- China

- /

- Electrical

- /

- SZSE:301012

Unearthing January 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets experience a boost from cooling inflation and robust bank earnings, small-cap stocks have been drawing attention with the S&P MidCap 400 and Russell 2000 indices showing notable gains. This positive market sentiment creates an opportune environment for identifying promising small-cap companies that demonstrate strong fundamentals, resilience in fluctuating economic conditions, and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Crystal Growth & Energy EquipmentLtd (SHSE:688478)

Simply Wall St Value Rating: ★★★★★★

Overview: Crystal Growth & Energy Equipment Co., Ltd. (SHSE:688478) specializes in the development and production of equipment for crystal growth and energy applications, with a market capitalization of approximately CN¥3.95 billion.

Operations: Crystal Growth & Energy Equipment Co., Ltd. generates revenue through the sale of equipment designed for crystal growth and energy applications. The company's financial performance is reflected in its market capitalization of approximately CN¥3.95 billion, although specific revenue figures are not provided.

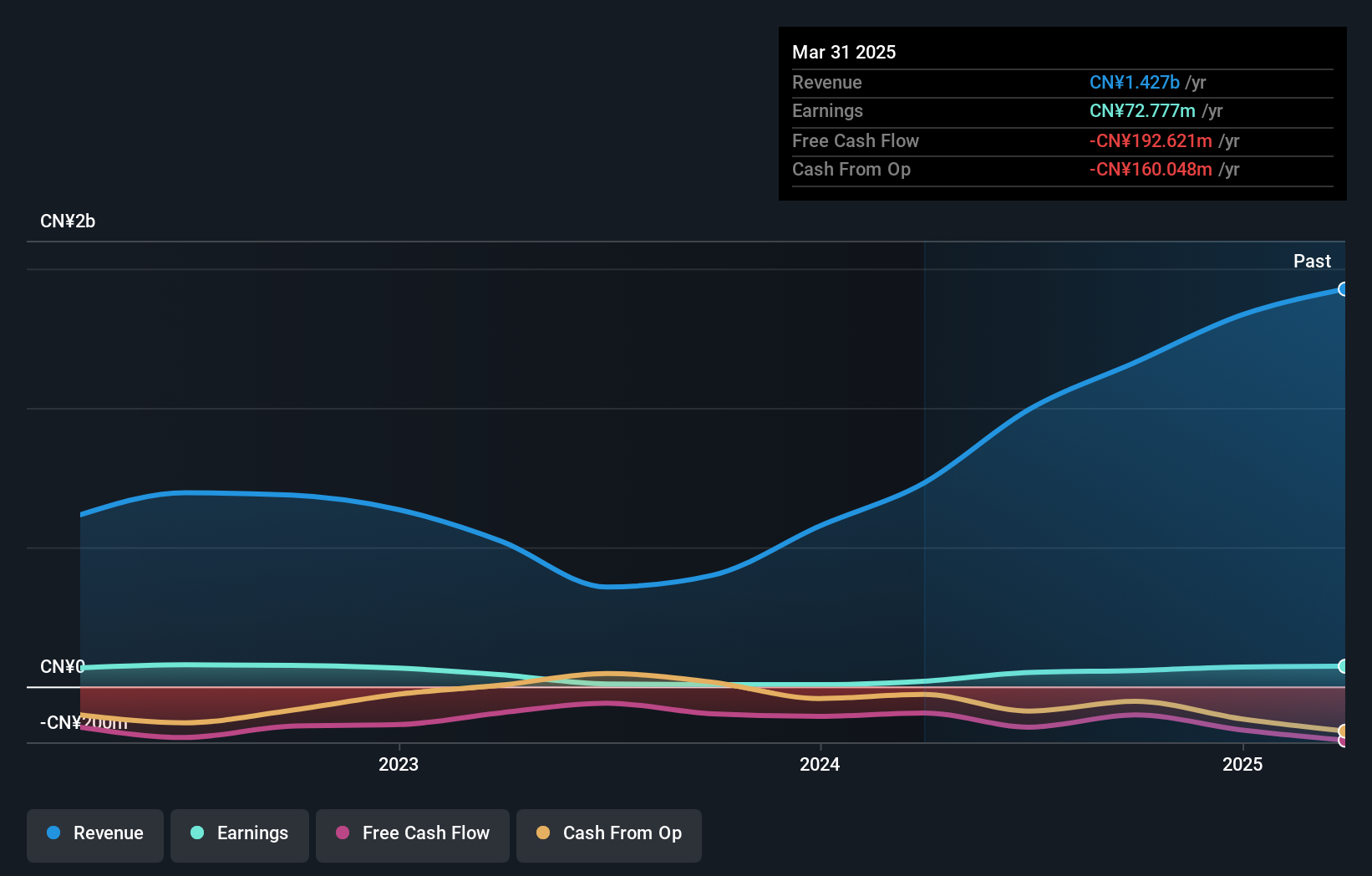

Crystal Growth & Energy Equipment Ltd. has been making strides with a 39.5% earnings growth over the past year, outpacing the Semiconductor industry's 12.1%. The company remains debt-free, which eliminates concerns about interest payments and positions it well for future growth. Despite not being free cash flow positive recently, its profitability alleviates immediate cash runway worries. Recent activities include a share repurchase of 1,700,117 shares (1.23%) for CNY 50.09 million and an acquisition of a 6.51% stake by Lu Yu for approximately CNY 290 million at CNY 32.07 per share, reflecting investor confidence in its potential.

