- China

- /

- Aerospace & Defense

- /

- SHSE:688282

There's Reason For Concern Over Beijing Navigation Control Technology Co.,Ltd.'s (SHSE:688282) Massive 26% Price Jump

Beijing Navigation Control Technology Co.,Ltd. (SHSE:688282) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 85% in the last year.

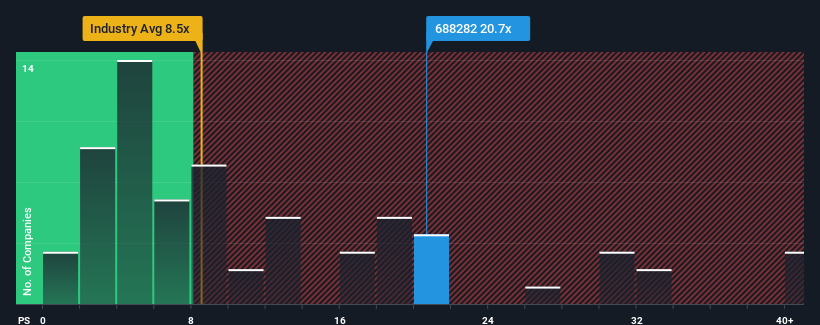

Following the firm bounce in price, you could be forgiven for thinking Beijing Navigation Control TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 20.7x, considering almost half the companies in China's Aerospace & Defense industry have P/S ratios below 8.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beijing Navigation Control TechnologyLtd

How Has Beijing Navigation Control TechnologyLtd Performed Recently?

With revenue growth that's exceedingly strong of late, Beijing Navigation Control TechnologyLtd has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing Navigation Control TechnologyLtd's earnings, revenue and cash flow.How Is Beijing Navigation Control TechnologyLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Beijing Navigation Control TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Still, revenue has fallen 46% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 64% shows it's an unpleasant look.

With this information, we find it concerning that Beijing Navigation Control TechnologyLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Shares in Beijing Navigation Control TechnologyLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Beijing Navigation Control TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It is also worth noting that we have found 1 warning sign for Beijing Navigation Control TechnologyLtd that you need to take into consideration.

If these risks are making you reconsider your opinion on Beijing Navigation Control TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Navigation Control TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688282

Beijing Navigation Control TechnologyLtd

Beijing Navigation Control Technology Co.,Ltd.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026