- China

- /

- Aerospace & Defense

- /

- SHSE:688081

There's Reason For Concern Over Wuhan Xingtu Xinke Electronics Co.,Ltd.'s (SHSE:688081) Massive 25% Price Jump

Those holding Wuhan Xingtu Xinke Electronics Co.,Ltd. (SHSE:688081) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

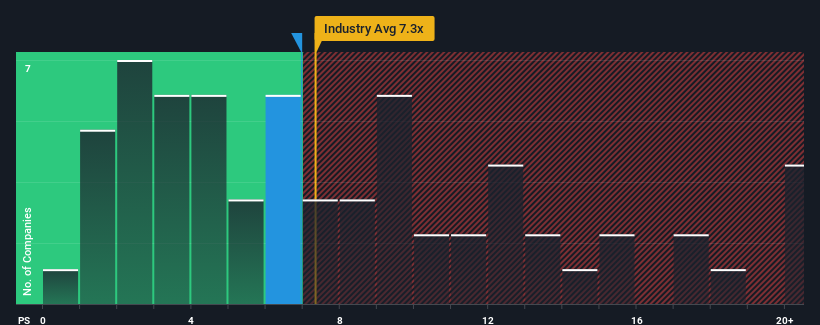

Even after such a large jump in price, there still wouldn't be many who think Wuhan Xingtu Xinke ElectronicsLtd's price-to-sales (or "P/S") ratio of 7x is worth a mention when the median P/S in China's Aerospace & Defense industry is similar at about 7.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Wuhan Xingtu Xinke ElectronicsLtd

What Does Wuhan Xingtu Xinke ElectronicsLtd's Recent Performance Look Like?

The recent revenue growth at Wuhan Xingtu Xinke ElectronicsLtd would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on Wuhan Xingtu Xinke ElectronicsLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wuhan Xingtu Xinke ElectronicsLtd's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Wuhan Xingtu Xinke ElectronicsLtd?

In order to justify its P/S ratio, Wuhan Xingtu Xinke ElectronicsLtd would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.9% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 20% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 48% shows it's an unpleasant look.

With this in mind, we find it worrying that Wuhan Xingtu Xinke ElectronicsLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Wuhan Xingtu Xinke ElectronicsLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Wuhan Xingtu Xinke ElectronicsLtd revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Wuhan Xingtu Xinke ElectronicsLtd has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Wuhan Xingtu Xinke ElectronicsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Xingtu Xinke ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688081

Wuhan Xingtu Xinke ElectronicsLtd

Provides military video command and control systems based on network communications.

Excellent balance sheet with very low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026