- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

Insider-Led Growth Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly focused on the resilience of growth stocks amidst fluctuating economic signals. In such an environment, companies with high insider ownership can offer a unique advantage, as their leaders have a vested interest in steering the company towards sustainable growth and stability.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Wetown Electric Group (SHSE:688226)

Simply Wall St Growth Rating: ★★★★★★

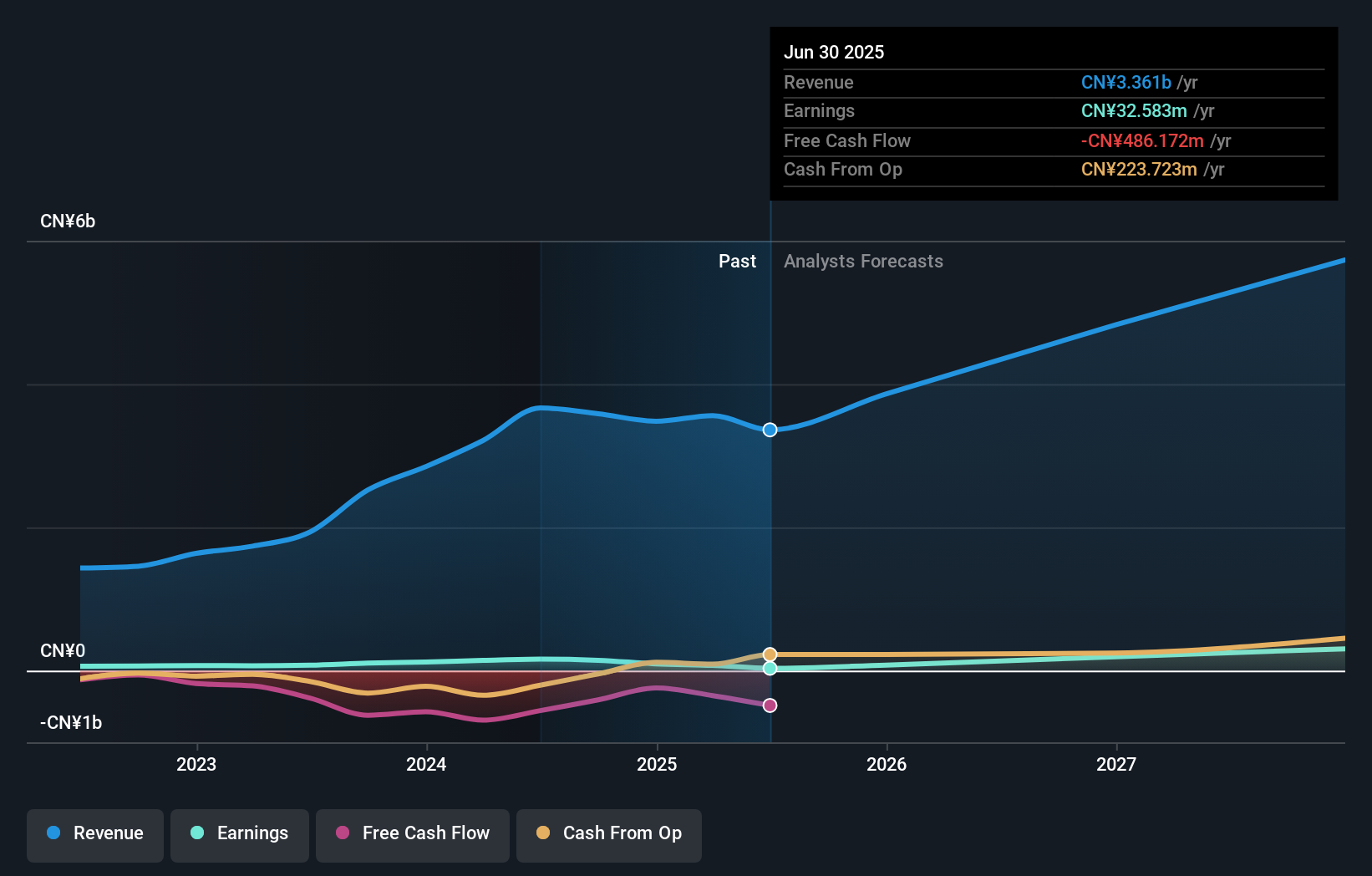

Overview: Wetown Electric Group Co., Ltd. is involved in the research, development, production, and sale of electrical products both in China and internationally, with a market cap of CN¥3.89 billion.