Shandong Jinling Mining (SZSE:000655)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Jinling Mining Co., Ltd. operates in the iron ore mining industry in China with a market capitalization of CN¥3.90 billion.

Operations: The primary revenue stream for Shandong Jinling Mining comes from its iron ore mining operations in China. The company has a market capitalization of CN¥3.90 billion, reflecting its scale within the industry.

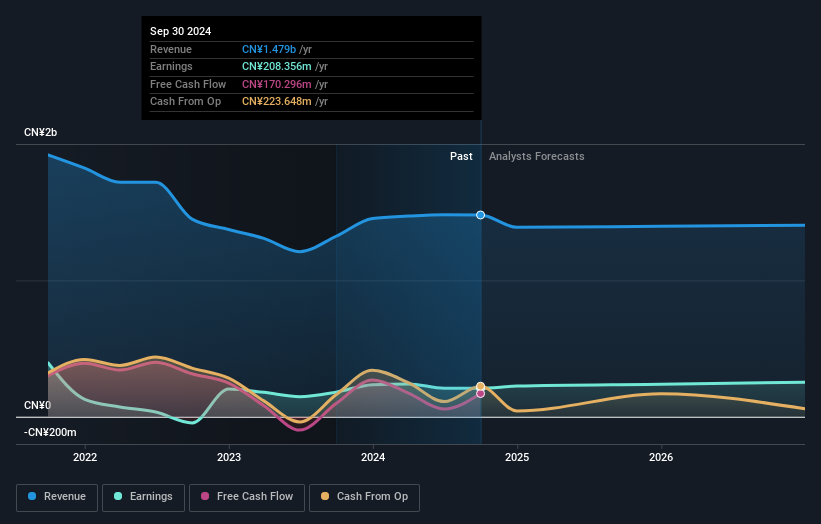

Shandong Jinling Mining, a relatively small player in the mining sector, has demonstrated resilience with a 15.5% earnings growth over the past year, outpacing the industry average of -2.3%. The company is debt-free and boasts high-quality earnings, reflected in its attractive price-to-earnings ratio of 18.7x compared to the CN market's 34.3x. Recent developments include a cash dividend announcement for Q3 2024 at CNY0.50 per share and board changes approved at an extraordinary general meeting in November 2024, indicating active governance adjustments amidst stable financial performance despite net income dipping to CNY149.88 million from CNY176.78 million last year.

Jiangsu Yangdian Science & Technology (SZSE:301012)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Yangdian Science & Technology Co. operates in the technology sector and has a market cap of CN¥3.63 billion.

Operations: Yangdian Science & Technology's revenue streams are not specified in detail, but the company operates within the technology sector. The financial information provided does not include a breakdown of costs or specific revenue segments.

