- China

- /

- Construction

- /

- SHSE:605178

Beijing New Space Technology Co., Ltd. (SHSE:605178) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Beijing New Space Technology Co., Ltd. (SHSE:605178) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

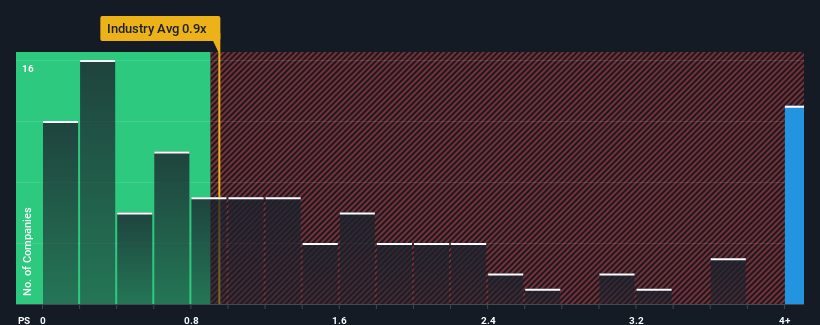

Even after such a large drop in price, given around half the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Beijing New Space Technology as a stock to avoid entirely with its 6.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Beijing New Space Technology

What Does Beijing New Space Technology's Recent Performance Look Like?

For example, consider that Beijing New Space Technology's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Beijing New Space Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Beijing New Space Technology?

The only time you'd be truly comfortable seeing a P/S as steep as Beijing New Space Technology's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 54%. The last three years don't look nice either as the company has shrunk revenue by 81% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Beijing New Space Technology's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

A significant share price dive has done very little to deflate Beijing New Space Technology's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Beijing New Space Technology revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Beijing New Space Technology that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Beijing New Space Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing New Space Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605178

Beijing New Space Technology

Engages in the provision of professional contracting services for urban and road lighting engineering.

Flawless balance sheet and fair value.

Market Insights

Community Narratives