- India

- /

- Entertainment

- /

- NSEI:NAZARA

Top Growth Companies With Insider Ownership November 2024

Reviewed by Simply Wall St

In November 2024, global markets are experiencing a notable upswing, with U.S. indices reaching record highs following the Republican "red sweep" in the elections, which has fueled optimism around potential economic growth and tax reforms. This environment of heightened investor confidence underscores the importance of identifying growth companies where high insider ownership aligns interests and could potentially drive long-term value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 45.4% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Nazara Technologies (NSEI:NAZARA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nazara Technologies Limited, along with its subsidiaries, operates a gaming and sports media platform across India, Africa, the Middle East, the Asia Pacific, the United States, and other international markets with a market cap of ₹67.51 billion.

Operations: The company's revenue is derived from three main segments: Gaming (₹3.90 billion), E-Sports (₹6.46 billion), and AD Tech Business (₹1.02 billion).

Insider Ownership: 22.1%

Nazara Technologies is experiencing significant earnings growth, forecasted at 24.9% annually, outpacing the Indian market. Despite this, its return on equity is projected to be low in three years. Recent board changes and a substantial private placement raising INR 9 billion indicate strategic shifts and potential dilution concerns. The company's revenue growth of 17.9% surpasses the market average but remains below high-growth benchmarks, highlighting both opportunities and challenges for investors focused on insider ownership dynamics.

- Click here to discover the nuances of Nazara Technologies with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Nazara Technologies shares in the market.

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market capitalization of SEK22.03 billion.

Operations: The company generates revenue from four main segments: Medtech (€112.75 million), Diagnostics (€20.32 million), Specialty Pharma (€163.45 million), and Veterinary Services (€56.11 million).

Insider Ownership: 11.1%

Vimian Group faces mixed financial dynamics, with earnings forecasted to grow significantly at 94.1% annually, outpacing the Swedish market. However, recent results show a net loss of EUR 2.13 million in Q3 2024 despite increased sales of EUR 87.65 million. Insider transactions have been minimal recently, and shares were diluted over the past year. The stock trades below its estimated fair value by 20.1%, presenting potential value for investors considering insider ownership trends amidst these challenges.

- Dive into the specifics of Vimian Group here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Vimian Group is trading behind its estimated value.

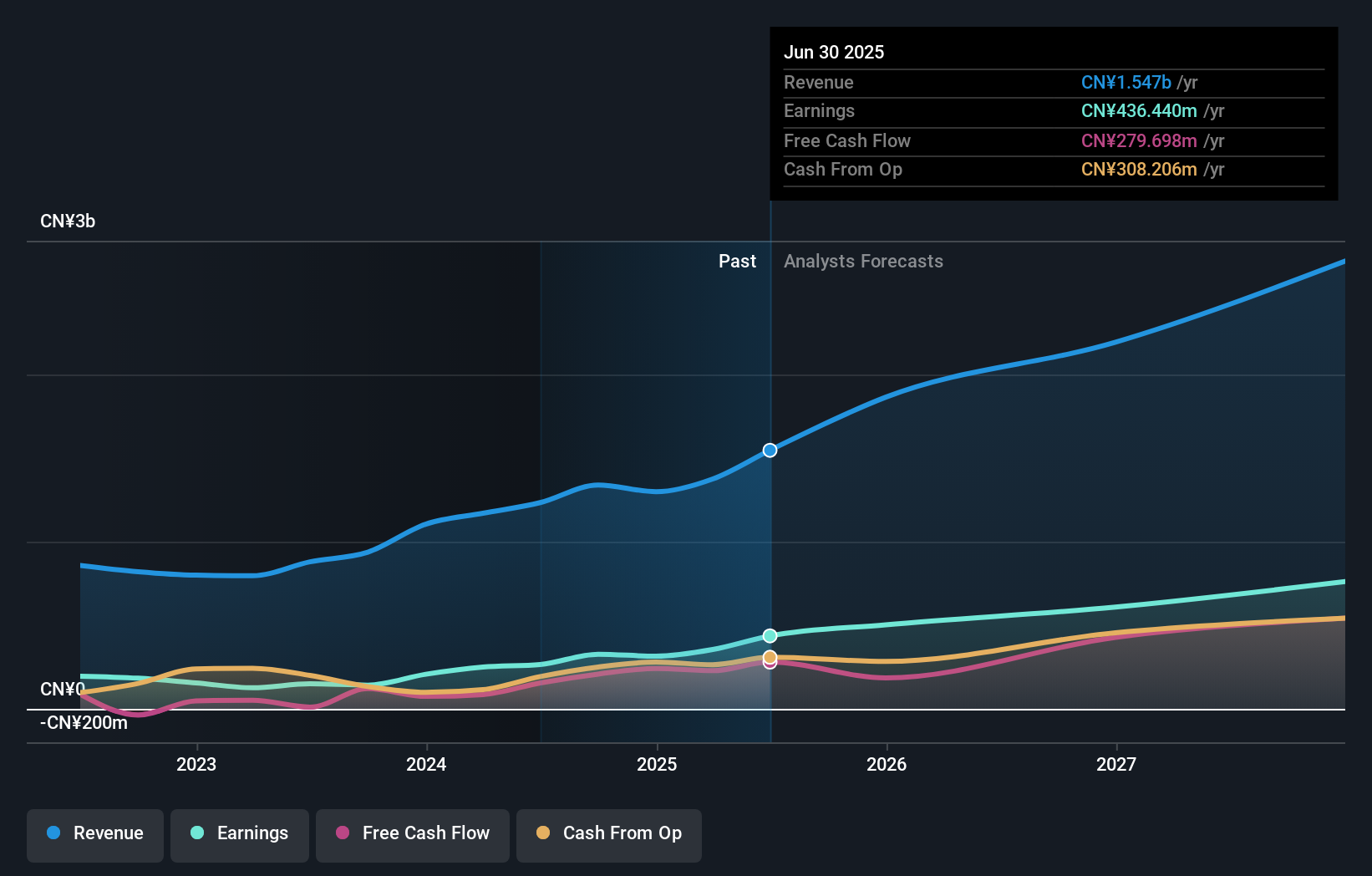

Ficont Industry (Beijing) (SHSE:605305)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ficont Industry (Beijing) Co., Ltd. manufactures and supplies wind turbine tower internals and safety systems for wind turbine manufacturers in China and internationally, with a market cap of CN¥6.12 billion.

Operations: The company's revenue is derived from its Construction Machinery & Equipment segment, totaling CN¥1.34 billion.

Insider Ownership: 27.9%

Ficont Industry (Beijing) shows promising growth with recent earnings rising to CNY 238.29 million for the first nine months of 2024, doubling from a year ago. Revenue increased significantly to CNY 934.08 million, reflecting strong business performance. The stock trades at a substantial discount to its estimated fair value and is expected to grow revenue by over 24% annually, outpacing the Chinese market's growth rate, although its earnings growth lags slightly behind market expectations.

- Take a closer look at Ficont Industry (Beijing)'s potential here in our earnings growth report.

- Our valuation report unveils the possibility Ficont Industry (Beijing)'s shares may be trading at a discount.

Next Steps

- Click through to start exploring the rest of the 1519 Fast Growing Companies With High Insider Ownership now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nazara Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NAZARA

Nazara Technologies

Operates a gaming and sports media platform in India, Africa, the Middle East, the Asia Pacific, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives