Why Investors Shouldn't Be Surprised By Hangzhou Jingye Intelligent Technology Co., Ltd.'s (SHSE:688290) 31% Share Price Surge

The Hangzhou Jingye Intelligent Technology Co., Ltd. (SHSE:688290) share price has done very well over the last month, posting an excellent gain of 31%. The last 30 days bring the annual gain to a very sharp 33%.

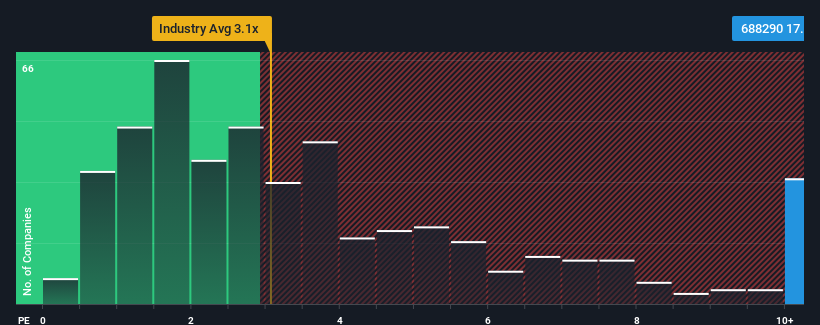

Following the firm bounce in price, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Hangzhou Jingye Intelligent Technology as a stock to avoid entirely with its 17.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Hangzhou Jingye Intelligent Technology

How Hangzhou Jingye Intelligent Technology Has Been Performing

Hangzhou Jingye Intelligent Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hangzhou Jingye Intelligent Technology.Is There Enough Revenue Growth Forecasted For Hangzhou Jingye Intelligent Technology?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hangzhou Jingye Intelligent Technology's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 21% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 111% over the next year. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

In light of this, it's understandable that Hangzhou Jingye Intelligent Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Hangzhou Jingye Intelligent Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Hangzhou Jingye Intelligent Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hangzhou Jingye Intelligent Technology you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Hangzhou Jingye Intelligent Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hangzhou Jingye Intelligent Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688290

Hangzhou Jingye Intelligent Technology

Hangzhou Jingye Intelligent Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives