EFORT Intelligent Equipment Co., Ltd.'s (SHSE:688165) Share Price Not Quite Adding Up

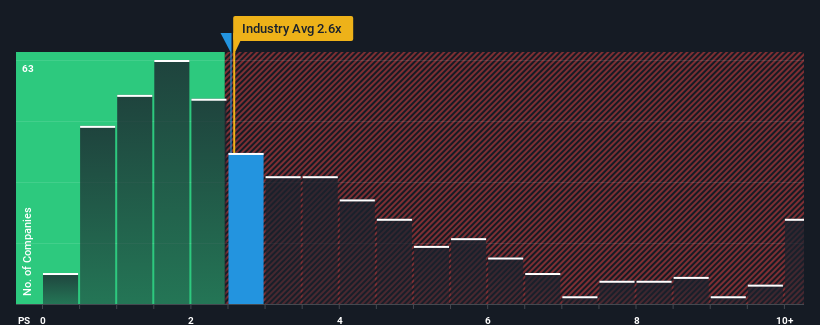

It's not a stretch to say that EFORT Intelligent Equipment Co., Ltd.'s (SHSE:688165) price-to-sales (or "P/S") ratio of 2.5x right now seems quite "middle-of-the-road" for companies in the Machinery industry in China, where the median P/S ratio is around 2.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for EFORT Intelligent Equipment

What Does EFORT Intelligent Equipment's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, EFORT Intelligent Equipment has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on EFORT Intelligent Equipment will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like EFORT Intelligent Equipment's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. Pleasingly, revenue has also lifted 66% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 27% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that EFORT Intelligent Equipment's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that EFORT Intelligent Equipment's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You always need to take note of risks, for example - EFORT Intelligent Equipment has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on EFORT Intelligent Equipment, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade EFORT Intelligent Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EFORT Intelligent Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688165

EFORT Intelligent Equipment

Designs and manufactures industrial automation equipment in China and internationally.

Excellent balance sheet minimal.

Market Insights

Community Narratives