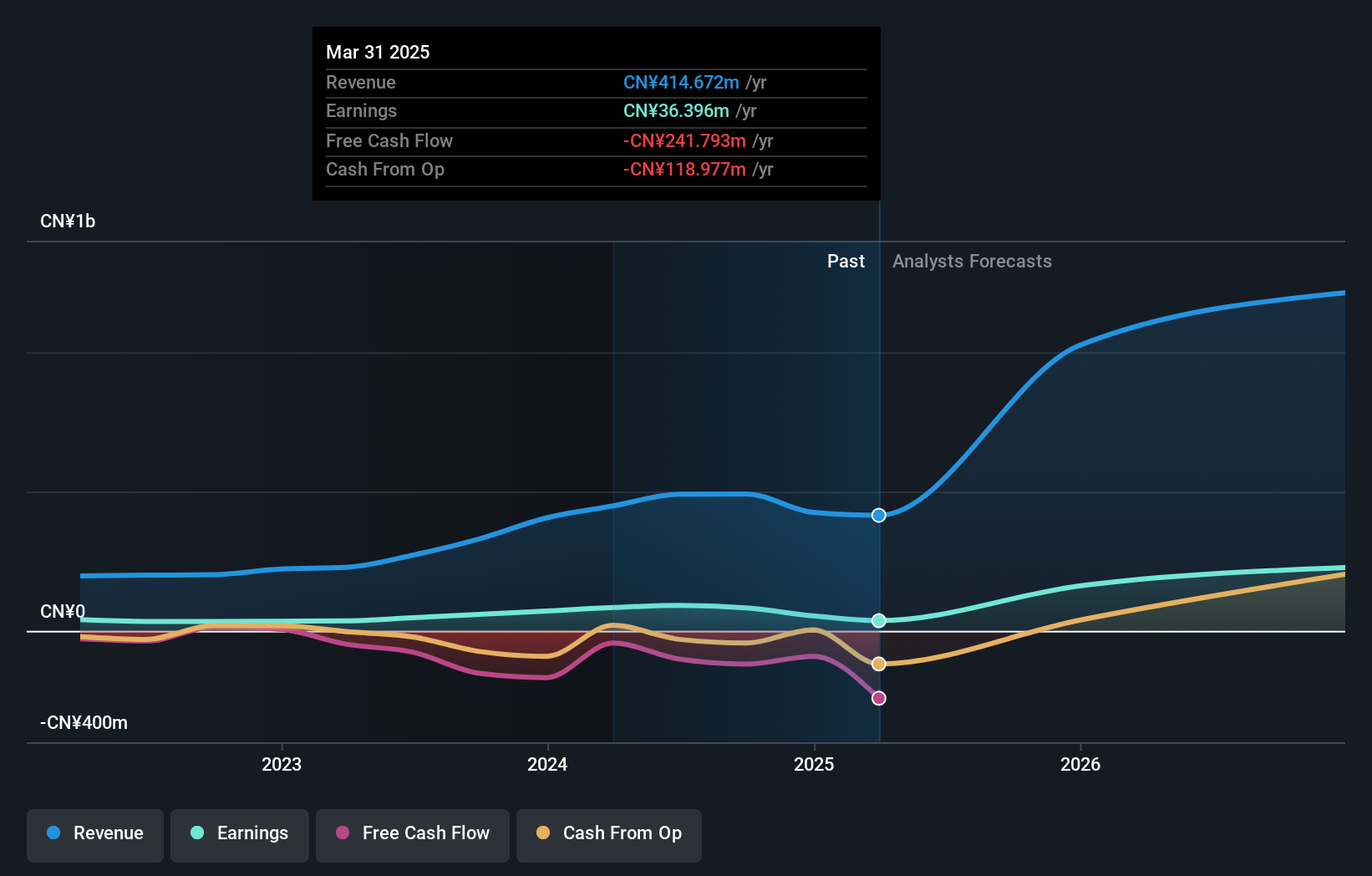

Jiangsu Yangdian Science & Technology has shown a remarkable performance over the past year, with earnings growth of 696%, significantly outpacing the Electrical industry's 1.1%. The company's debt to equity ratio improved from 33.6% to 25.2% over five years, indicating better financial health. Recent earnings announcements revealed sales of CNY 893 million for nine months ending September 2024, up from CNY 305 million previously, while net income reached CNY 53.6 million compared to CNY 2.78 million a year ago. Despite these achievements, free cash flow remains negative at -CNY101 million as of late last year due to high capital expenditures likely impacting liquidity management strategies moving forward.

- Click here to discover the nuances of Jiangsu Yangdian Science & Technology with our detailed analytical health report.

Understand Jiangsu Yangdian Science & Technology's track record by examining our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 4651 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301012

Jiangsu Yangdian Science & Technology

Jiangsu Yangdian Science & Technology Co.

Excellent balance sheet slight.

Market Insights

Community Narratives