Earnings Tell The Story For Ningbo Deye Technology Group Co., Ltd. (SHSE:605117) As Its Stock Soars 28%

Ningbo Deye Technology Group Co., Ltd. (SHSE:605117) shares have continued their recent momentum with a 28% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

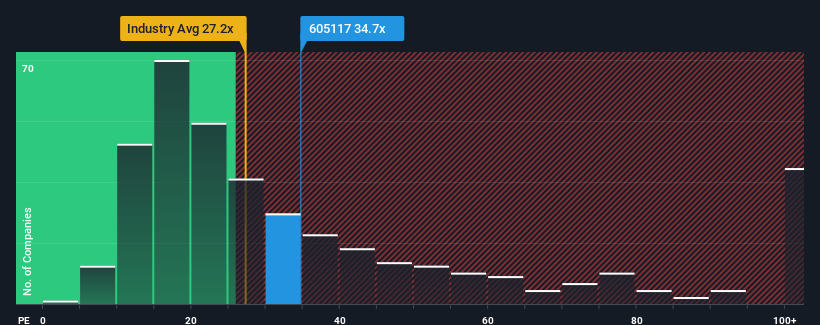

Since its price has surged higher, Ningbo Deye Technology Group may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 34.7x, since almost half of all companies in China have P/E ratios under 28x and even P/E's lower than 17x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Ningbo Deye Technology Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Ningbo Deye Technology Group

How Is Ningbo Deye Technology Group's Growth Trending?

In order to justify its P/E ratio, Ningbo Deye Technology Group would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. Still, the latest three year period has seen an excellent 165% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 29% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 24% per year, which is noticeably less attractive.

With this information, we can see why Ningbo Deye Technology Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Ningbo Deye Technology Group's P/E

Ningbo Deye Technology Group shares have received a push in the right direction, but its P/E is elevated too. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ningbo Deye Technology Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Ningbo Deye Technology Group (1 is a bit unpleasant!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Deye Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605117

Ningbo Deye Technology Group

Engages in the production and sales of heat exchangers, inverters, and dehumidifiers in China, the United Kingdom, the United States, Germany, India, and internationally.

Very undervalued with exceptional growth potential and pays a dividend.