Operations: Wetown Electric Group Co., Ltd. generates revenue through its research, development, production, and sale of electrical products across domestic and international markets.

Insider Ownership: 22.3%

Revenue Growth Forecast: 33% p.a.

Wetown Electric Group exhibits strong growth potential with forecasted annual revenue and earnings growth rates of 33% and 41.6%, respectively, outpacing the Chinese market averages. Recent earnings show a significant increase in net income to CNY 109.04 million from CNY 84.76 million year-over-year, indicating robust performance. Despite a high price-to-earnings ratio of 26.9x compared to the market, its valuation remains attractive relative to peers, although dividends are not well-covered by free cash flows.

- Take a closer look at Wetown Electric Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Wetown Electric Group is priced lower than what may be justified by its financials.

M31 Technology (TPEX:6643)

Simply Wall St Growth Rating: ★★★★★★

Overview: M31 Technology Corporation offers silicon intellectual property design services within the integrated circuit industry and has a market capitalization of NT$32.23 billion.

Operations: The company generates revenue from its Semiconductor Equipment and Services segment, amounting to NT$1.67 billion.

Insider Ownership: 27.2%

Revenue Growth Forecast: 21.8% p.a.

M31 Technology is poised for significant growth with forecasted annual revenue and earnings increases of 21.8% and 47.8%, respectively, outpacing Taiwan's market averages. Despite recent declines in profit margins from 30.2% to 17.5%, the company's strategic advancements, such as the USB4 IP validation on TSMC's N5 process, highlight its innovative edge in high-performance IP solutions. However, the stock has experienced high volatility recently, which may concern potential investors seeking stability.

- Click here to discover the nuances of M31 Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that M31 Technology is trading beyond its estimated value.

