- China

- /

- Electrical

- /

- SHSE:605196

Further Upside For Hebei Huatong Wires and Cables Group Co., Ltd. (SHSE:605196) Shares Could Introduce Price Risks After 38% Bounce

Hebei Huatong Wires and Cables Group Co., Ltd. (SHSE:605196) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 33%.

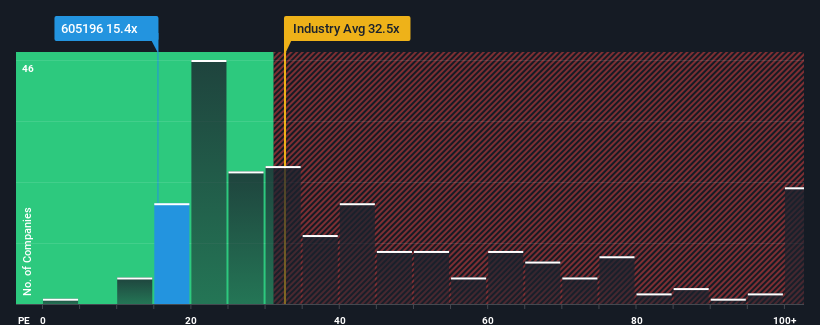

Although its price has surged higher, Hebei Huatong Wires and Cables Group's price-to-earnings (or "P/E") ratio of 15.4x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 34x and even P/E's above 64x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Hebei Huatong Wires and Cables Group as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Hebei Huatong Wires and Cables Group

How Is Hebei Huatong Wires and Cables Group's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Hebei Huatong Wires and Cables Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 12%. Even so, admirably EPS has lifted 165% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 35% as estimated by the sole analyst watching the company. With the market predicted to deliver 37% growth , the company is positioned for a comparable earnings result.

With this information, we find it odd that Hebei Huatong Wires and Cables Group is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Hebei Huatong Wires and Cables Group's P/E

Shares in Hebei Huatong Wires and Cables Group are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Hebei Huatong Wires and Cables Group's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Hebei Huatong Wires and Cables Group, and understanding should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade Hebei Huatong Wires and Cables Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hebei Huatong Wires and Cables Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605196

Hebei Huatong Wires and Cables Group

Hebei Huatong Wires and Cables Group Co., Ltd.

Mediocre balance sheet low.

Market Insights

Community Narratives