and fluctuating economic indicators, investors are increasingly turning their attention to Asian growth companies with strong insider ownership. In this environment, such companies can offer unique insights into potential resilience and alignment of interests between management and shareholders, making them noteworthy considerations for those seeking opportunities in the region's evolving market dynamics.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.0% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 53.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Here's a peek at a few of the choices from the screener.

Ningbo PIA Automation Holding (SHSE:688306)

Simply Wall St Growth Rating: ★★★★☆☆

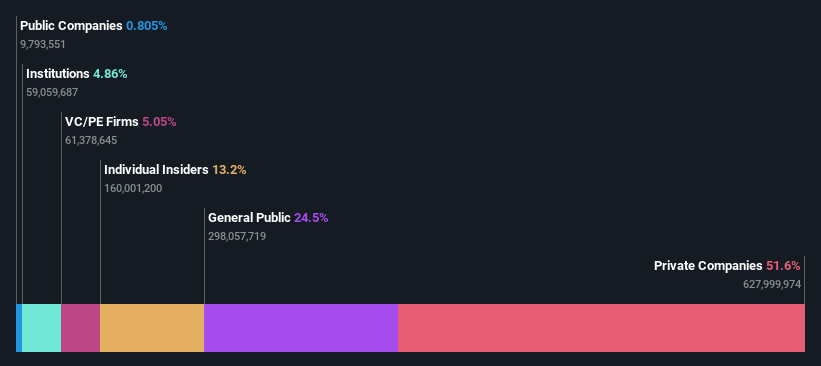

Overview: Ningbo PIA Automation Holding Corp. specializes in the research, development, production, sales, and service of intelligent manufacturing equipment and software for various industries including automotive and healthcare, with a market cap of CN¥13.72 billion.

Operations: The company's revenue is derived from its Machinery & Industrial Equipment segment, which generated CN¥2.51 billion.

Insider Ownership: 13.2%

Ningbo PIA Automation Holding has shown significant earnings growth potential, with forecasts indicating a 111% annual increase, outpacing the Chinese market. Despite this, recent financials reveal volatility and challenges; Q1 2025 saw a revenue decline to CNY 329.39 million from CNY 478.73 million year-on-year, alongside a reduced net loss of CNY 30.16 million. The company completed a minor share buyback but hasn't repurchased any shares in early 2025 under its current plan.

- Delve into the full analysis future growth report here for a deeper understanding of Ningbo PIA Automation Holding.

- Our valuation report unveils the possibility Ningbo PIA Automation Holding's shares may be trading at a premium.

Qingdao Gaoce Technology (SHSE:688556)

Simply Wall St Growth Rating: ★★★★☆☆

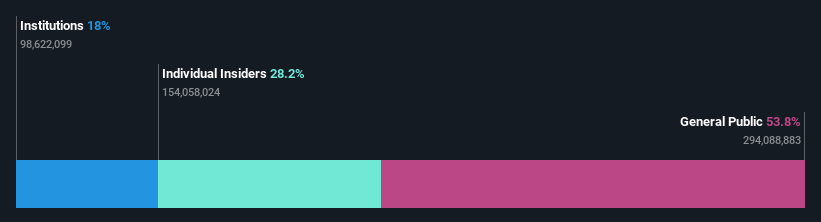

Overview: Qingdao Gaoce Technology Co., Ltd is involved in the research, development, manufacture, and sale of cutting equipment for hard and brittle materials and cutting tools in China, with a market cap of CN¥5.87 billion.

Operations: Qingdao Gaoce Technology Co., Ltd generates its revenue primarily from the production and sale of cutting equipment and tools designed for hard and brittle materials within China.

Insider Ownership: 28.2%

Qingdao Gaoce Technology's recent earnings report highlights challenges, with Q1 2025 revenue dropping to CNY 685.79 million from CNY 1,420 million year-on-year, leading to a net loss of CNY 74.14 million. Despite this downturn, the company is forecasted for strong annual earnings growth of nearly 79% and is expected to become profitable within three years. However, its dividend yield of 7.08% isn't well supported by free cash flows, indicating potential sustainability concerns.

- Unlock comprehensive insights into our analysis of Qingdao Gaoce Technology stock in this growth report.

- Our comprehensive valuation report raises the possibility that Qingdao Gaoce Technology is priced lower than what may be justified by its financials.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

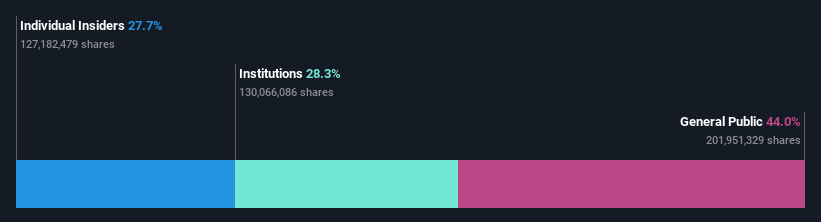

Overview: Thunder Software Technology Co., Ltd. develops operating-system products for various regions including China, Europe, the United States, and Japan, with a market cap of CN¥26.75 billion.

Operations: Thunder Software Technology Co., Ltd. generates revenue from its operating-system products across China, Europe, the United States, Japan, and other international markets.

Insider Ownership: 27.4%

Thunder Software Technology's recent performance shows growth, with Q1 2025 revenue rising to CNY 1.47 billion from CNY 1.18 billion year-on-year, and net income slightly increasing to CNY 92.57 million. Despite a modest full-year profit decline in 2024, the company's earnings are forecasted to grow significantly at over 28% annually, outpacing the Chinese market average. Its price-to-earnings ratio of 65.3x is competitive within its industry, and it has initiated a share buyback program for equity incentives.

- Dive into the specifics of Thunder Software TechnologyLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Thunder Software TechnologyLtd implies its share price may be too high.

Key Takeaways

- Investigate our full lineup of 618 Fast Growing Asian Companies With High Insider Ownership right here.

- Seeking Other Investments? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Gaoce Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688556

Qingdao Gaoce Technology

Engages in the research, development, manufacture, and sale of cutting equipment for hard and brittle materials and cutting tools in China.

Good value with reasonable growth potential.

Market Insights

Community Narratives