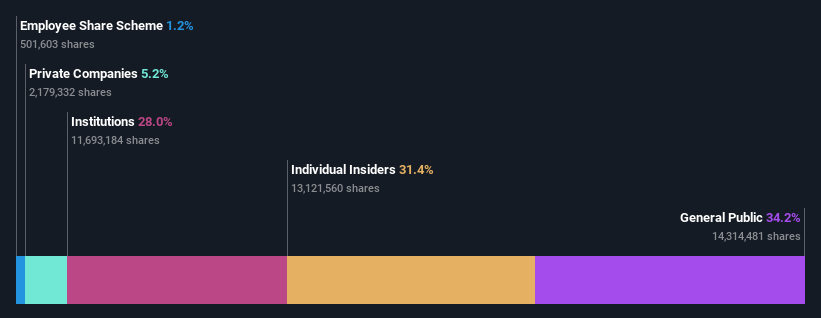

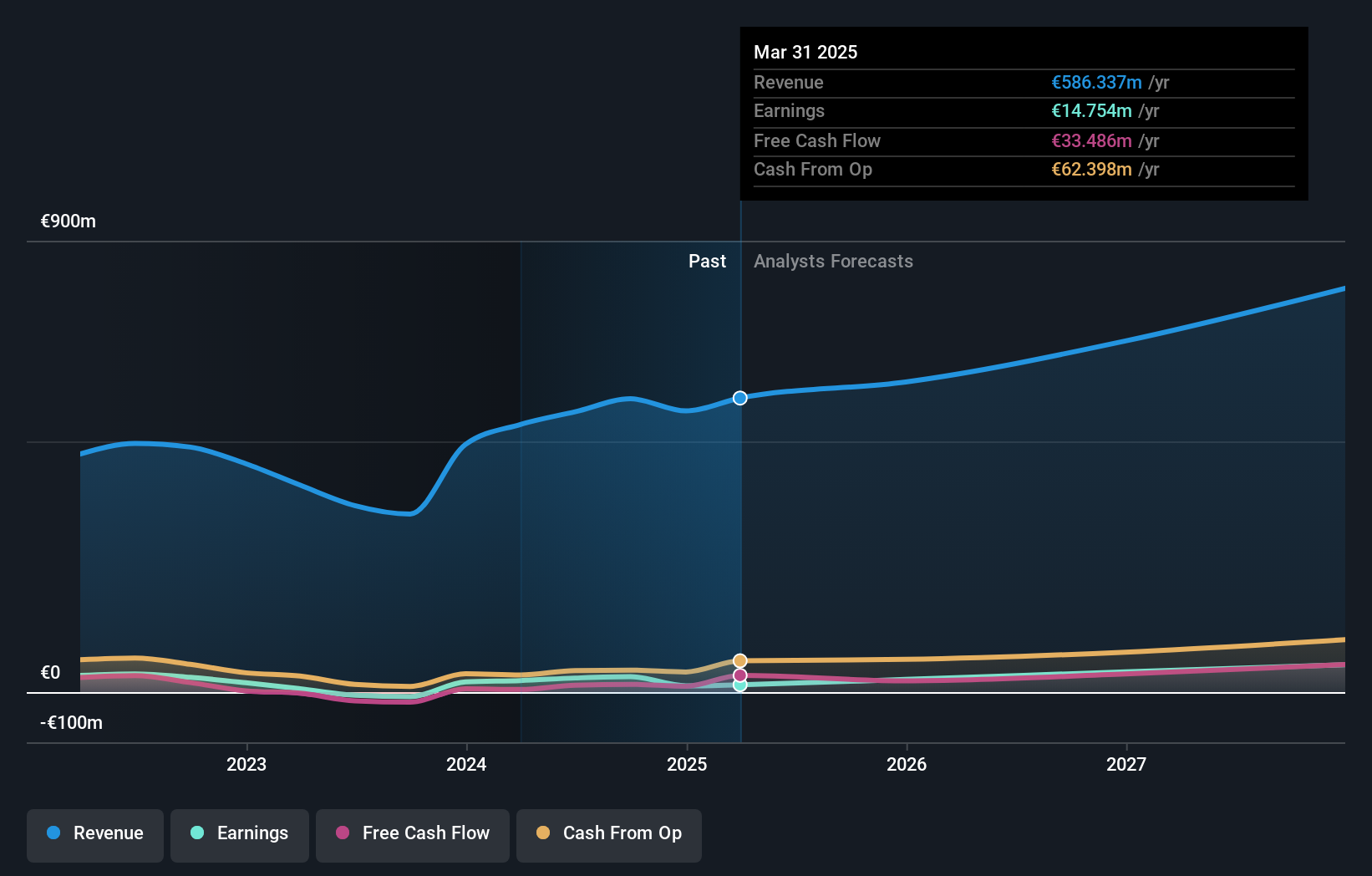

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE develops and markets technology platforms for the financial services, property, and insurance industries in Germany, with a market cap of approximately €1.14 billion.

Operations: The company's revenue segments include €27.44 million from Holding, €66.60 million from the Insurance Platform, and a Segment Adjustment of €359.92 million.

Insider Ownership: 33.5%

Revenue Growth Forecast: 11.5% p.a.

Hypoport SE has demonstrated strong financial recovery, with third-quarter sales rising to €113.86 million and a net income turnaround to €1.81 million. The company's earnings are projected to grow significantly at 28.9% annually, surpassing the German market average, while revenue growth is also expected to outpace the market at 11.5%. Despite low forecasted return on equity and substantial one-off items affecting results, analysts anticipate a stock price increase of 50.9%.

- Dive into the specifics of Hypoport here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Hypoport's share price might be too optimistic.

Summing It All Up

- Unlock our comprehensive list of 1515 Fast Growing Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HYQ

Hypoport

Develops and markets technology platforms for the financial services, property, and insurance industries in Germany.

Reasonable growth potential with adequate balance sheet.