- China

- /

- Semiconductors

- /

- SHSE:688535

Insider Backed Growth Companies To Watch

Reviewed by Simply Wall St

As global markets experience a positive shift with cooling U.S. inflation and strong bank earnings driving stock indices higher, investors are keenly observing sectors where insider ownership can signal confidence in future growth. In this context, companies with high insider ownership often attract attention as they suggest alignment between management and shareholder interests, making them potential candidates for those looking to navigate the current economic landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 35.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

Ficont Industry (Beijing) (SHSE:605305)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ficont Industry (Beijing) Co., Ltd. manufactures and supplies wind turbine tower internals and safety systems for wind turbine manufacturers in China and internationally, with a market cap of CN¥6.40 billion.

Operations: The company generates revenue of CN¥1.34 billion from its Construction Machinery & Equipment segment, focusing on wind turbine tower internals and safety systems for manufacturers both domestically and abroad.

Insider Ownership: 33.6%

Earnings Growth Forecast: 24.9% p.a.

Ficont Industry (Beijing) demonstrates strong growth potential, with earnings increasing by 130.5% over the past year and revenue forecasted to grow at 24.8% annually, outpacing the broader Chinese market's 13.4%. Despite trading at a significant discount to its estimated fair value, its return on equity is projected to remain modest at 16.5%. Recent earnings showed substantial improvements in sales and net income, highlighting its growth trajectory amidst an unstable dividend history.

- Take a closer look at Ficont Industry (Beijing)'s potential here in our earnings growth report.

- The analysis detailed in our Ficont Industry (Beijing) valuation report hints at an deflated share price compared to its estimated value.

Wuxi Chipown Micro-electronics (SHSE:688508)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Chipown Micro-electronics Limited focuses on the research, development, design, and supply of analog and mixed signal integrated circuits (ICs) in China with a market cap of CN¥5.90 billion.

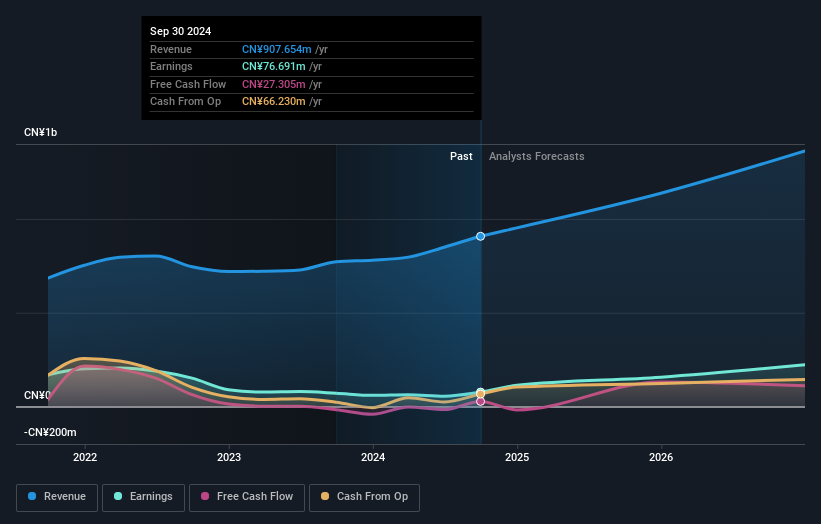

Operations: The company's revenue is primarily derived from its integrated circuit segment, amounting to CN¥907.65 million.

Insider Ownership: 34.9%

Earnings Growth Forecast: 42.4% p.a.

Wuxi Chipown Micro-electronics shows robust growth prospects, with earnings projected to increase significantly at 42.43% annually, outpacing the Chinese market's 25.2%. Although revenue growth is slower than 20%, it surpasses the market average of 13.4%. Recent financial results indicate strong performance, with sales reaching CNY 707.23 million and net income rising to CNY 77.24 million for the first nine months of 2024, reflecting a solid upward trajectory despite low forecasted return on equity at 7.4%.

- Unlock comprehensive insights into our analysis of Wuxi Chipown Micro-electronics stock in this growth report.

- The valuation report we've compiled suggests that Wuxi Chipown Micro-electronics' current price could be inflated.

Jiangsu HHCK Advanced Materials (SHSE:688535)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu HHCK Advanced Materials Co., Ltd. operates in the advanced materials sector with a market cap of CN¥7.39 billion.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to CN¥318.30 million.

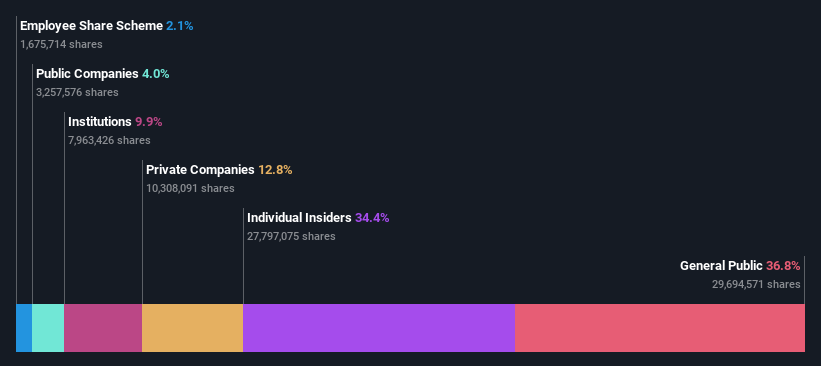

Insider Ownership: 34.4%

Earnings Growth Forecast: 31.4% p.a.

Jiangsu HHCK Advanced Materials is poised for growth, with earnings projected to rise 31.38% annually, outpacing the Chinese market's 25.2%. Revenue is expected to grow faster than the market at 22.3% per year. Despite a volatile share price and low forecasted return on equity at 7.2%, insider ownership remains high, supporting strategic initiatives like a CNY 50 million share repurchase program aimed at employee incentives and convertible bond conversions.

- Dive into the specifics of Jiangsu HHCK Advanced Materials here with our thorough growth forecast report.

- Our valuation report here indicates Jiangsu HHCK Advanced Materials may be overvalued.

Next Steps

- Click through to start exploring the rest of the 1468 Fast Growing Companies With High Insider Ownership now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688535

Jiangsu HHCK Advanced Materials

Jiangsu HHCK Advanced Materials Co., Ltd.

Flawless balance sheet with high growth potential.