- China

- /

- Aerospace & Defense

- /

- SHSE:688132

After Leaping 29% Bangyan Technology Co., Ltd. (SHSE:688132) Shares Are Not Flying Under The Radar

Despite an already strong run, Bangyan Technology Co., Ltd. (SHSE:688132) shares have been powering on, with a gain of 29% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

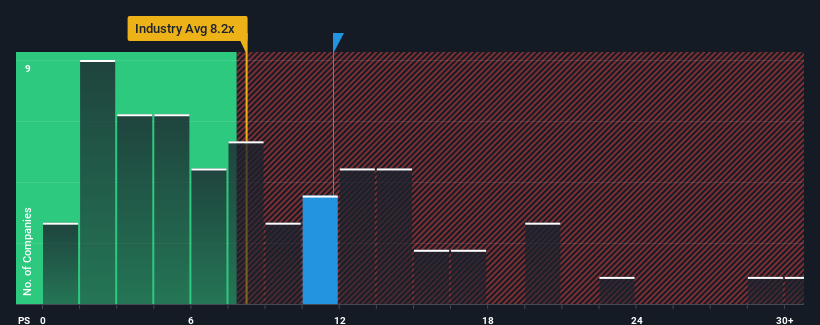

After such a large jump in price, Bangyan Technology may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 11.7x, since almost half of all companies in the Aerospace & Defense in China have P/S ratios under 8.2x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Bangyan Technology

What Does Bangyan Technology's Recent Performance Look Like?

Bangyan Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Bangyan Technology will help you uncover what's on the horizon.How Is Bangyan Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Bangyan Technology would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 31%. The last three years don't look nice either as the company has shrunk revenue by 13% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 134% as estimated by the only analyst watching the company. With the industry only predicted to deliver 33%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Bangyan Technology's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Bangyan Technology's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Bangyan Technology shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Bangyan Technology with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bangyan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688132

Bangyan Technology

Engages in the research, development, manufacture, sale, and service of information communication and security equipment for the military industry in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives