- South Korea

- /

- Entertainment

- /

- KOSE:A352820

Global Growth Stocks Insiders Are Eager To Own

Reviewed by Simply Wall St

As global markets navigate the complexities of a U.S. government shutdown and shifting economic indicators, growth stocks have been leading the charge, with indices like the Nasdaq Composite and Russell 2000 outperforming their peers. In this environment, companies with strong insider ownership can be particularly appealing as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| KebNi (OM:KEBNI B) | 36.3% | 63.7% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.7% |

| CD Projekt (WSE:CDR) | 29.7% | 43.1% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We'll examine a selection from our screener results.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩11.11 trillion.

Operations: The company's revenue segments include Platform, which generated ₩369.99 billion.

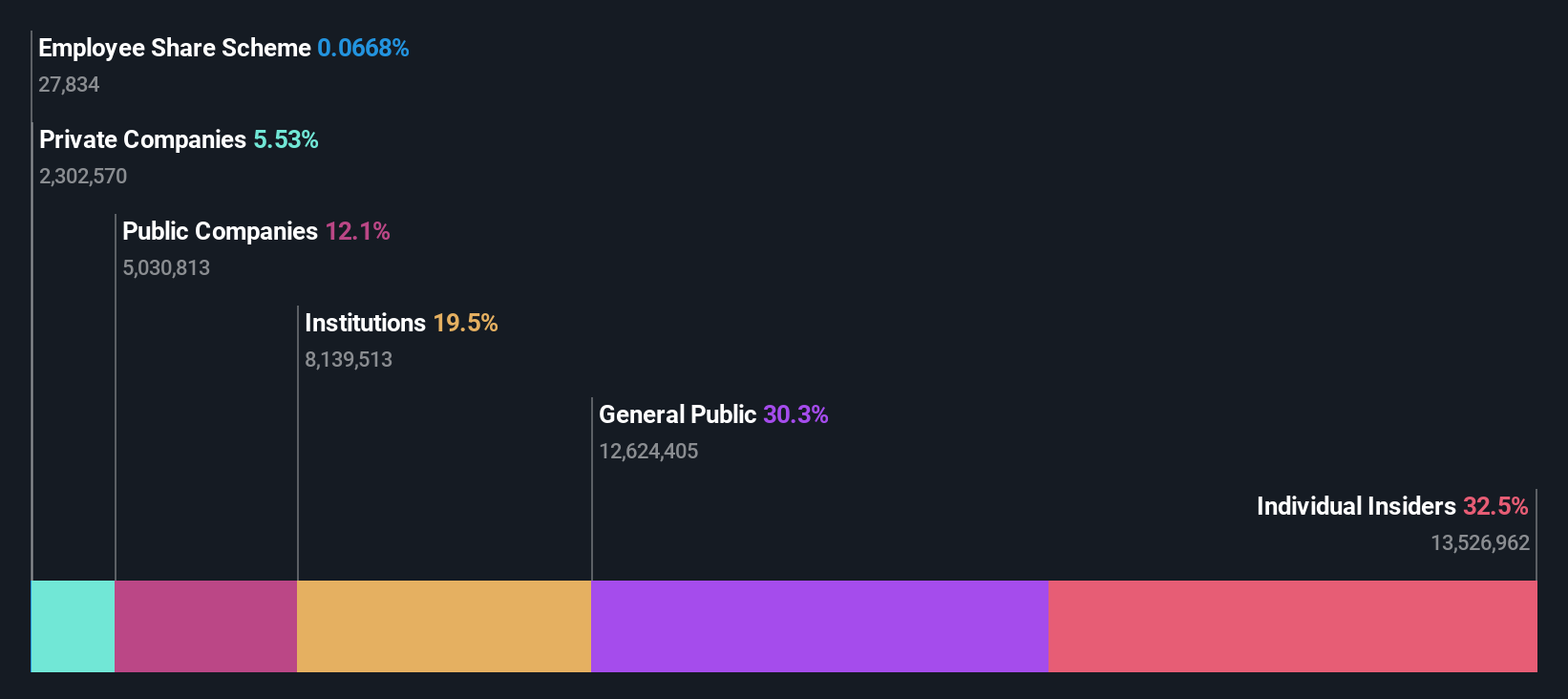

Insider Ownership: 32.6%

Earnings Growth Forecast: 46.3% p.a.

HYBE demonstrates robust growth potential with forecasted earnings expected to grow significantly at 46.3% annually, outpacing the Korean market's 24.1%. While revenue is projected to increase by 16.8%, it remains below the high-growth threshold of 20%. Recent financial results highlight increased sales and net income, indicating operational improvements despite a decline in profit margins. Analysts anticipate a stock price rise of 20.9%, reflecting positive sentiment amidst stable insider ownership trends without substantial recent trading activity.

- Navigate through the intricacies of HYBE with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report HYBE implies its share price may be too high.

Shanghai Daimay Automotive Interior (SHSE:603730)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd specializes in the research, development, and sale of passenger car components both in China and internationally, with a market cap of CN¥13.21 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue through its core activities in the passenger car components sector, serving both domestic and international markets.

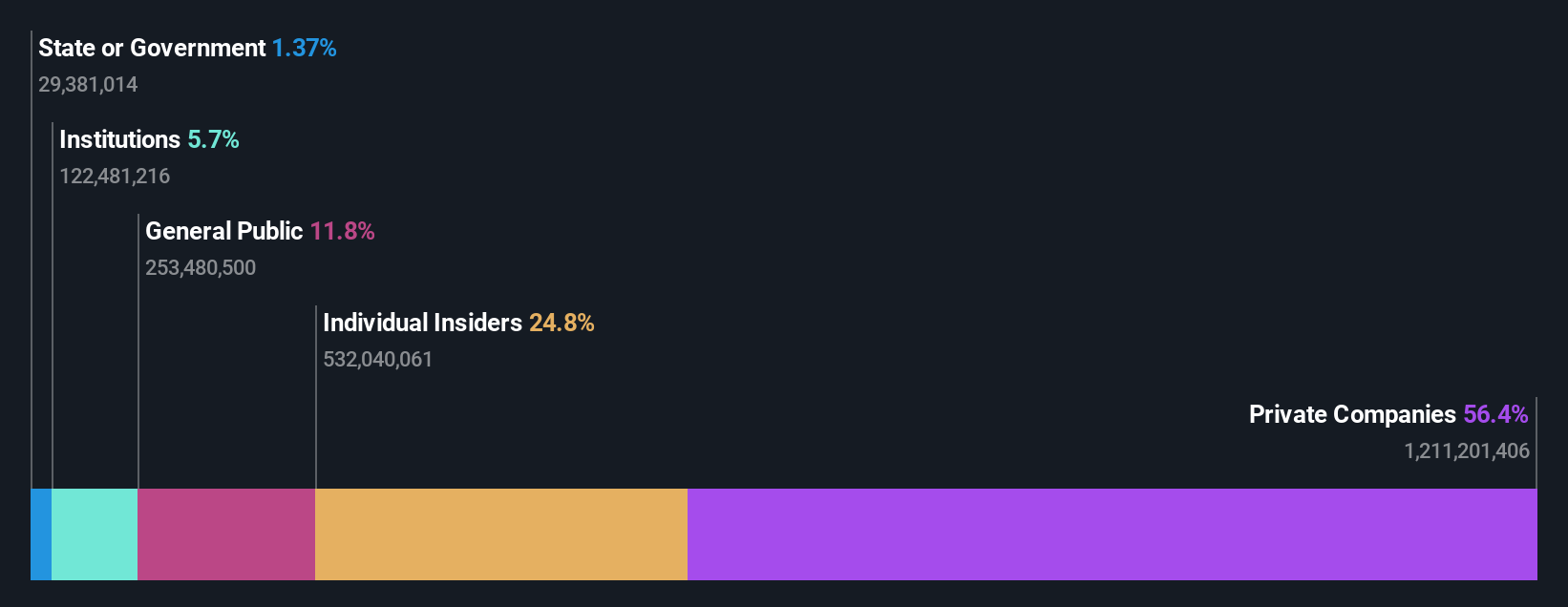

Insider Ownership: 24.8%

Earnings Growth Forecast: 25.6% p.a.

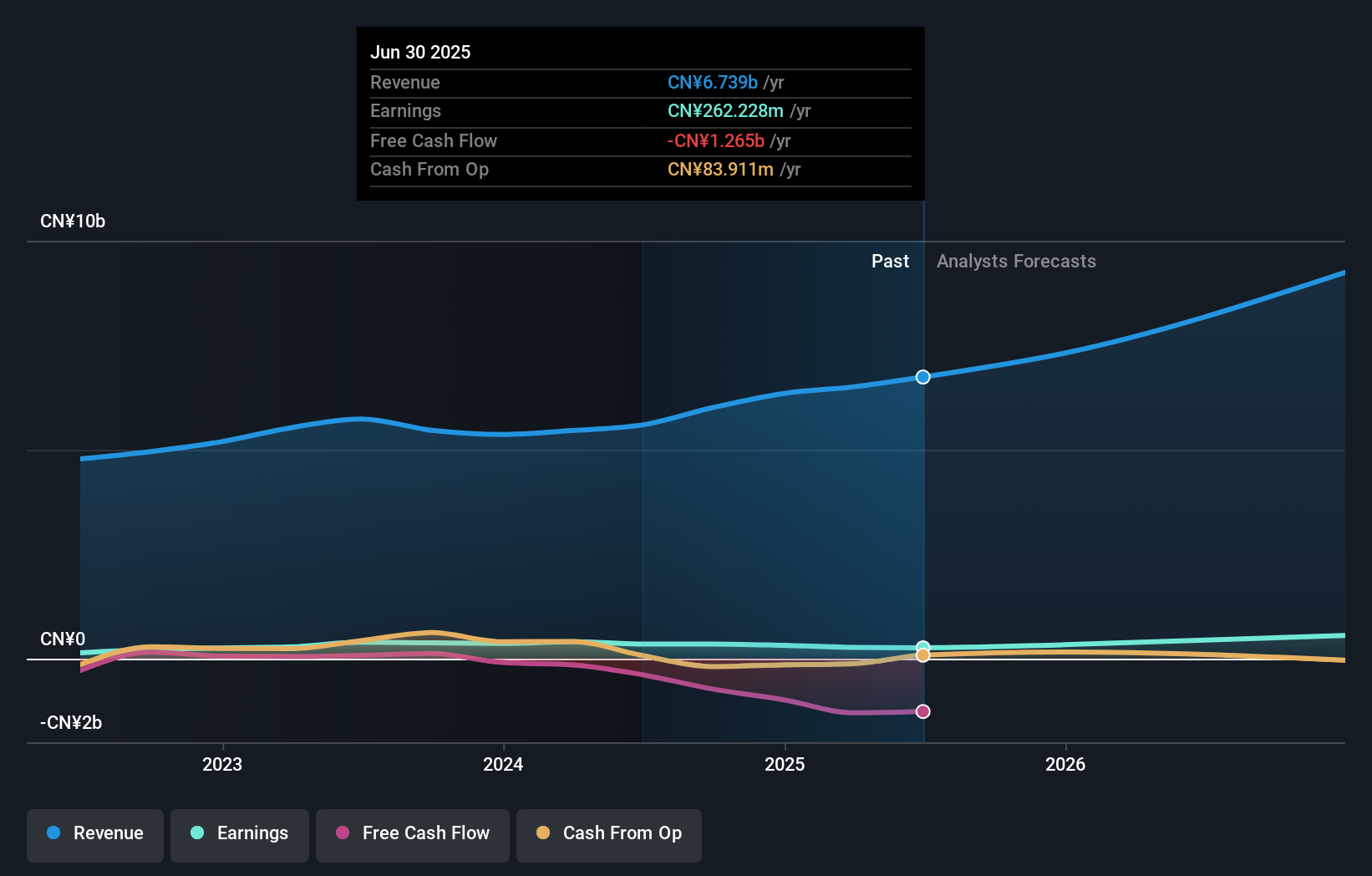

Shanghai Daimay Automotive Interior faces mixed prospects, with earnings expected to grow significantly at 25.56% annually, though slightly below the Chinese market's pace. Revenue growth is anticipated at 16.8%, outpacing the broader market but not reaching high-growth benchmarks. Despite a favorable Price-To-Earnings ratio of 22.9x compared to the CN market, recent financials show declining sales and net income for H1 2025, underscoring challenges despite stable insider ownership and no substantial recent trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of Shanghai Daimay Automotive Interior.

- Upon reviewing our latest valuation report, Shanghai Daimay Automotive Interior's share price might be too pessimistic.

Hebei Huatong Wires and Cables Group (SHSE:605196)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hebei Huatong Wires and Cables Group Co., Ltd. (ticker: SHSE:605196) is engaged in the manufacturing and distribution of wires and cables, with a market capitalization of approximately CN¥12.78 billion.

Operations: Hebei Huatong Wires and Cables Group Co., Ltd. generates its revenue primarily through the production and sale of wires and cables.

Insider Ownership: 37.3%

Earnings Growth Forecast: 51.8% p.a.

Hebei Huatong Wires and Cables Group exhibits strong growth potential, with earnings projected to increase significantly at 51.81% annually, outpacing the Chinese market. Revenue is also expected to grow robustly at 21.9% per year. Despite a volatile share price recently and declining profit margins from 6.3% to 3.9%, the company trades at a favorable Price-To-Earnings ratio of 51.6x compared to industry peers and was recently added to the S&P Global BMI Index, reflecting positive market sentiment.

- Unlock comprehensive insights into our analysis of Hebei Huatong Wires and Cables Group stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Hebei Huatong Wires and Cables Group shares in the market.

Key Takeaways

- Delve into our full catalog of 810 Fast Growing Global Companies With High Insider Ownership here.

- Curious About Other Options? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives